When it Comes to Cost of Sales, Size Matters

Factors such as selling, general and administrative (SG&A) costs and cost of goods sold (COGS) directly influence a sales force’s revenue potential. Growing businesses must monitor and analyze the cost of doing business to maximize revenue growth during and after expansion. The amount a company spends on each product or sale will impact the decisions of when, where and how to scale up.

Analyzing SG&A

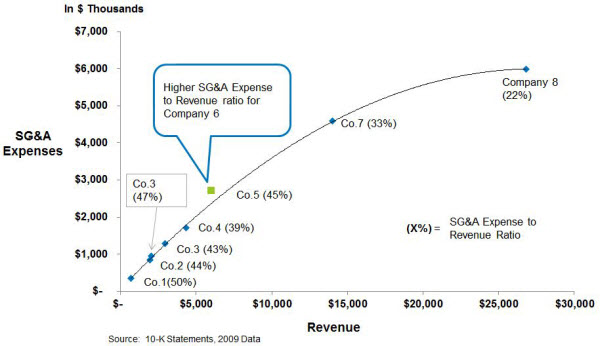

Alexander Group’s Sales Analytics practice recently compared the total revenues and SG&A costs for eight software companies. The relationship between total revenue and SG&A formed an interesting curve, where the SG&A expenses declined as a percent of revenue as a company grew larger, per the chart below.

The Relationship Between SG&A Expenses and Revenue

It is logical that SG&A expense as a percentage of revenue would decrease as a company grows larger. The companies that achieve these cost improvements implement methods that establish two types of economies—economies of scale and economies of scope.

Economies of Scale

Economies of scale allow large sales organizations to spread overhead costs across a greater headcount. Companies that create economies of scale increase production while maintaining similar expenses.

Increasing production output is possible for larger organizations that can focus their personnel groups on specific activities. By expanding the sales force, companies can form specialized groups that sell specific products or address specific markets.

The cost of each sale decreases because the sales force deploys the most qualified sellers for each product. Meanwhile, these specialized sales teams perfect their craft, driving output at a sharp rate and improving the ratio of SG&A costs to revenue.

Economies of Scope

Likewise, a sales force can improve the ratio of expenses to revenue by carefully adding new products to their repertoire.

An economy of scope describes a business that produces a second product alongside its initial offering. This business implements co-production lines, complementary production processes or shared production inputs to manufacture and sell a new revenue-boosting product. Using related processes allows the business to introduce a new product at a low incremental cost.

Sales organizations can create economies of scope by delegating more products to the same sellers. The cost of employing the seller may see incremental growth in the way of a raise, but the value that each seller adds by selling two products will outweigh the expenses.

Failing to Achieve Synergies

Economies of scope and scale optimize the ratio of SG&A expenses to revenue, but depend on synergy between production and sales processes. Sales forces fail to optimize SG&A expenses and revenue when a rep carrying multiple products is not able to achieve the intended synergies. Failure to synergize can occur for numerous reasons:

- Multiple buyers on an account: When different buyers within the same account purchase products, those buyers could offset the efficiency gains that economies of scope create by purchasing related products at separate times.

- Dissimilar products: Businesses should seek to add new products that fit seamlessly into the existing production infrastructure. Similarly, synergy fails when the buying process for the products is dissimilar. The buyer could purchase dissimilar products at different times or not purchase the new product at all.

- Inefficient mergers: Failure to synergize can occur if a company grows through acquisition but does not adequately merge or integrate sales forces. The merger should combine sales forces from related companies with common knowledge and resources at a time when the revenue gains can outgrow the new SG&A costs.

A Case in Point—Company 6

Notice how nicely all the companies fit along the polynomial trend line in the chart above, with one exception—Company 6. Their SG&A expense as a percentage of revenue of 45% is unusually high given the company’s total revenue, at least when compared with this group of eight software companies.

The “fit” line indicates that Company 6’s SG&A expense should be approximately 39% of revenue. The delta between 45% and 39% translates into $357 million per year in SG&A expense. This company is failing to meet its potential, causing it to fall from the optimal line.

If Company 6 were to realize more economies of scale and scope with their SG&A expense and align with the trend line, they could conceivably increase earnings per share (EPS) by $0.47 per share. With a current price-to-earnings (PE) ratio of 23, this, in theory, would raise the value of their stock price from just short of $18 a share on March 6, 2011, to nearly $29 a share, a 60% increase.

Compare these results with Company 8, which has acquired over 100 companies in the last 10 years or so. Company 8 quickly and carefully integrates the sales force in each case, allowing them to disperse overhead costs and drive revenue. So, as you can see, size matters, but only if you have the right sales strategy.

Finding the Right Moment and Methods

Economies of scale and scope are available to sales leaders who thoughtfully chart their course of growth. Simply adding headcount organically or acquiring more headcount through acquisition can lead to bloated sales organizations and even more bloated costs. Sales forces must exercise diligence and precision when expanding in order to achieve an optimal ratio of SG&A expenses to revenue.

Incorporating COGS

As sales forces attempt to improve the ratio of SG&A expenses to revenue, it is common to analyze the cost of goods sold. Where SG&A expense represents the cost of operating a sales force, COGS is the cost of creating the products or services that generate revenue.

COGS varies with the type of sales organization, such as manufacturing businesses, service businesses or Software as a Service (SaaS) businesses. A manufacturing business’s COGS encompasses manufacturing costs and related expenses, such as the cost of materials, product storage and product transportation. Service businesses incorporate tools, parts, transportation and direct labor. SaaS COGS encompasses expenses like application hosting and monitoring, software license fees, subscription fees and data communication costs.

How to Find COGS

COGS optimization begins with quantification. Use the following steps to determine COGS for an accounting period:

- Count the total number of inventory units at the start of an accounting period.

- Calculate the cost of purchases made producing the starting inventory units.

- Calculate the total production expenses that the business accrued producing additional inventory units throughout the accounting period.

- Add the cost of purchases for the accounting period to the cost of producing the starting inventory units.

- Count the total number of inventory units remaining at the end of the accounting period.

- Calculate the total cost of producing the remaining inventory units.

- Subtract the cost of producing the remaining inventory units from the sum of the starting inventory’s production costs and the purchases made throughout the accounting period.

COGS = Beginning inventory + Purchases – Ending inventory

The Challenge of Optimizing COGS

Reducing COGS is a challenge for businesses of all types because the expenses contribute to product quality. Businesses must implement precise, cautious changes when optimizing COGS so that they continue to offer the quality that buyers expect. Partnering with a COGS software company can help a sales force understand and optimize its production expenses.

Alexander Group’s SG&A and COGS Optimization Capabilities

Alexander Group drives profitability by unveiling cost-reduction opportunities while you integrate revenue-boosting products. We will optimize your SG&A expense-to-revenue ratio, so contact us online to discuss the value we provide.

Learn more at Alexander Group.

Need Help With Your Organization?

Alexander Group drives profitability by unveiling cost-reduction opportunities while you integrate revenue-boosting products.