Is Your Sales Compensation Upside in Overdrive?

As with any sales compensation program, balancing the need to provide competitive incentives and manage costs can be difficult to get right. One of the areas that can cause headaches is “upside,” the term given to the payments made for above-goal performance. Getting it right can spur talented sellers into over-goal performance; getting it wrong can bleed your sales compensation budget dry.

Incorrectly setting upside can lead to negative consequences whether it is set too high or too low. Low upside, for example, can significantly affect motivation, morale and retention of talented sellers. But upside that is set too high results in sales compensation overpayments. Below are three examples that illustrate overpayment.

Example 1: Small quota with high upside.

In some declining revenue industries, such as integrated media, quota sizes have declined over time and may be causing increased costs. Consider the example below of a local territory representative with a $300K quota size and a $30K target incentive. If the plan is designed to pay 3x Target incentive at 120 percent performance (i.e., Excellence point: The performance level where we expect the top 10 percent of sellers to achieve and pay full upside), all incremental revenue above goal will be paid to the sales representative. Clearly, this plan would not be affordable.

Be careful to balance plan upside with appropriate quota sizes. In this example, either upside needs to be reduced or the quota needs to be increased.

Example 2: Incorrect excellence point.

The Alexander Group recently worked with a company that set their excellence point for a new revenue stream at 150 percent targeting 3x leverage. Analysis of historical performance showed that the excellence point should have been set at 190+ percent. Not only did this miscalculation lead to significant overpayments as people outperformed expectations, it also indicated a larger issue with quota setting.

To reduce the financial exposure of new products, consider including a cap or decelerator. Alternatively, ensure thorough analysis goes into determining quotas and excellence points.

Example 3: High compensation cost of sales.

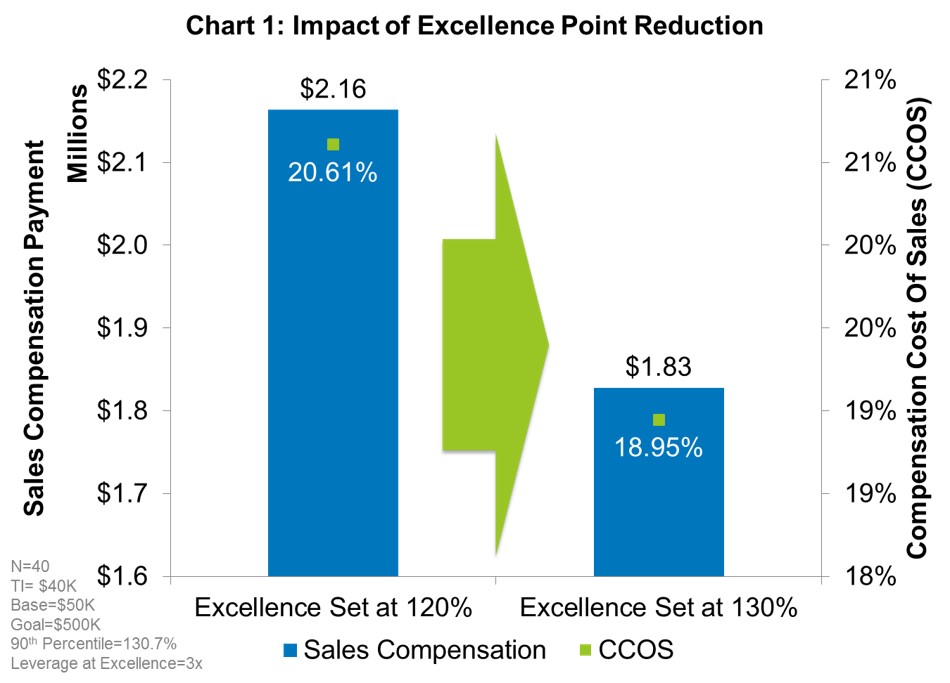

Compensation Cost of Sales (CCOS) is a metric organizations use to determine the sales compensation costs as a percentage of revenue. To calculate, simply sum up all the total cash sales compensation components (base salary, variable incentive and SPIFFs) and divide by total revenue. As the excellence point decreases and the upside amount increases, the CCOS will invariably increase.

The CCOS for each role within a company can vary significantly. In integrated media, local territory representatives can have a CCOS between 15 percent and 20 percent due to their smaller quota sizes. Strategic representatives, on the other hand, will have a CCOS less than 5 percent.

To avoid an unnecessarily high CCOS, conducting comprehensive modeling under different performance scenarios is essential once plan designs are complete.

Avoiding the above pitfalls can lead to a reduction in the CCOS and more efficient use of the sales compensation budget. Chart 1 below shows the modeled impact on a group of 40 sellers as a result of correctly setting the excellence point with historical data.

Read more about Sales Compensation upside.

To learn how CCOS and other Sales Compensation key metrics enable maximum return on sales investments, consider participating in AGI’s Modern Media Ad Sales Study.

Contact Us

Is your company's sales compensation upside in overdrive? Contact our Sales Compensation practice leaders to learn how AGI helps organizations successfully balance sales compensation incentives and costs.