London Report: Keeping Pace With Evolving Buyer Needs

Revenue leaders recently convened in London to discuss the realities of changing go-to-market structures required by shifting technology-buying behaviors. Alexander Group’s XaaS go-to-market trends study served as the foundation for the discussion and included the increasing focus on recurring revenue streams and a particular focus on customer success. In all, the group explored the tradeoffs and investments inherent in keeping pace with evolving buyer needs.

The technology industry continues to invest in developing their recurring revenue engines in accordance with “Rule of 40.” When the sum of recurring revenue growth rate and margin percentage approaches 40%, the market tends to value these revenue streams differentially. This valuation is central for attracting investments in commercial models, whether in internal budget allocation processes in a large corporation, or as a private equity-backed growth firm. Planning, building and measuring/rewarding the new commercial models required to deliver XaaS revenue is central to the ability to maximise this revenue and therefore valuations. One of the Summit attendees articulated this well:

“Creating value for shareholders from a sales perspective is directly related to the type of conversation you’re having. Speeds and feeds is very low value to customers and therefore shareholders. General outcomes are better. Customer-specific outcomes are the best and create stickiness, which creates outsized value.”

Our recent technology study shows that participants recognise this reality and continue to invest in generating this type of revenue. In EMEA, XaaS firms with over 80% of bookings from recurring revenue models expanded this percentage to 92%. Firms in the “hybrid” segment (less than 80% of bookings from recurring revenue) continued to react to this trend as well. They increased their bookings percentage from 9% in 2016 to 16% in 2018. This focused largely on converting customers (new and existing) to recurring revenue rather than the high focus on expansion selling by pure play providers.

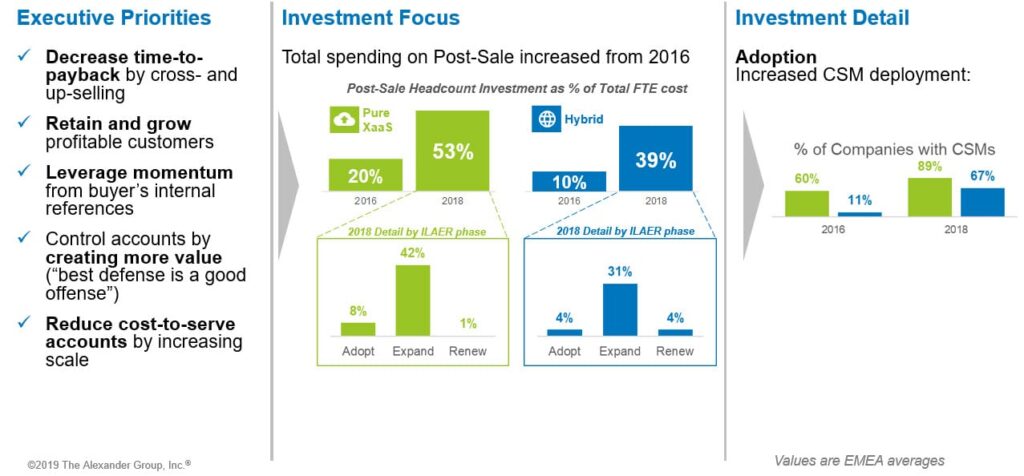

With that information as a backdrop, discussion amongst the Summit participants concentrated largely on the implications of this revenue model shift for their organisations. In particular, the conversation centered on post-sale investment generally and customer success organisations specifically. The XaaS study indicated continued investment in this function from 2016 to 2018:

Post-Sale: Coverage Investments Increasing Quickly

Two major customer success themes emerged from the conversation:

- Customer success as a function with senior buy-in: Some participants indicated difficulty with the charter for a new customer success team given existing sales and service teams with purview over different elements of the buyer journey.

- Business case for customer success: Often the need to identify the ROI for customer success teams leads to an over-reliance on “expansion” responsibilities, KPIs and sales compensation plans that dilute the impact of the original role design.

Customer success is and will continue to be a challenge and opportunity for both pure play and hybrid technology providers. A recurring revenue transformation requires a shift in the mindset of an entire organisation, including the revenue team. This change in thought process directly affects the ability of a CSM function to provide value. As one of the Summit participants said, “We are all in customer success in some way. We have to be.”

Designing revenue teams, including customer success, in order to support adherence to Rule of 40, will be a top priority for revenue leaders in the near future. Companies or divisions creating outsized returns will continue to attract internal and external investment. The revenue organisation directly facilitates a company’s ability to generate and maintain these high value income streams and must be engineered to support this way of selling. The Alexander Group can offer perspectives on aligning your organisation to high-value revenue streams and customer success in particular.

Contact us today for more information on how we can help or to schedule a briefing.

___________________

RELATED RESOURCES