Bridging the Gap: Health Tech Company Trends

Digital health is a fast-growing segment, but are these companies healthcare, tech or both?

Digital health companies are one of the fastest-growing segments of the healthcare continuum. Organizations are looking to technology solutions to drive patient outcomes and experiences, improve clinical and operational efficiencies and comply with all of the related regulations. As these market factors drive increased focus and investment in digital heath companies, many revenue and commercial leaders are struggling with questions such as: Are we a healthcare company? A tech company? Or both? And what are the right metrics of commercial success?

Digital health companies may differ from healthcare and pure tech companies in their strategy, focus, operations or any number of ways. Here are a few examples that illustrate how digital health companies are behaving differently.

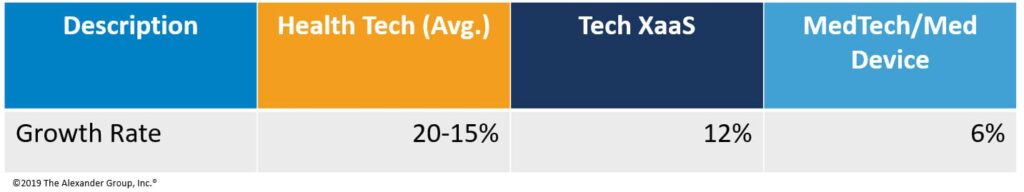

Growing Quickly…

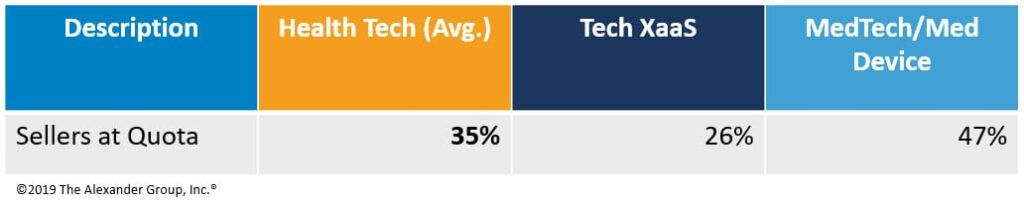

Digital health firms are growing at over twice the rate of traditional healthcare companies and more closely mimic pure technology organizations. When dissected, this growth can be attributed to the overall market and company growth but also individual seller success.

Digital health sellers are retiring their individual revenue/bookings quotas at almost 1.3x that of their pure technology peers. This disparate metric also helps to explain the reduced attrition in health tech organizations versus their peers: 17% versus 23% in pure technology organizations. Higher performers are earning at target compensation rates and therefore less likely to seek new opportunities.

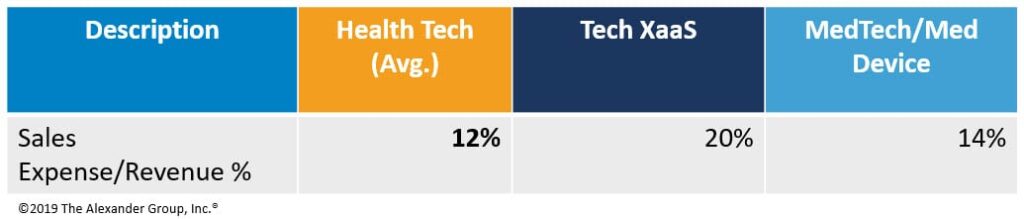

…but Potentially Underfunded

In general, the commercial sales organizations (defined as customer-facing field reps) of digital health companies are half the size of the average pure technology company, but only about 20% the size of an average healthcare company. When it comes to revenue per headcount, digital health companies straddle the mark for revenue per field rep.

While this is an encouraging statistic, the investment to obtain that revenue number becomes potentially problematic to fueling current and future growth.

A depressed Expense to Revenue ratio, when revenues per rep are favorable, indicates a deficit on the numerator, or the expenses of the commercial organization. In particular, Alexander Group’s ongoing research indicates a deficit of investment in enablement tools, sales compensation, support resources and digital programs. While all of these factors may be in play, sales compensation seems to be a key driver. Compensation rates for field sellers in health tech companies typically lag technology rates while still producing similar revenue.

While an efficient commercial organization is favorable now, low investments today may slow future growth in a growing and rapidly changing market.

Behavioral and financial data prove it may be impossible to categorize digital health companies as pure healthcare or pure technology organizations. As a result, the unique factors of these organizations demand a novel approach when assessing commercial alignment and excellence.

If you would like to see how your digital health commercial organization stacks up, contact us to participate in our latest study.

__________________

RELATED RESOURCES