Three Key Findings to Accelerate Revenue Growth

Sales leaders invest in new market models as technology advances.

A recent Alexander Group research study within the Industry & Capital Equipment market resulted in three key findings that companies are utilizing to accelerate revenue growth:

- High growth companies don’t just ‘throw more sellers’ at the opportunity

- Core sellers need a strong support network, from robust revenue enablement and operations teams to sales support resources, to effectively collaborate on new and strategic offerings

- On target earnings will continue to increase as the sales talent profile evolves

High growth companies don’t just ‘throw more sellers’ at the opportunity.

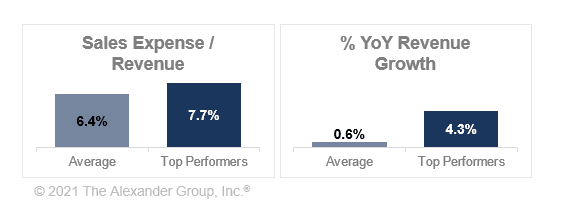

Top performing Industrial & Capital Equipment companies are spending more than their peers to deliver on their stretch targets. These leaders have an average of 7.7% sales expense/revenue ratio, while the industry average is only 6.4%. The majority of those extra investments are in the form of overlay specialist resources and revenue operations enablement – not extra sellers!

It is worth noting that these investments do result in a more expensive model, despite a 34% higher productivity per rep. But the lens to consider how to think about these investments should be forward-looking. And the results are clear: smarter investments to drive sales productivity have resulted in an average of 3.7% higher overall revenue growth than the market. Bottom line – make the investment to provide your sellers with the sales support resources and tools they need to drive productivity and longer-term success.

Core sellers need a strong support network, from robust revenue enablement and operations teams to sales support resources, to effectively collaborate on new and strategic offerings.

Alexander Group recently surveyed revenue leaders on market trends, perspectives and initiatives ranging from the 24/7 buyer journey to coordinating sales, service and marketing. As part of the research, leaders were asked to rate according to two factors:

- How Important is this to your organization’s success? (1 = not important, 5 = very important)

- How Effective is your organization? (1 = not effective, 5 = very effective)

Of all topics explored, leaders overwhelmingly cited the most significant gap between how important and how effective their organization was in supporting strategic offerings (e.g., software, advanced services). For this question, revenue leaders reported very high importance (4.8), but only modest effectiveness (2.8). When interviewed, leaders cited the lack of clear direction to their core sellers on how to ‘run the new plays’ of these offerings. Sellers didn’t know how to introduce the new offerings or blocked access to their accounts from product overlays.

Those that reported high on effectiveness had clear rules of engagement laid out for how to ‘run the plays’ – when to bring in a specialist, when to go it alone, etc. A VP of Sales from an industrial components company added, “We use technical specialists to build and impart knowledge to our key account managers who then articulate that information to our customers.”

On target earnings will continue to increase as the sales talent profile evolves.

Sales compensation cost of sales (sales compensation expense/revenue) is expected to continue to rise at a rate of 1.6% year-over-year. This is mainly due to the core selling role continuing to evolve to new and elevated competencies and skillsets, with more of a focus on advocacy and solution selling vs. a more traditional fulfillment sales motion.

The industrial talent market is on the move, and successful companies have started searching outside of the industry. This is especially true for new software/IIoT sales and overlay roles. These specialized resources typically seek higher total sales compensation packages. Companies are revamping their talent acquisition strategies to ensure these key job openings are filled.

For more information on how Alexander Group can help you develop your go-to-market model to accelerate revenue growth, please visit our Industrial & Capital Equipment webpage. You can also explore benchmarks and insights from our Manufacturing and Distribution research by requesting a complimentary Industry Trends research briefing.