2022 Sales Force Trends

The Headlines: Wage Inflation! Great Resignation! Hard-to-Find Applicants!

The 2021 employment picture produced some sobering headlines: accelerating wages, rampant turnover and prevailing open positions. These observations hold true for many employment sectors. But, what about sales departments? The Alexander Group’s 2022 Sales Compensation Trends Survey found some surprising answers for the sales departments; not all the results aligned with the headlines. However, the survey found one pronounced employment trend worthy of attention: open positions.

Key Findings

Here are select key findings:

- Wage Increases: Wage growth remains constant; no big jump in wages in 2021 and none expected in 2022.

- Turnover: Turnover rates returned to historical pre-pandemic levels, with the typical turnover of 10% for sales personnel in 2021 and projected for 2022.

- Staffing Levels: There are growing open positions; the survey found a marked increase in open positions.

The survey indicates wages and turnover are following historic trends. However, the increase in open positions might be a harbinger of challenges ahead.

Wage Increases

The headline of a recent article in the Wall Street Journal [WSJ] touted “Companies Plan Big Raises for Workers in 2022.” The article cited a study by The Conference Board showing wage budgets are growing for 2022:

- 2019: 3.2%

- 2020: 2.5%

- 2021: 3.0%

- 2022: 3.9%

This information covers the broad reach of the U.S. workforce. While the percentage increase from last year to this year might be significant (i.e., 3% to 3.9%), the actual percent change is still modest. In the broader economy, the recent uptick in lower wage workers’ pay may be impacting this number. For example, consider the impact of a $1.00 increase from $15.00 per hour to $16.00 per hour for an hourly worker. The percent increase is 6.25% (1$/16$=6.25%). Yes, overall wages are increasing, but the proclamation of “big raises” requires additional consideration.

However, let’s focus on sales departments. Sellers’ pay consists of two components: base pay and incentive amount. Base pay increases are more stable and usually match the allocated budget for base salary increases. Payouts of the incentive portion vary from year to year; sometimes payouts exceed the budget, sometimes they are less than the budget. The best way to evaluate changes in wages for sales departments is to examine the planned budget increase in target total compensation (TTC) for the sales force. This provides a more stable picture of what will happen to overall seller pay levels. Of course, each market segment is different, each company is different, each job is unique, and select employees might require special treatment. Regardless, reviewing planned TTC budgets provides a good starting point for wage increase planning purposes.

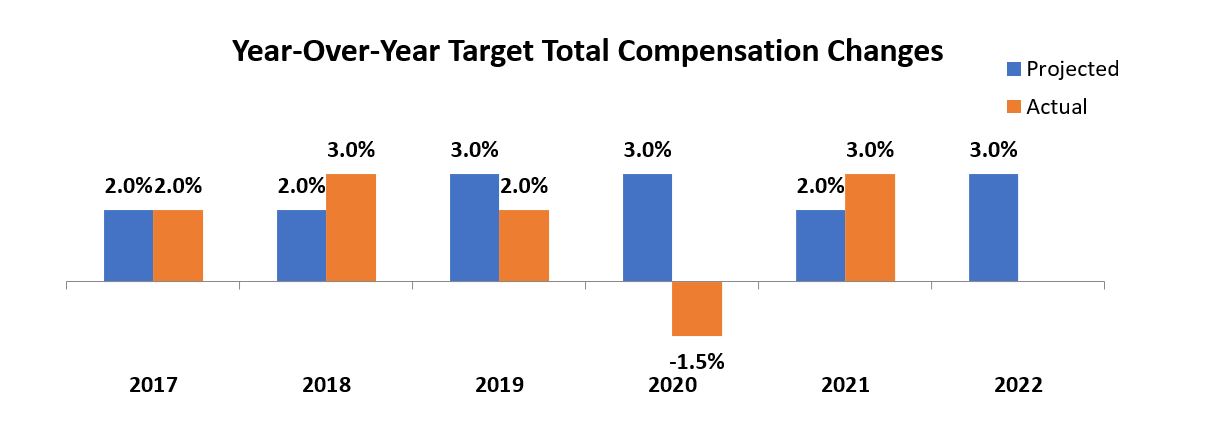

The following five-year chart is from the recently completed 2022 Sales Compensation Trends Survey:

The chart suggests that the TTC budget increase for the sales force is 3% in 2022. Although the actual payouts vary from year to year, the planned budget increase remains a constant 3% median increase since 2018.

Turnover

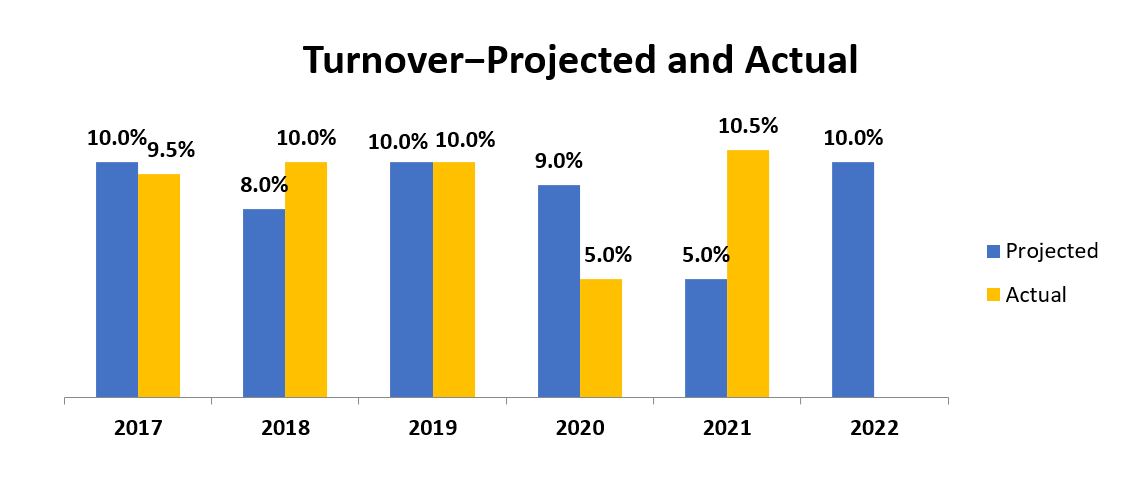

The survey participants are divided about turnover for 2022. Half think turnover will increase; the other half does not. Turnover in 2021 leaped from 5% in 2020 to 10.5% in 2021. However, 10% is the historical turnover rate for sellers. When asked to project their turnover for 2022, the survey participants estimated 10% as the turnover rate for 2022, the historical trend for sellers. No big news here.

Turnover might still be a stalking challenge in 2022. Early investments in seller development, job alignment, seller tools, quality of work-life balance and target pay increases might fortify the retention of the existing sales personnel.

Staffing Levels

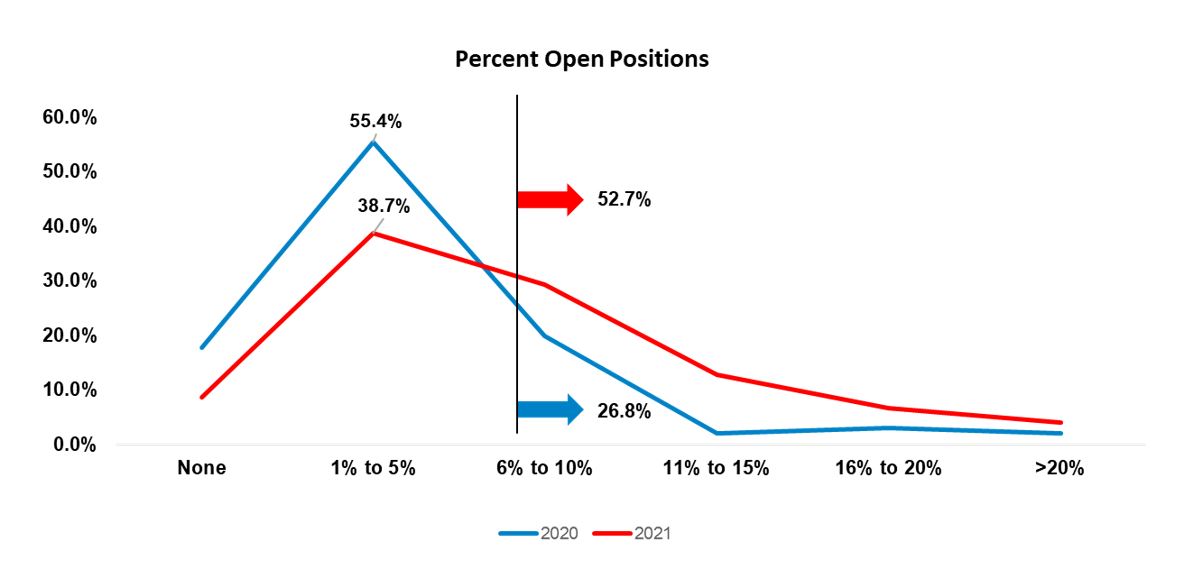

Staffing levels mean keeping open positions to a minimum and ensuring qualified personnel occupy the approved positions. More than 56% of the participating sales departments plan to increase headcount in 2022 and many believe they can find qualified candidates. However, the “open positions” statistic is concerning.

The following chart shows how the percent of open positions above 5% has jumped from 26.8% in 2020 to 52.7% in 2021. Of course, the low number in 2020 reflects the low turnover (5%) that year. However, 52.7% had 6% or more open positions in 2021. This is a significant number, which may be fueled by increasing approved headcount levels, turnover, limited number of applicants and less than robust hiring efforts.

A high number of open positions hurts a sales organization. Reduced sales production is a sobering outcome. Overstressing existing personnel—sellers and managers—can reduce commitment and engagement.

To solve open positions, increasing applicant sourcing efforts is a good first step. (We favor a central sourcing team.) Social media investments will help better tell the company’s story. Referral programs will encourage a flow of trusted applicants. And, an associate program—sellers-in-waiting—will provide timely “bench relief” as open positions occur.

Unfortunately, a potential negative outcome of excessive open positions is expedient, but a harmful practice of inflating new hire pay offers and offering large increases to retain resigning employees. While both practices, to some degree, may be necessary, inflating new hire pay levels will create compression, and saving terminating employees with a “pay bump” may cause pay distortions.

Pay compression occurs when new hire pay levels exceed those of existing employees. “Saving” departing employees with major pay increases might be effective in the short run, but unchecked, excessive “save” practices will create pay distortions among peers. Both pay compression and pay distortion may cause the need to reprice the whole sales force, a costly endeavor indeed.

Summary

What the 2022 Sales Compensation Trends Survey tells us: Major wage inflation: not yet. Turnover: back to traditional levels. Staffing Levels: management needs to address open positions.

About the Survey

Now in its 20th year, the annual Sales Compensation Trends Survey gathers employment, pay and incentive plan design information. In addition to topical questions, key metrics repeat each year giving a multiyear perspective on trends and practices. Participants submitted data in November/December of 2021, and results were published to participants in January 2022. 155 sales departments with a total employment of nearly 150,000 sellers participated in the survey.