Saying the current market is unique is an understatement, but macroeconomic chaos will always force businesses to adapt. It simply creates a climate where productivity and efficiency sit on the throne. So how are firms and portfolio companies adapting to better balance top- and bottom-line growth?

For most, the slow-growth environment means finding the least disruptive ways to take cost out of the business.

“Simple math,” said Kevin Jeon, director of revenue optimization at Summit Partners. “In the early days of rising interest rates and inflation, we pulled levers like price increases and strictly enforcing price accelerators at renewal to drive incremental NDR. But more recently, it’s more about making our businesses simpler – fewer pet projects, focus more on your core business.”

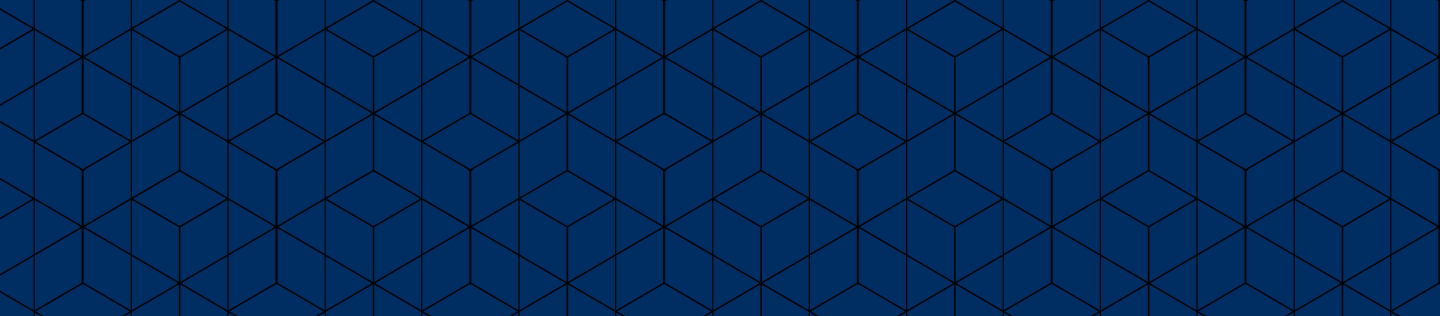

Implementing price increases has been a popular means to combat inflation and leaky buckets because the results are tangible with quick revenue growth impact. This was a popular move as Covid hit: catch up to costs and pass it on.

Since then, however, operating partners are spending time on more strategic pricing initiatives such as transitioning from cost-plus to value-based pricing strategies – a complex and heavy lift that is equal parts art and science with a big payoff if done right. Calculating the value of the product or service is science, executing against it is art.

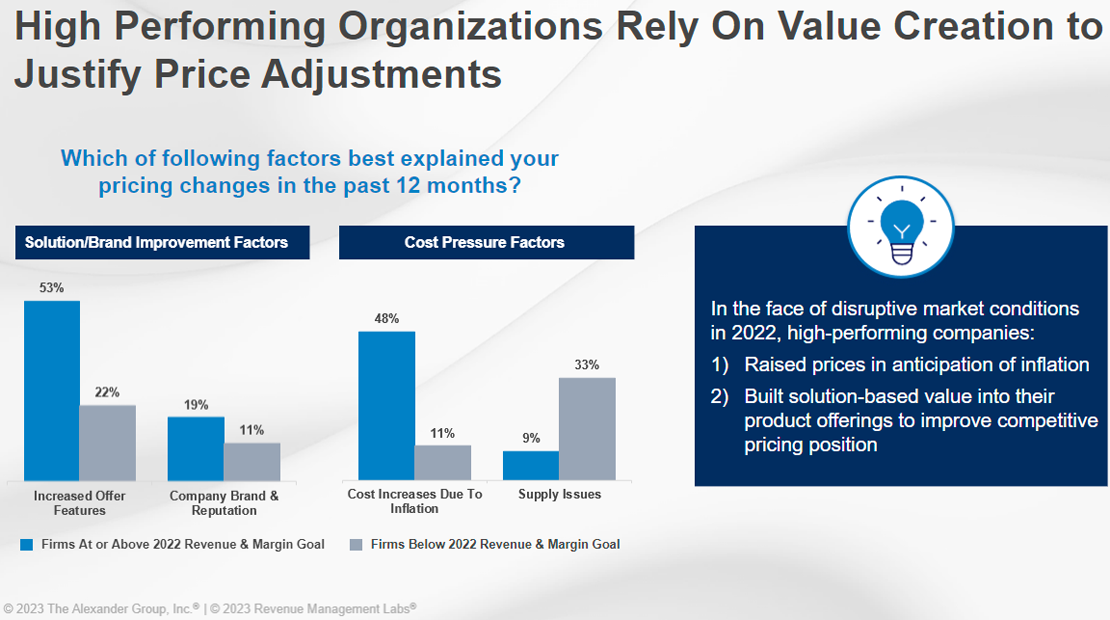

Beyond pricing, partners are seeking ways to drive productivity across the commercial organization. Getting the most out of your resources by orienting them around the right customer segments is crucial to balanced growth. As one operating partner at a firm with $80bn in AUM across 25 portfolio companies said, “If demand wanes, are we sure we have the right resources with the right skills deployed in the right places? This way, we’re not forced to look at the bottom 10% again.”

Combining advanced segmentation analyses with a powerful demand stimulation engine is central to building durable pipelines with efficiency in mind.

“An in-depth (not high level) total addressable market analysis is the holy grail,” Tulsidas said. “Then we can go into ICP development and segmentation to weed out any unprofitable business and understand where white space exists, what services are being bought today, what services we can sell, and identify the customers that understand value and care less about price.”

Similarly, Chris Westington, director of portfolio management and value creation at British Columbia Investment Management Corporation cited the importance of understanding the voice of those customer segments, something he’s encouraging portfolio companies to do in the current environment. Over the next 6-12 months, Westington wants portfolio companies to understand how consumer needs are shifting so they can then align and reinforce their top value propositions.

Westington’s point on customer centricity is validated in Alexander Group’s Commercial Practices to Drive Profitable Growth & Valuation study. After analyzing 1,000+ companies to identify the go-to-market characteristics of profitable growth leaders, customer centricity and customer experience are at the heart of the commercial organization. This is demonstrated in their ability to capture the voice of their customers, reflect that voice in their value proposition and underpin it in how they align commercial roles and responsibilities across the buyer the journey.

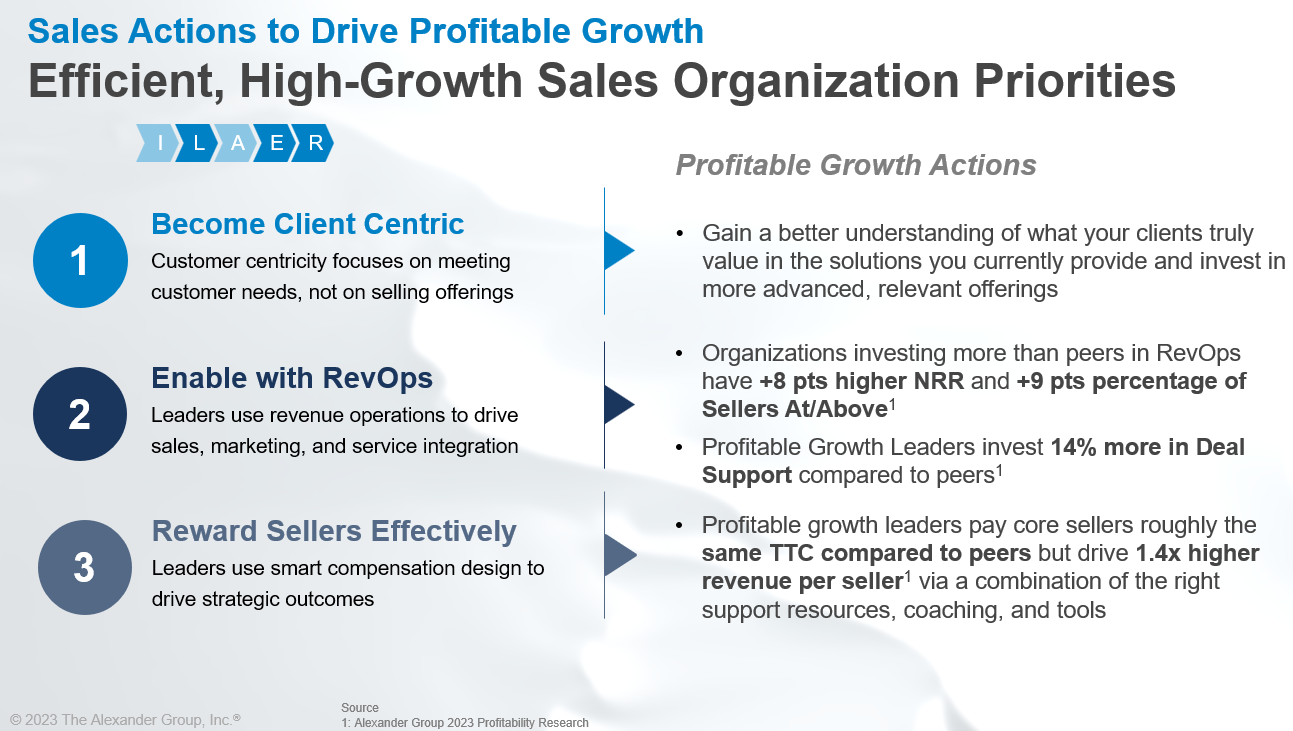

Many of these initiatives fall under the Revenue Operations (RevOps) function, another frequently cited investment area for firms and portfolio companies. While RevOps constructs are growth-phase dependent, establishing this muscle can have a significant impact on top and bottom lines. RevOps can have ownership or influence over a number of core go-to-market elements (as in Figure 3).

According to Alexander Group’s recently published 2023 Revenue Operations Study, there is a strong correlation between investing in RevOps and driving top- and bottom-line goals. The study shows that companies with top RevOps organizations outperformed peers in terms of margin, growth and exceeding sales targets via smart investments in Sales, Marketing and RevOps.

For example, when RevOps has more centralized control over price realization and execution, they tend to keep tighter control on discounting behaviors, resulting in a 33% lower overall discount increase and a 22% lower discount increase offered by individual sellers. To preserve profit margin and achieve profitable growth, discounting strategy and behaviors should work with, not undermine, the pricing strategy.

“Now is the time to get your house in order – build automation, clean up processes, get clear visibility into your levers in the business,” Jeon said. “Even if those levers can’t be pulled now and you won’t see results right away. When the economy picks up, who’s going to be the most prepared to take advantage of the market?”

Regardless of how the economy shakes out, it’s clear that private equity firms are directing their companies to take a proactive approach to growth by adjusting go-to-market models with a keen eye on margin and a customer-centric mindset.