Evolving Strategic Talent Architecture

When executed properly, strategic talent architecture harnesses a strong talent brand and job role competency models to improve both employee and customer experience. Leading companies are more likely to have formal and well-documented key job design components:

- Jobs designed around the skills required to be successful

- Documented Rules of Engagement (ROE) between other roles

- More frequent skill assessments to drive career advancement

These leaders are less likely to lose sellers due to a lack of well-defined jobs and career paths and can fully operationalize field sellers up to 30% faster. As part of strategic talent architecture, talent acquisition should align with talent retention by developing new employees and building up more experienced hires.

Building a Talent Brand

Employee Experience

Employee engagement is a significant predictor of motivated employees, and keeping employees engaged requires active effort by companies. Workplace flexibility, defined culture and cohesion improve employee experience and customer outcomes.

Companies with engaged employees simultaneously reduce bottom-line costs and increase customer satisfaction to grow margins – reporting a +11% increase in customer satisfaction ratings for interactions with sales reps and a +7% increase in service quality.

Talent Acquisition

Effective talent acquisition encompasses the entire hiring process from start to finish – not just finding high-performing talent, but also attracting those candidates to the business. Profitable growth leaders employ dedicated resources to quickly identify and fill open positions, utilize brand reputation to entice high-quality candidates and seek out candidates with non-traditional, value-add skills.

Companies with formal programs to communicate advancement opportunities can fill vacancies up to two weeks earlier and fully ramp sellers up to two months faster.

Driving Commercial Excellence

Compensation & Total Rewards

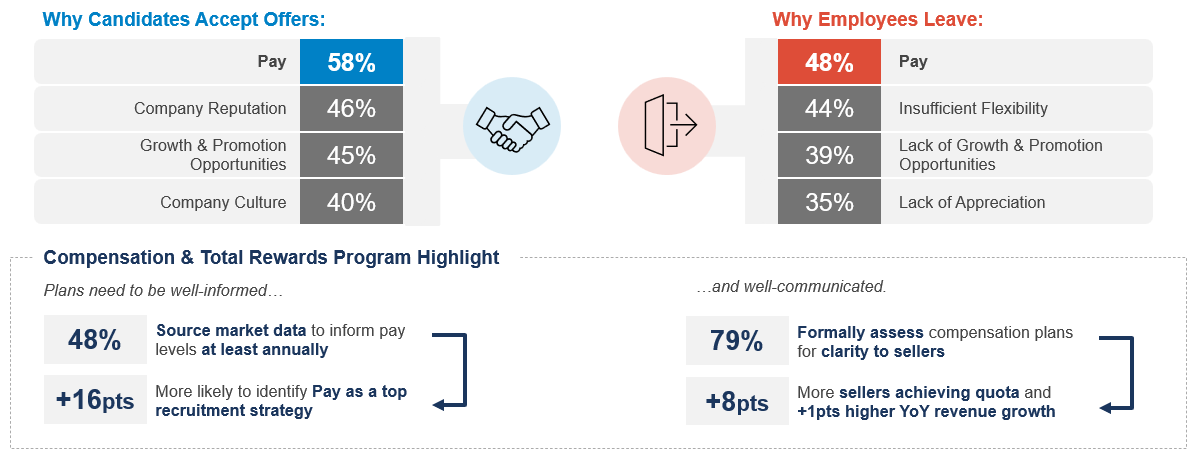

Once top talent is through the door, companies need effective strategies for keeping them there, and sales compensation plans continue to be an important determining factor for employees when accepting new roles, and when walking away from current roles.

An effective sales compensation plan should be both competitive and clearly outlined, which means sourcing market data to inform pay at least on an annual basis and ensuring compensation plans are well-communicated. Respondents that formally assessed sales compensation plans for clarity saw an increase in sellers achieving quota by +8%.

Pay levels and incentive plan structure are important, but there are several other factors that cause sellers to leave. Workplace flexibility such as offering a hybrid work environment, or flexible hours and other employee experience factors weigh heavily on the decision to leave. Also, clarity of job roles and career paths are important drivers that cause sellers to depart.

Coaching & Recognition

Along with attracting and hiring top talent, profitable growth leaders also establish effective performance evaluation programs. Like sales compensation plans, employee performance must be clearly measurable, formally documented and actively communicated to employees on an ongoing basis.

Profitable growth leaders are more likely to evaluate beyond standard seller quotas, including:

- Manager Assessments

- Sales Competencies

- Cultural Fit

- Share of Wallet

Leaders that analyze these additional KPIs are better informed on the overall team and business performance and are therefore better equipped to identify and address issues. Leaders must frequently re-evaluate programs to ensure managers are equipped to coach teams, key performance metrics are identified, and poor performers are properly coached out.

Our research shows that key talent strategy and effective talent management can drive profitable growth and set companies apart from their peers. By investing in talent architecture, building a talent brand and driving commercial excellence, firms can increase revenue and EBITDA margins without paying higher shares above-market costs.