Companies frequently evaluate go-to-market routes and deliberately choose to use partners as one of those routes. Alexander Group’s latest 2024 market research indicates that regardless of company size, there’s a wide spectrum of partner program sophistication. Companies with more mature partner programs, stemmed from scale and productivity, tend to have incorporated best practices and key differentiators into their ecosystem, programs and structure. This article highlights some key takeaways from the research to aid in your go-to-market planning process.

4 Practices Utilized by Companies with Mature Partner Programs

- Maintenance of a strong base of partners that have the capability to identify new opportunities

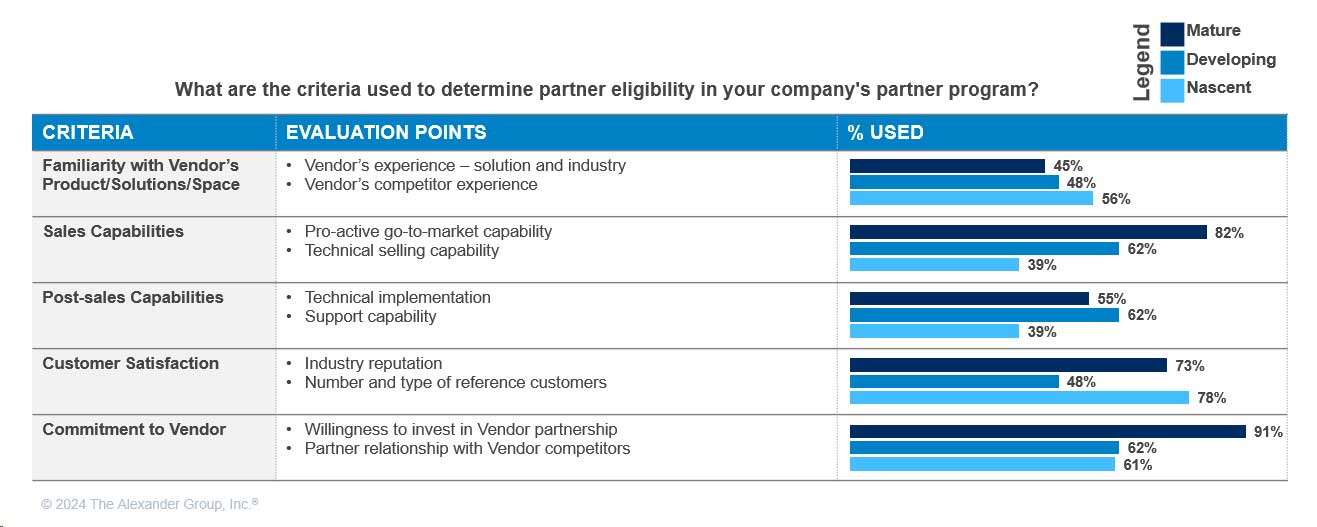

- Recruitment of partners that have sales capabilities

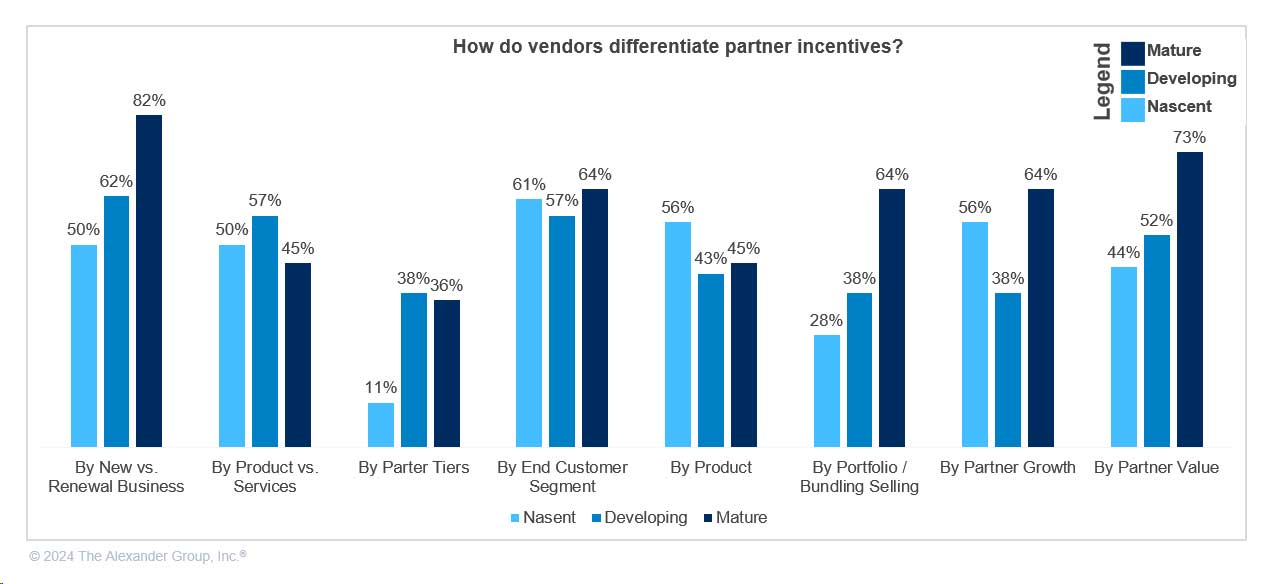

- Differentiation of partner incentives by new vs. renewal business and level of partner’s value during the sales process (e.g., sourced vs. influenced vs. fulfillment)

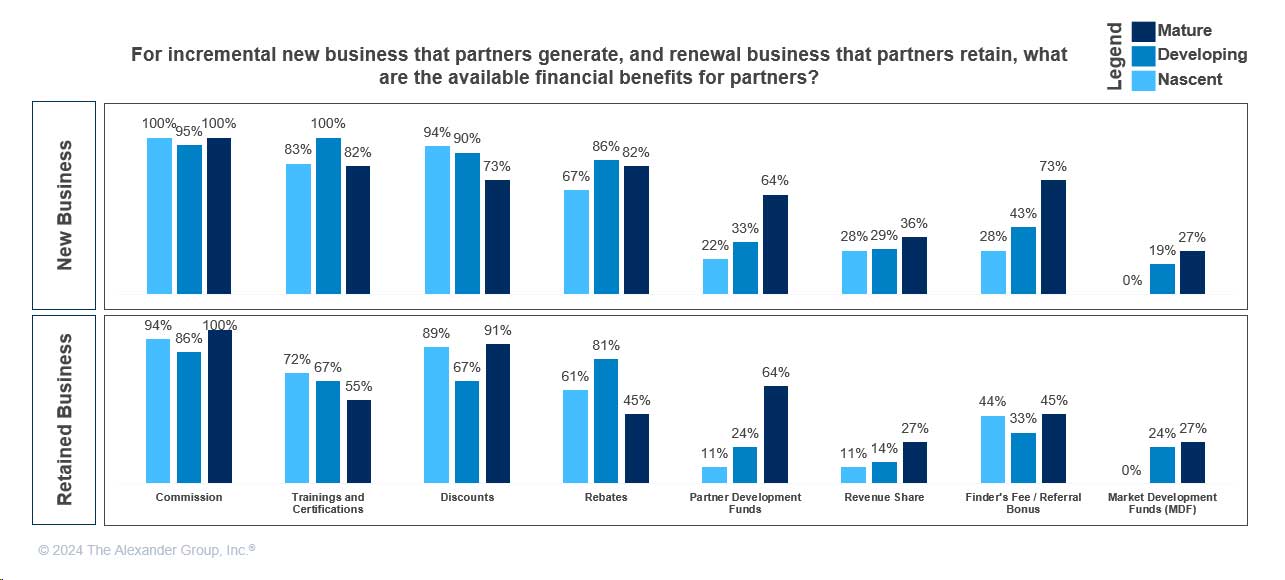

- Provision of special financial benefits of training, certifications and rebates to drive focus on new business

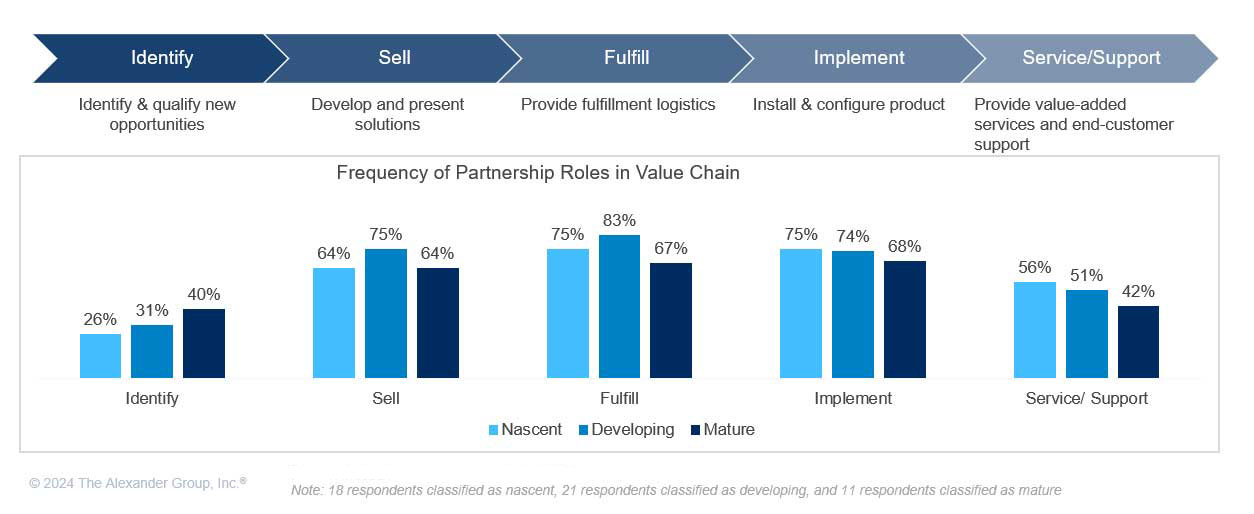

Maintenance of a Strong Base of Partners that Have the Capability to Identify New Opportunities

Companies with mature partner ecosystems and programs have the largest base of partners with capabilities to identify and qualify new opportunities. By maintaining these types of partners, companies can leverage existing networks to drive organic growth. Mature companies also have the smallest volume of partners that handle fulfillment, implementation and service/support. This indicates that mature vendors have “weeded out” transactional partners that satisfy low-value activities