Go-to-Market Value Realization

Part 3 of 3

Recent years pushed private equity partners and their portfolio companies to seek additional paths to create enterprise value. Go-to-market (GTM) – Marketing, Sales and Service – became a popular area of focus as traditional plays were insufficient. In part 1 of this series, we offered a framework to identify and scope GTM value creation initiatives. In part 2 of the series, we shared a view of what “great” looks like to guide initiative scoping and selection. Part 3 offers five levers to help private equity partners and their portfolio realize value from their GTM initiatives.

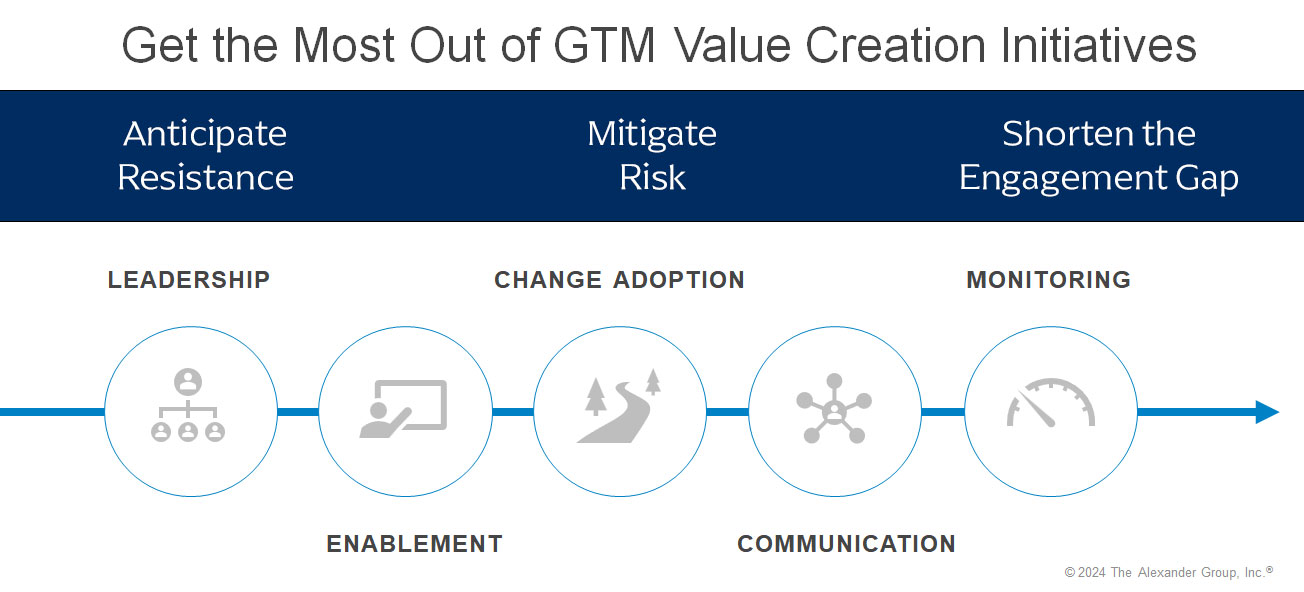

The 5-levers of GTM value realization are leadership, enablement, planning, communication and ongoing monitoring.

Leadership

Our private equity and portfolio executive community consistently report the #1 factor impacting the return on value creation efforts is leadership. The right talent, appropriately resourced and effectively enabled, outperforms the market. Further, not having the right team in place is a signal that investments in projects and associated changes are less likely to deliver desired results.

In addition to thoughtful senior leadership investments, identify enterprising talent from the middle of the organization. Engage them with career development opportunities to serve as champions for high impact GTM value creation initiatives. Involve them in the development of the value creation plan. As the plan comes together, invest in internal public relations efforts to stoke enthusiasm about accelerating profitable top-line growth. Establish feedback loops and herald success.

Enablement

Why do GTM value creation efforts fail? It’s not because the plan was wrong. Most often it’s because the business GTM team gets busy chasing this year’s results and initiative execution fizzles.

Realizing results requires the plan to be effectively enabled. The simplest part of enablement is maintaining a flow of information across the business. Keep talking about the plan. Make initiatives ongoing topics in board meetings, quarterly business reviews and monthly manager meetings.

GTM value creation initiatives require funding. Budgets should be set during annual planning. Performance should be measured on a regular basis, including budget adjustments. Accountable teams should be goaled and incented to deliver results.

Change Adoption

Building the GTM value creation plan is easy. Creating momentum, gaining commitment and sustaining change is hard.

Great change adoption starts with a thorough plan. Develop comprehensive programming and sustain it 12-18 months or as long as it takes to call success or pull the plug.

Great change adoption looks and feels like the internal communication you experience with a big new product launch or an M&A event. Programs include internal PR (communications and promotion), training, manager coaching, regular newsletters, help desks or email inbox, reporting as part of management cadence, and celebrating individual and team success.

Communication

Communication is part of change adoption but worth a double click. GTM value creation initiatives are energizing. Sure, executing takes time, effort and cash but who isn’t energized about being part of a growth story?

Tell the story and then tell it again. Tell the story throughout the organization. Cascade it from executive to functional leaders to individual contributors and cross-functional teams.

Make the message overwhelmingly positive. Make it visionary. Talk about how the business will arrive at the next phase of growth. Include calls to action for the entire business – focus on profitable growth and emphasize customer experience.

Communication should come in many forums—all hands, monthly newsletters, annual meetings, weekly meetings and others. Most importantly, celebrate success, show progress and results.

Monitoring

Getting the most out of your value creation efforts closes with having a plan, assigning accountability for each initiative, and tasking the right person with ongoing oversight of the program. That person then coordinates execution, and reports up and down the organization. They ensure initiatives deliver the promised results and are responsible for killing those that don’t.

Our private equity and portfolio executive community suggest the right person is a chief of staff or revenue operations leader. This person has a wide purview to see and influence the breadth of the business. They have experience and acumen to execute in the trenches while keeping in mind the long-term vision.

Conclusion

Companies that are great at delivering value through GTM planning operate holistically. They start with strategy. They align their investments in structure with strategy. They utilize management systems to reinforce strategy execution. They know where growth will come from. They tune their models in alignment with growth pathways. They operate agile organizations that respond to market and customer shifts. They utilize tactics to realize value. They invest in leadership, enablement, change adoption, communication and monitoring systems.

Be sure to check out part 1 and part 2 of this 3-part series to learn more about driving value with “great” GTM strategies.

Need Help?

To join our private equity community and learn more about how Alexander Group partners with private equity and their portfolio companies to accelerate profitable growth, please visit our Private Equity Council webpage.