Rebuilding the go-to-customer strategy to drive growth

Part 1 of this series established a go-to-customer framework for private equity managers. Part 2 examined the leadership element of this framework: selecting the right leadership to drive top-line growth to the next level. Part 3 below addresses the strategy behind the framework.

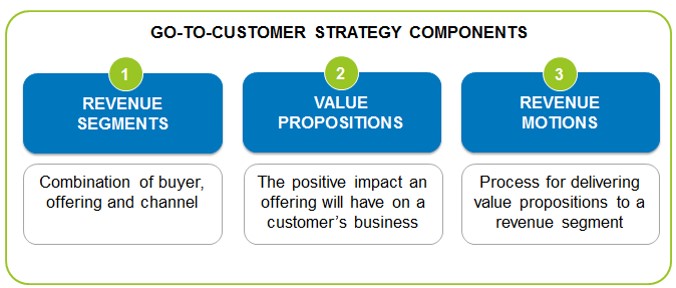

Historically, when a private equity firm acquired a new portfolio company, managers would improve operational efficiencies and quickly flip the investment. In the new world of private equity, firms require more than simple cost cutting to achieve sales growth. Taking a fresh look at organic growth is the surest sign of a company’s health and the best way to obtain the highest exit multiple. A framework and systematic approach is key to understanding the customer’s needs and how to align those needs to the acquired company. In part 3 of this series, Alexander Group explores the strategy components of AGI’s go-to-customer framework: Revenue Segments, Value Propositions and Revenue Motions. Employ these correctly to reinvigorate top-line growth.

Pre-acquisition due diligence provides limited answers to marketing and sales effectiveness issues. What is the correct starting point to review sales strategy and illuminate the revenue equation? What is the best way to begin to tweak or rebuild the go-to-customer strategy of the new portfolio company? Is it as simple as turning the business upside down, shaking it like a piggy bank and seeing what excess revenue can be found? Of course not. Evaluating the go-to-customer strategy for a portfolio company involves three steps:

- Map the revenue segments of the business. A revenue segment is the combination of buyer, offering and channel. Companies segment buyers by size, industry, function, title or persona. Company products and services, or offerings, must be matched to target buyers. The channel refers to the route to the buyer, i.e., direct, indirect, high touch, low touch. Mapping revenue segments is an exercise that includes every part of the existing and future business and is the beginning step of building a go-to-customer strategy. For each segment, the portfolio company should identify total available opportunity (TAO), current revenue and numbers of customers, market share, spend potential per account and account penetration. This analysis allows prioritization of segments and evaluates a key investment question – how do current customer-facing investments (marketing efforts, sales headcount, services programs) align to the most attractive revenue segments? Private equity portfolio companies require healthy EBITDA; dollars must be focused on the correct parts of the market. After prioritizing revenue segments, management can then focus on building customized value propositions; channel & coverage models; and, eventually, downstream elements such as territories, quotas and compensation design.

- Create value propositions for target revenue segments. This sounds basic and elementary, yet companies routinely have product-based, feature and benefit, speed- and feed-oriented sales messages and collateral. These are not VALUE propositions. A value proposition describes not what the product IS, but what it DOES. Such as the value it brings to the customer in terms of higher revenue, lower cost, risk mitigation or some combination. The actual value proposition may have little to no description of the actual product. Value propositions should instead focus on the outcomes, results and impact of the offering when properly used by the customer. The buying process is becoming more complicated in almost every industry. More complex purchasing environments require enhanced value propositions that grab the attention of new buyers whose primary concern is not product features.

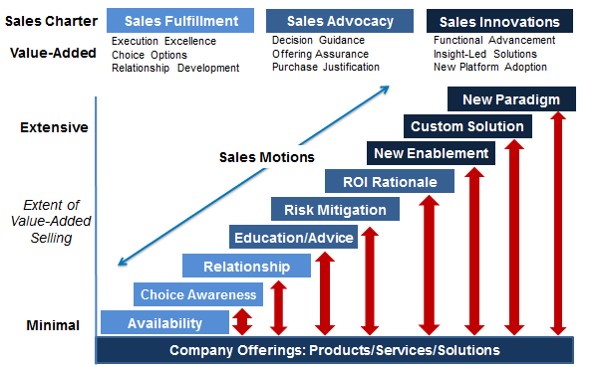

- Define the sales motion(s) by revenue segment. What is a sales motion? It is the combination of 1) buyer type, 2) value proposition and 3) selling process. There is a big difference between selling a mature, well-established core product versus selling a new, cutting-edge, complex solution. One requires a fulfillment sales motion where cost management is paramount. The other requires an innovative sales motion where higher-priced sales evangelist resources must “create the market.”

Managers regularly fail to identify their company’s sales motions and corresponding execution requirements. This leads to sub-optimal allocation of precious investment dollars and sales resources. Either too much is spent on fulfillment motions or not enough is spent to support growth in innovation motions.

Private Equity leaders must step in to scrutinize management’s decisions at the first sign of top-line stagnation. Ask management pointed questions around revenue segments, value propositions and sales motions. These three strategy-specific focus areas to improve growth represent the foundation a portfolio company should employ to execute its go-to-customer strategy. Execution is where the rubber hits the road. AGI will examine Structure and Management in future installments.

Read Part 1, Part 2, Part 4 or Part 5 of this blog series.

Learn more about the Alexander Group’s Private Equity practice.

Contact an Alexander Group Private Equity practice leader.

Read more articles about our Private Equity practice.