2021 Trends for Life Sciences and Analytical Instruments

Strategic plan value drivers for revenue growth

How will Life Sciences and Analytical Instruments companies plan for the next three to five years after navigating a tumultuous 2020? Alexander Group’s whitepaper, 2021 Life Sciences and Analytical Instruments: Industry Commercial Predictions and Trends, reviews how companies are adapting their go-to-customer strategy in response to new realities. This article is the first in a series that takes an in-depth look at how the Life Sciences and Analytical Instruments sector moves forward into new territory.

Planning Ahead

2020 was a year of herculean effort to serve existing customers while pivoting to a virtual world. Looking ahead was nearly impossible given heightened global uncertainty, forcing revenue leaders to shorten planning horizons while reacting to volatile industry changes.

2021 is when commercial organizations build upon lessons learned and revamp their three- to five-year growth plan. Trends are emerging, providing fertile ground for companies to deploy investments.

New Realities

Strategic plans must reflect new realities for revenue growth:

- Funding shifts. Pharma, BioPharma, Clinical, Environmental and Testing segment growth are accelerating while Academia and other sectors are less certain.

- Emerging customer segments. Growth markets such as cannabis, agriculture/bio, genetic testing and others are competing for marketing, sales and service budget and mindshare.

- New customer priorities. New value drivers – including supply assurance, lab productivity and vendor responsiveness – are becoming more important to customers.

- Changing buyer behaviors. Customers expect virtual interactions and self-service. The decision-making process now has a breadth of influences including distributors, peer-reviewed content, social networks and organic search.

- Limited lab access. Customer access is restricted. Essential vendors and companies with appropriate credentials will gain access and benefit from face-to-face interactions. Others must rethink how they identify opportunity and engage during the buying process.

How will Marketing, Sales and Service Respond to New Trends?

In light of these emerging trends, leaders will revamp their three- to five-year strategic plans to sustain top-line revenue. New growth plans will feature an emphasis on growth segments, modern revenue motions and shifts in resource deployment.

Pharma and BioPharma will receive intense focus due to increases in R&D and production spend. Clinical and Testing segments will also command a high degree of mindshare as the markets are poised to deliver sustained growth in the wake of the pandemic.

Academia is still an anchor segment but will be affected by uncertain funding. Commercial organizations will shift resources or leverage lower-cost customer coverage.

Geographies with increasing government funding and regulations, will be the beneficiary of shifts in resource deployment.

Consumables, service and informatics will see an emphasis greater than their relative contribution to revenue as companies seek to fortify more stable, recurring revenue parts of the portfolio.

Companies will invest in modern revenue motions, incorporating 2020’s lessons learned. They will shift resources to data- and technology-driven modes of engagement. Virtual interactions are now a mainstay and require continued investment to avoid stalled revenue.

Strategic Priorities

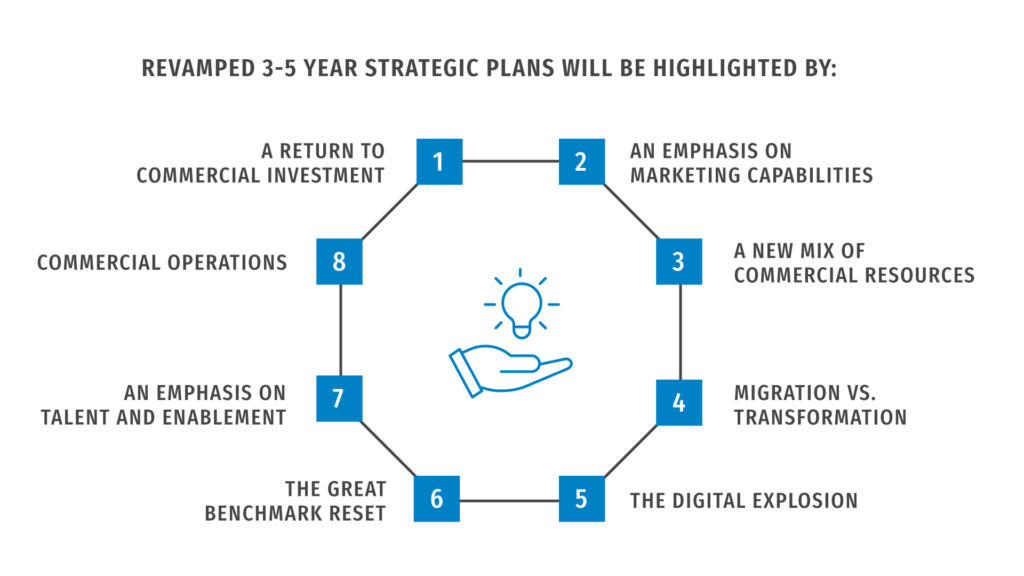

Strategic plans will feature eight areas of focus, each of which will appear in future articles. New strategic priorities include:

- Commercial investment

- Marketing capabilities

- A mix of commercial resources

- Migration vs. transformation

- The digital explosion

- The great benchmark reset

- Talent and enablement

- Commercial operations

Revenue Growth Expertise for 2021 and Beyond

Life Sciences and Analytical Instruments strategic plans must be proactive, incorporating new trends that enhance revenue growth. Alexander Group is a leading revenue growth expert that helps companies develop and adapt strategic plans while collaborating with clients to install the structure and management systems to execute growth strategy and capture profitable growth.

Register for one of our upcoming virtual roundtables.