Advertisers Want Solutions, Not Just More Options

New research reveals understanding advertiser and agency perspectives, placing winning product and customers bets, investing in talent, aligning sales compensation and professionalizing revenue operations are the key factors to grow revenue

Advertisers focus on proof that investments have tangible outcomes

What is the solution?

Alexander Group’s 2021 Media Sales Industry Trends research identified five key areas that media revenue and sales leaders excel in to continue to win in an ever-changing and hyper-competitive sales environment. Alexander Group captured insights from across media segments including pure play digital, broadcast, print, radio, out-of-home, ad tech and more to find out what leading organizations are doing to thrive in today’s evolving landscape.

Capturing the voice of the advertiser and agency (VO2A)

Understanding the perspective of advertisers and agencies has always been important, but the significance of showing value and understanding needs and perceptions of the interconnected (brand, agency, publisher, platform) stakeholders in the cookie-less future has made it even more critical. Voice of the advertiser and agency (VO2A) processes are designed to capture an objective view of how partners and customers perceive and value a company and then integrate those insights into selling, product and engagement strategies.

Alexander Group research shows that embedding a structured VO2A process into the marketing and sales functions is essential. Still, only a third (35%) of media companies have a defined process that translates findings into actionable strategies. Leading media organizations not only engage multiple internal stakeholders in the VO2A process, but they also have a formal and regular process to both capture and embed advertiser and agency insights, requiring a commitment to VO2A across the entire organization. When designed and executed properly, VO2A will help companies stay abreast of changing advertiser and business needs and continuously recalibrate the go-to-market strategy to increase competitiveness and achieve better results.

INSIGHT: 35% of media companies have a defined VO2A process

“They [Publishers] need to stop showing us 30 pages of why we should work with them and give us five pages on how we [Advertisers] can work with them in new ways.” SVP/GM response― “Wow, I can’t believe we’re still hearing this, I thought we had fixed this years ago.”

Placing winning product and customer bets

Data-driven opportunity planning allows companies to model and plan for what the future may hold versus basing plans solely on historical trends. But are media organizations positioned to take advantage of the next big new opportunity?

Alexander Group research found that most media companies are not set up to capitalize on significant and rapid market shifts, resulting in uncertainty and inaction. Most media companies rely heavily on historical spend data and current account plans as inputs into their opportunity planning, thus focusing primarily on where past growth came from. Alexander Group research shows that media sales opportunity models rely 95% on historical spend, 70% on plans for current accounts and 60% on expectations by product.

What was surprising was that less than half of participants (45%) use campaign performance metrics, macroeconomic projections, or segment (vertical) data to identify new growth drivers. Campaign performance metrics can help companies uncover and prioritize those products and offerings that are the most successful.

Effective opportunity analysis requires firms to look at both the past and the future, pairing historical account spend with research to see where the new growth will come from. Instead of prioritizing individual product wins, the shift to a buyer-centric organization means a greater focus on increased advertiser lifetime value (ALTV).

INSIGHT: Only 12% of media companies have advanced opportunity planning

“I skate to where the puck is going, not where it has been.” – Wayne Gretzy

Deploying revenue-accretive account management and specialist roles

Relying on a jack-of-all-trades hunter/farmer account executive model won’t retain and grow revenue in the long term. Advertisers are demanding dedicated account managers to track, optimize and report on the ROI of their campaigns. Now an integral part of the sales team, account managers are evolving from pure support to now being a role that ensures retention and assists with, and in some cases owns, expansion (cross-sell) opportunities.

Overlay roles, including vertical and product specialists, have existed since the introduction (or re-introduction) of new products (e.g., over-the-top (OTT), podcast, newsletters). These roles are not new, but they do add cost to the sale and must be deployed efficiently.

Account management and overlay roles fit well into the new revenue cycle that is less linear, more circular like a race car track, and heavily relies on an ongoing relationship with clients and specialized functions. Account managers can help reduce churn and maximize advertiser lifetime value (ALTV).

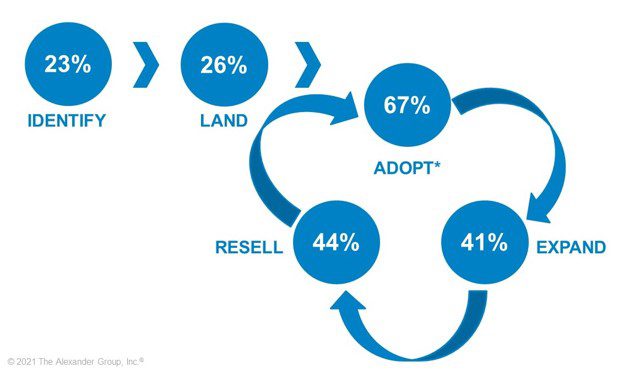

*Includes delivery, service and optimization

Chart: Percentage of account managers that lead each portion of the sales process

Account executives (Hunters) and overlay specialists focus primarily on Identifying and Landing the account. Account managers have a more significant contribution to the ongoing post-sales buyer relationship, during the Adopt (67%) (includes delivery, service, and optimization), Expand (41%) (cross-sell and upsell to existing customers), and Re-Sell (44%) (retaining revenue and reducing churn) phases.

Media leaders consider factors like account potential, offerings and sales complexity to determine the right role(s) to deploy. Once they select the right roles for each segment of their business (e.g., enterprise vs. small/mid-size business), they enable them with sales playbooks and the proper incentive program. Successful teams rely on these resources working together, in a coordinated fashion, linked together with shared data and workflows.

INSIGHT: Media companies rate their effectiveness as high at 25% for account managers and 44% for specialists

“The ability of AMs to execute well is why we get repeat business.” – Chief Revenue Officer

“If my AEs are on leave, we can still operate on day-to-day. But if my AMs are out, it’s a lot more difficult.”―Chief Business Officer

Aligning sales compensation and strategy

In 2020, over 70% of media companies adjusted plans in the pandemic to stabilize earnings for their sellers. For example, they removed thresholds, adjusted quotas and made it easier to hit accelerators. As media companies return to growth, they have begun to reassess their sales compensation plans to support a pay-for-performance culture. However, going back to the plans that they had before is not a viable option. Given the significant changes to the buyer population, company sales strategies, and job expectations, simply re-instating pre-pandemic plans is short-sighted and can significantly limit the impact of this critical program.

The lone wolf who lands the account is a thing of the past. As roles and offerings expand, teaming also becomes more important. When collaboration is critical, companies look to balance pay-for-performance with teaming, while also expanding the roles eligible for variable compensation. Our research shows that companies are increasingly using a combination of individual and team goals for roles such as Account Executives and Account Managers. But, team goals are not the only way to incent teaming, and companies must select the right approach to incentivize the right behavior.

Alexander Group research also shows that most firms (86%) use mechanics to promote integrated selling, including SPIFs or bonus payments (61%) and accelerators or quotas (56%). Getting it right takes some practice as leading firms are exploring a variety of sales compensation plans.

INSIGHT: Only 19% rate their sales compensation strategy as highly effective

“The biggest miss is that we haven’t established how to compensate some of the other functions, such as account managers. In fact, I haven’t figured out how to reward what is now the majority of my team.” – Chief Revenue Officer

Professionalizing Revenue Operations

Revenue Operations (Sales/Commercial Operations) oftentimes partners with sales to simply provide data analysis. Alexander Group research shows that media companies that achieve double-digit revenue growth also use Revenue Operations to unlock growth by centralizing crucial Revenue Operations functions, such as account prioritization and targeting. Some leaders see Revenue Operations as the “data science side” of sales, helping to uncover opportunities for greater productivity, at a desirable ROI.

As one CRO said, “Every sales leader has an operations person who is analyzing the business and how we are performing.”

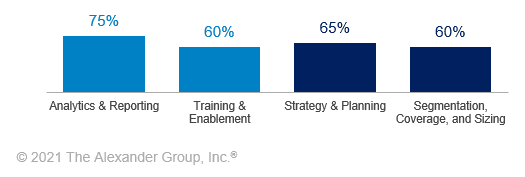

Media leaders are evolving their Revenue Operations teams. As a result, revenue operations leaders are tasked with not only revenue analysis (75% own analytics and reporting), as well as salesforce enablement (50% own training and enablement), but also with revenue strategy (65% own strategy and planning and 60% own segmentation, coverage and sizing).

Chart: Activities owned by Revenue Operations teams

What’s the benefit? A single source of truth for “the numbers,” as well as a data-driven, effective revenue strategy. Revenue Operations can be a true partner that drives sales strategy and execution.

INSIGHT: 48% of media companies have centralized Revenue Operations

“We are getting requests to increase our headcount as one revenue operations analyst can help a manager find 5-10% more productivity across their entire team of eight to 12 reps.” – Head of Revenue Operations

Driving towards growth

These preliminary results are just a glimpse into the latest trends in the media industry. For a full, complimentary briefing on Alexander Group’s 2021 Media Sales Industry Trends research that includes comprehensive findings and benchmarking, please contact an Alexander Group media practice leader today.

_______________________________________________