Analytics in Action: Improve sales time, territory planning & forecasting

The story seems to repeat itself over and over again. Organic growth starts to slow and the company goes on an acquisition spree. But the sales force continues to miss its number. In this edition of our blog series Analytics in Action, we take a look at a software company that decided to end the cycle and ultimately found itself reinvigorating its sales force for growth.

For more than 20 years, the company found success in mid-tier public sector accounts. Growth rates remained steady, but management increasingly found that growth was primarily a result of acquisitions. Arguably worse, the sales force was repeatedly missing what turned out to be overly optimistic forecasts. Looking to improve its organic growth rate, the company asked Alexander Group to assess the effectiveness of the sales force. Working with the company’s leadership team, Alexander Group consultants completed a thorough analysis of the client’s sales practices. While we often see one or two glaring issues that need to be resolved, in this situation four key inhibitors conspired to reduce the company’s growth prospects.

1. It’s About Time

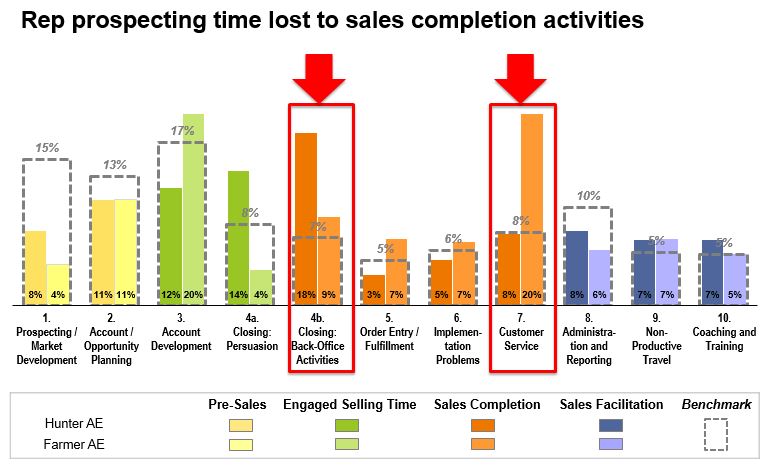

Profiling how the sales team spent their time uncovered some fundamental challenges with the company’s coverage model. Both the Hunter and Farmer roles were losing significant amounts of prospecting time to Sales Completion activities, including back-office work and customer service (see Figure 1). Salespeople spent so much time dealing with existing customers that they weren’t able to focus on building and closing new opportunities. Once they closed a deal, salespeople had little left in their pipeline to pursue and close in the short-term. This led to very lumpy revenue results and exacerbated the company’s forecasting challenges.

Figure 1

Further analysis revealed that multiple institutional issues negatively impacted how sellers spent their time. Even though the company was spending significantly more money on deal support resources relative to our benchmarks, there was no ROI. Sales reps reported it taking almost 50 percent longer to produce a RFP response after the new process was put in place. Similarly, the company invested heavily in sales management. Its ratio of 2.5 reps per manager, compared to a benchmark average of 8.3 for the software industry, did not translate to improved selling competencies or process effectiveness.

2. Get the Balance Right

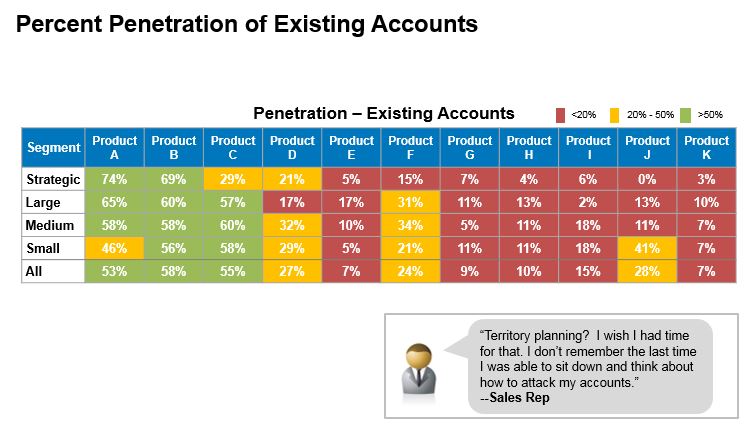

Analysis of the workload requirements and quota associated with each salesperson identified significant imbalances in territory opportunity. Coupled with the lack of time spent on prospecting and territory planning, this imbalance manifested itself in limited focus on identifying and attacking cross-sell opportunities, as illustrated in Figure 2.

Figure 2

This lack of cross-selling, combined with a limited focus on new accounts, showed up in the Expense-to-Bookings (E/B) ratio as well. Total sales expenses per rep for the company were generally in line with our software benchmarks: $485k per rep at the client company, versus $474k per rep benchmark. But lower bookings productivity resulted in an E/B value 30 percent higher than the benchmark. The company was investing significantly in the sales force but was not able to produce the desired Bookings results.

3. [Some] Pay for Performance

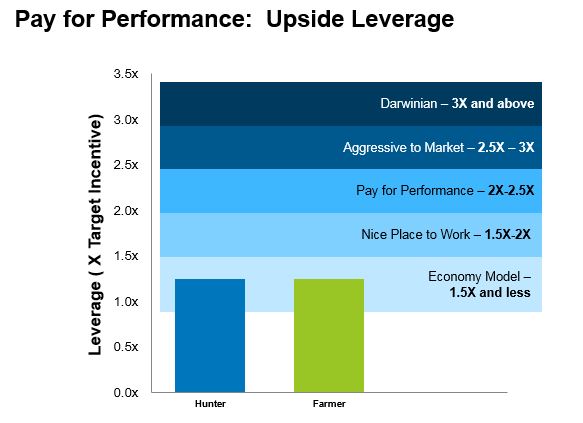

The ratio of base salary to incentive built into the sales rep comp plans was in line, if not on the aggressive side, of what we see in similar organizations: both hunters and farmers had 50/50 plans. What made the company’s plans unusual and problematic from a pay for performance perspective was the lack of upside. The leverage of both plans was 1.25x above target, well below the typical 2x – 3x seen in other software companies (Figure 3). Compounding the issue was a situation where the sales force was highly tenured and comfortable living off their base salaries alone. Incentive pay was viewed as more of an upside bonus, not part of a salesperson’s target pay package.

4. Forecasting: 90% Art, 10% Science

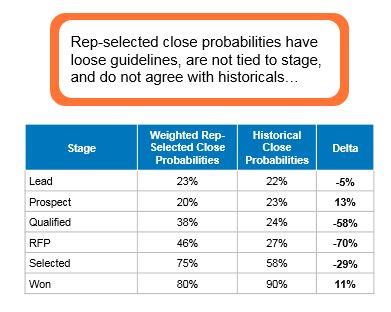

One particular challenge the company faced was that forecasts rarely aligned with actual results. Deals were forecasted on an in/out basis. Relative probabilities based on where the opportunity was in the sales cycle were not used as additional inputs to the forecast, entire deal classes were excluded, and the deal data itself (maintained in the company’s CRM system) was often non-existent. The close probabilities themselves were not tied to specific sales stages and did not reflect historical actual (Figure 4).

To bring more accuracy to the forecast, the company needed to add rigor to the forecasting process itself and address the ineffective CRM governance. Projected close dates would commonly move 100 days and sometimes up to a year or more. Close probabilities varied widely within a sales stage and customer profiles would lack important tags such as customer type and segment. The end result was a forecast process made up of 90% art and 10% science.

1 + 2 + 3 + 4 = Slower Growth

Taken together, the four inhibitors interact to create a self-perpetuating cycle. Skewed time profiles created a deficit in prospecting time, coupled with insufficient time spent on territory planning. Fewer opportunities drove oddly shaped sales funnels, leading to uneven sales growth and forecasting accuracy challenges. With a better understanding of the four key inhibitors and their impact on the company’s ability to grow, management recognized something had to change.

Embarking on a Transformation

Similar to many companies looking to transform their sales organization, the company needed to balance a desire to implement significant changes with the reality of limited budgets and the need to hit an existing number. Working with senior management, Alexander Group designed a five stage transformation program:

- Coverage and Job Evolution: Confirm the right jobs and go-to-market model

- Sales Compensation Upgrade and Competency Model Development: Clearly define the knowledge, skills and abilities required to be successful; create sales compensation plans that align with newly created roles

- Organizational Redesign: Align jobs and optimize headcount, taking into account the pragmatic impacts of changing rep-to-manager relationships

- Territory Optimization and Strategic Planning: Improve the balance of opportunity and workload across sellers

- Forecast Methodology & Pipeline Governance: Embed more science in the forecasting process to improve accuracy and credibility

Each of the five transformation work streams represents significant change to the sales force.

The Alexander Group has recently helped redesign the company’s sales model with an emphasis on the five programs listed above. Implementation will require careful communication, changing management and ongoing reinforcement. By partnering with executive and sales leadership, Alexander Group looks forward to instituting new capabilities that will reposition the sales organization and ultimately reinvigorate sales growth.

Learn how Alexander Group can help you transform your sales organization and achieve your revenue objectives.

Learn more about our sizing and deployment practice at the Alexander Group.