The education technology (EdTech) market encompasses a wide range of digital tools and solutions, designed to enhance learning and teaching experiences. In 2024, the market was valued at $194B with growth anticipated at 20.8% annually, reaching $1,063B by 2033. EdTech leaders are seeking to maximize their share of this market’s growth opportunity. The largest lever those leaders have to drive behaviors within their commercial teams is their sales compensation program. The EdTech ecosystem is complex with many different types of stakeholders, business models and challenges that impact how best to design an effective sales compensation plan.

EdTech Stakeholders

EdTech companies serve the needs of many different education stakeholders across the ecosystem including educators, administrators, learners, parents and professionals. These stakeholders are grouped into three primary segments: K-12, Higher Education and Professional Development. Each segment has unique sales challenges.

-

- K-12 education, which is heavily reliant on government funding, often struggles with capital constraints, rigid annual budgets and structured, unified decision-making processes, creating longer and more involved sales cycles.

- Higher Education (HE) is highly fragmented, with select educators making individual decisions on which titles and technologies to integrate into their curricula.

- Professional Development is on the rise, requiring a new sales approach to engage corporate buyers alongside academic institutions.

EdTech Business Models

Four main business models have emerged to meet the unique needs of each EdTech solution and the stakeholders they serve.

1. Digital Content Providers

Companies that create and distribute digital educational materials, such as eBooks, videos and interactive simulations. This includes many traditional, major textbook publishers adapting their existing products for digital formats.

2. Online Learning Platforms (SaaS)

Cloud-based solutions offering software applications over the internet on a subscription basis. This includes online learning providers and language learning platforms.

3. Learning Management Systems (LMS)

Platforms that manage, deliver and track educational courses and training programs.

4. Interactive Learning and Gaming Platforms

Platforms that use game design elements to make learning more engaging and interactive.

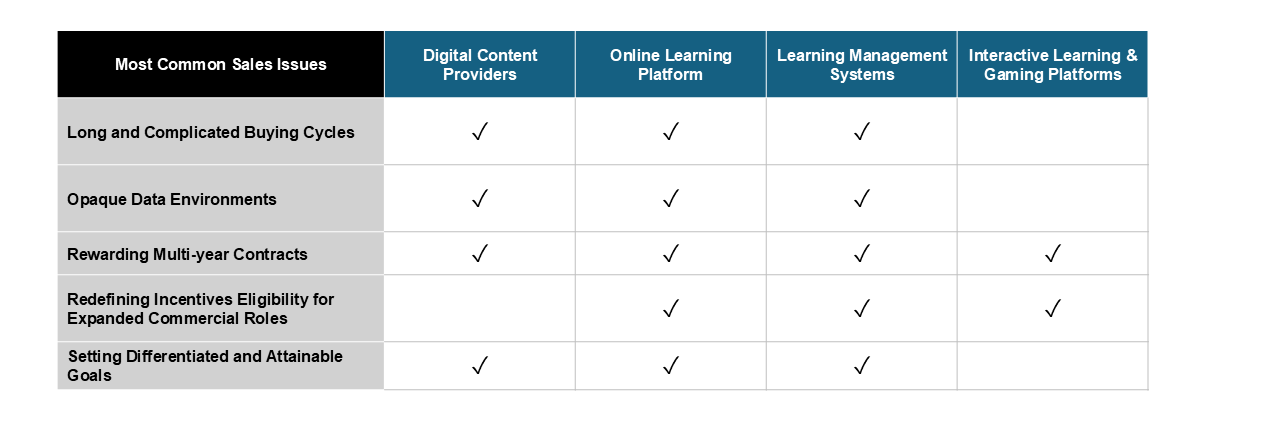

Common Sales Challenges in EdTech Businesses

Sales compensation is a motivational tool used to drive specific sales/success strategies that ultimately lead to successful business outcomes. Thus, seller sales compensation plans need to vary based on their company’s stakeholder focus and business model. The following list articulates the most common sales compensation challenges that many EdTech companies face.

1. Long and Complicated Buying Cycles: Institutional buying is often elongated and tedious navigating both buying cycles and complex buyer stakeholder maps. Sellers are often nurturing deals for over a year based on contracting cycles. As such, organizations measuring employees on success outside of an influenceable timeline can be seen as punitive and demotivating.

2. Opaque Data Environments: Organizations selling through a distributor (e.g., academic institutions) may lack insight into specific selling activity and/or lack confidence in the fidelity of their data. This impacts an organization’s ability to accurately forecast opportunities and set achievable growth quotas.

3. Rewarding Multi-Year Contracts: For cloud-based EdTech providers, the challenge lies in rewarding longer term deals that maximize the customer lifetime value while balancing the risk of over-selling accounts in which it may prove difficult to drive adoption and value realization results.

4. Redefining Incentives Eligibility for Expanded Commercial Roles: The importance of offering adoption focused support to drive repeat/recurring revenue has brought with it investments in customer success and renewals teams that are equally important in driving growth. EdTech companies need to balance the desire to drive new sales while also protecting their existing customer base.

5. Setting Differentiated and Attainable Goals:

- Organizations may lack control or influence in the final consumption of their offerings (e.g., selling courseware into an institution where enrollment has yet to be determined).

- As companies expand the types of jobs they deploy, they need to be able to set discrete quotas aligned to each job’s role and focus.

The table below maps the prevalence of these challenges across the various EdTech Business Models: