1. Define the Expansion Use Cases and Sales Plays

When going to market with value-added services, it’s important to identify and focus on the few key expansion motions that are the best fit for the organization’s growth plan and market opportunity.

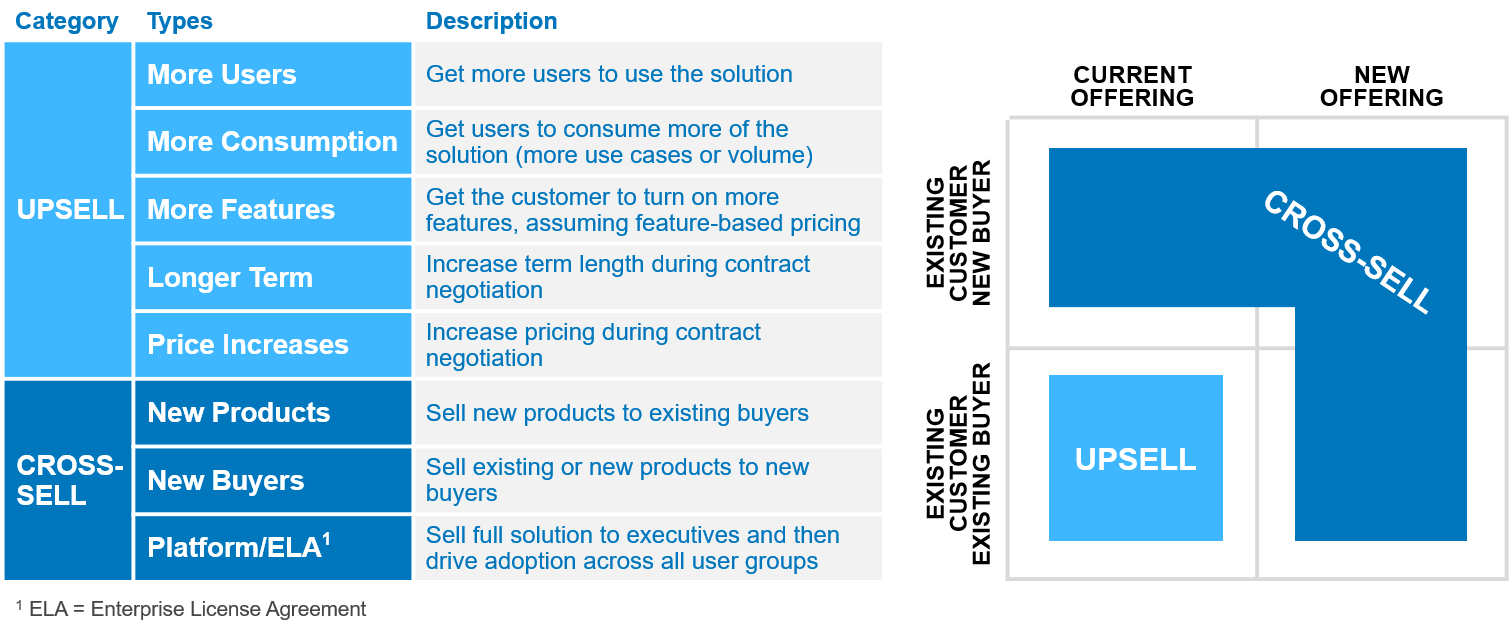

Typically, value-added services serve as a prime cross-sell play to both new and existing buyers. Value-added services are often made available with a platform offer to enable Fintech companies to extend their reach and access within clients. This could also be integrated as a feature of the core offering, which can provide an opportunistic upsell opportunity.

Next Step: Once the handful of targeted expansion sales plays have been defined, it’s critical to thoughtfully integrate them into your GTM plan. To start, Alexander Group recommends reviewing six areas:

- Size the whitespace and opportunity to quantify the total addressable market

- Document use cases and compelling value propositions

- Outline the buyer journey to understand customer’s pain points and business value

- Determine coverage and jobs to capitalize on opportunity

- Build an expansion pipeline, along with an account nurturing process, to pursue opportunities

- Enact enablement programs to enable sellers to sell and position value-added services

2. Coverage and Jobs

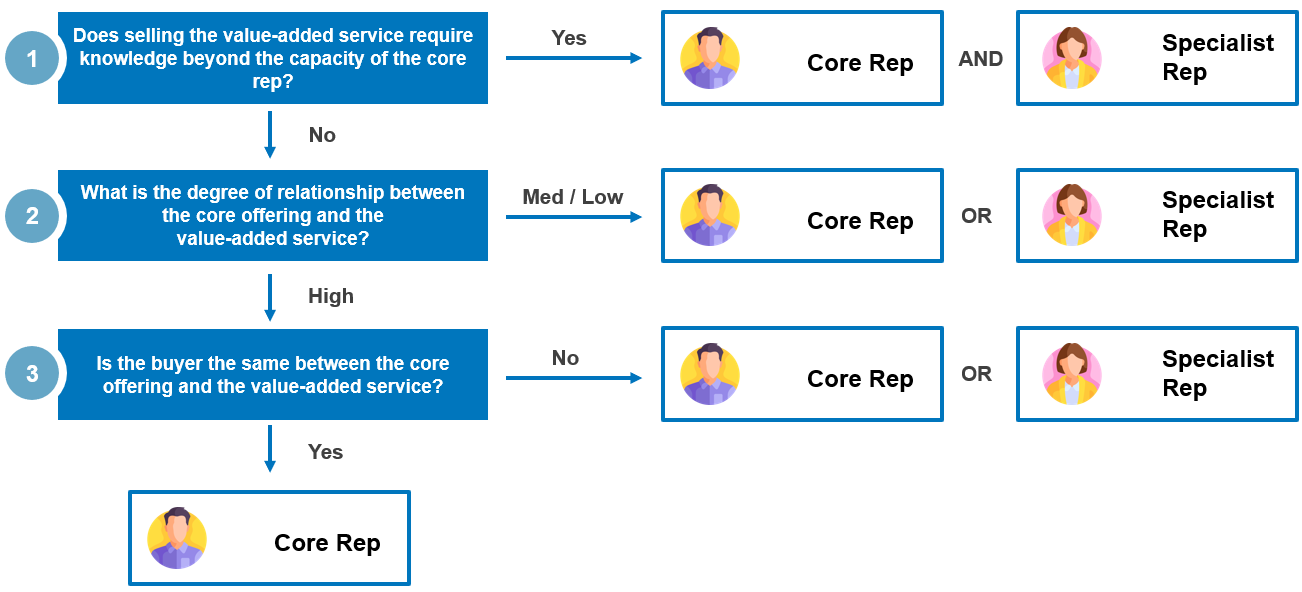

The second success factor in your GTM plan will be to determine if a value-added service should be covered by the core rep, a specialist rep or both. There are a couple key questions to answer:

If selling the value-added service requires knowledge beyond the capacity of the core rep, the pursuit team typically requires both the core rep and the specialist rep. In this case, the core rep acts as the “quarterback” and leverages the specialist rep to provide additional product support.

If the degree of relationship between the core offering and value-added service is medium-to-low and the buyers are different, the pursuit team could be either the core rep or the specialist rep. Internally, companies need to determine the strategic importance, investment feasibility and hiring capacity of the value-added services to determine the right role coverage.

Selling a new value-added service doesn’t necessarily mean that a specialist rep is required. If the core rep has the capacity and knowledge to sell the new value-added service, there’s a strong synergy between both offerings and the buyers are the same, then the core rep can absorb the value-added services to their bag.

Next Step: Once coverage and job roles have been determined, it’s critical to:

- Define the engagement model between the core rep and the specialist rep

- Build a playbook on the rules of engagement across pre- and post-sales motions

- Prepare a capacity model to right-size headcount

- Construct the right sales compensation plans

3. Sales Compensation

The third success factor to consider is sales compensation. There are several ways to use compensation as a mechanism to drive focus on value-added services for core reps. The answers to a couple of key questions can help steer you to the right compensation lever:

- Is there organizational alignment on the priority of selling and positioning value-added services?

- Where is the value-added service in the product lifecycle management process?

- Is it mandatory for core reps to sell value-added services or optional?

- Should it be a carrot, stick or both when core reps sell value-added services?

- Can the organization set an accurate quota for value-added services?

- How much is the organization willing to invest in compensation towards value-added services?

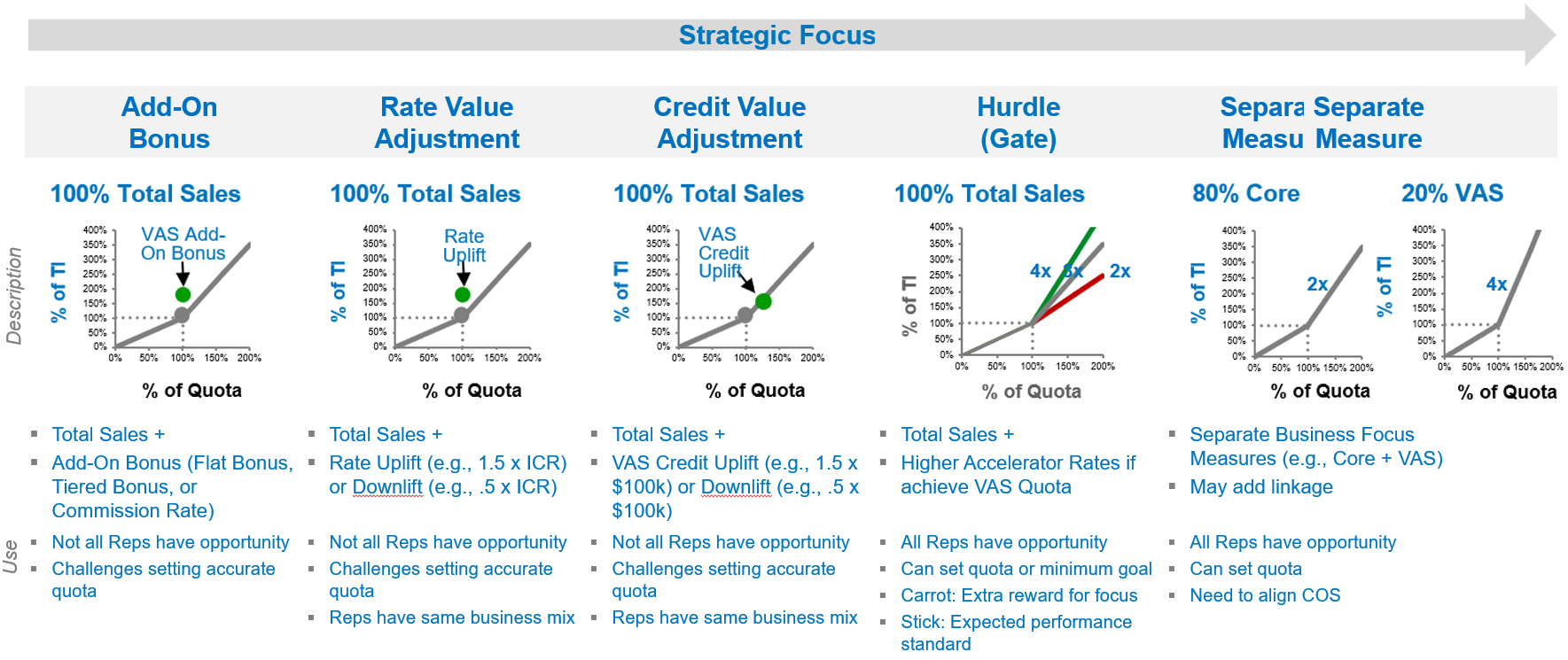

If it’s mandatory for reps to sell value-added services, companies may want to consider a separate value-added service measure to drive the discrete focus. This, however, requires the ability to set an accurate quota.

If companies want to provide more upside for selling value-added services, consider using a value-added services credit value adjustment, a rate value adjustment or an add-on bonus. Keep in mind how much the organization is able to fund for this additional earnings opportunity. More funding could lend towards an add-on bonus, less funding would be a credit value adjustment because some uplift could be baked into the quota.

If companies want to provide a penalty for not selling value-added services, consider using a value-added services hurdle. The hurdle works by not providing higher accelerators if the value-added services quota is not achieved.

Remember to keep the plan simple and straightforward to not lose sight of the core plan.

Next Step:

- Recognize if there is any internal misalignment around the priority of the value-added service vs. core offerings, and if so, the first step is to bring together the different points of view to develop an actionable consensus

- Confirm the sales compensation budget and goal expectations

- Design a plan that aligns with sales strategy for value-added services

In Closing and Next Steps:

Companies who successfully drive value-added services in their go-to-market plan will be more valuable to clients and positioned for stronger profitable growth with better competitive differentiation. Firms should review options within the three levers to drive value-added services: Sales Plays, Coverage & Jobs and Sales Compensation.