Global Pharma Sales Compensation Trends-Changes Abound

Today’s pharmaceutical world requires a sales force that is able to adjust to the changing regulatory landscape and embraces a shifting focus to patient-centric strategies. More than any other division within the company, the pharma salesforce and revenue-generating engine must also evolve to maximize returns.

To quantify changes over the past year, AGI conducted its annual Sales Trends Survey. This year’s participants included 19 companies in both the United States and Europe with 29 unique sales forces. These top pharmaceutical companies cited major adjustments to their upcoming challenges and changes for the next fiscal year. In particular, industry trends developed around changes to sales investments, incentive compensation plans and product launches.

Sales Investments Changes

“Investing in your sales team is an investment in growth.”

This sales insight aligns with our survey respondents. Most cite an intention to increase variable sales compensation costs while holding headcount relatively steady. In fact, the median U.S. respondent expects a 14 percent increase in incentive compensation costs while only 18 percent of these respondents expect to hire more headcount. Conversely, European companies expect only a 3 percent increase in total sales compensation costs from roughly the same headcount. In addition to increasing sales compensation costs, several respondents plan to increase sales force productivity by investing in technologies such as CRM and automation tools to monitor sales force performance.

Incentive Sales Compensation Plan Changes

Year to year sales environments rarely stay static. Not surprisingly, 89 percent of survey respondents plan to make changes to their sales compensation plans. Of these companies, 38 percent plan to make significant changes. These changes can include mechanic changes (i.e., moving from a commission to a quota-based bonus plan) or measure adjustments. The remaining 62 percent will incorporate minor changes such as threshold adjustments or measure weight rebalancing due to strategic shifts.

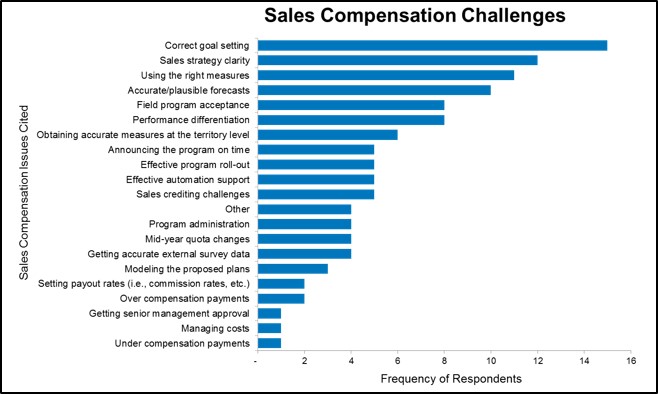

In addition to plan changes, there is certainly no shortage of challenges keeping sales incentive professionals up at night. When asked to identify these challenges, most cited an average of four unique issues (Figure 1). Traditional execution-oriented responses like Correct Goal Setting and Using the Right Measures came out as key concerns. Sales Strategy Clarity also made the infamous top three.

Figure 1

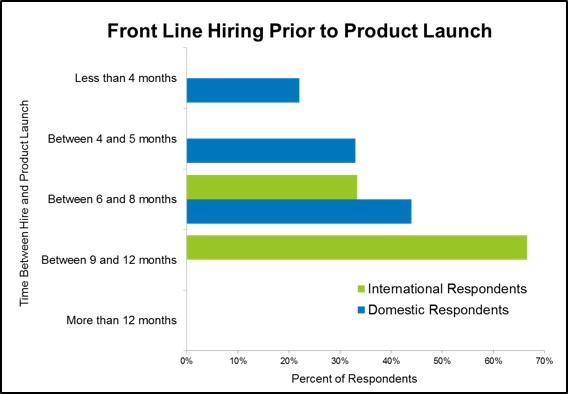

A final important observation from this year’s Sales Compensation Trends Survey was the prevalence of product launches and how companies are shifting the sales force to accommodate new promotional activity. 75 percent of respondents are in the midst of a new product launch, have just completed a calendar-year product launch, or will be launching a new product in the next 12 months. In contrast, only 9 percent of companies plan to retire a product in the coming 12 months. With new products to promote, how are companies getting the message out to their prescribers and patients? Most often pharma companies ask sales representatives to carry more products in their “bags,” but limitations or market potential often require companies to hire a stand-alone sales force (or even a contract sales force!). When this occurs, hiring the right talent and timing the hiring cycle to align with the desired launch period are paramount. Survey respondents shed some light into the differences between U.S. and European hiring when asked about the lead time between hiring and product launch (Figure 2):

Figure 2

European pharma companies require a longer time between hire and product launch while a minority of U.S. counterparts will actually hire in the same semester as a product launch. Sixty-six percent of European sales forces (versus just 36 percent of domestic companies) are more likely to change their plans, adjusting after a quarter.

This past year has witnessed remarkable change within the pharma industry. If history holds true, next year will see just as much transformation, if not more. The best sales professionals embrace change and the dynamic environment of a seller, regardless of industry,