Alexander Group Research Findings

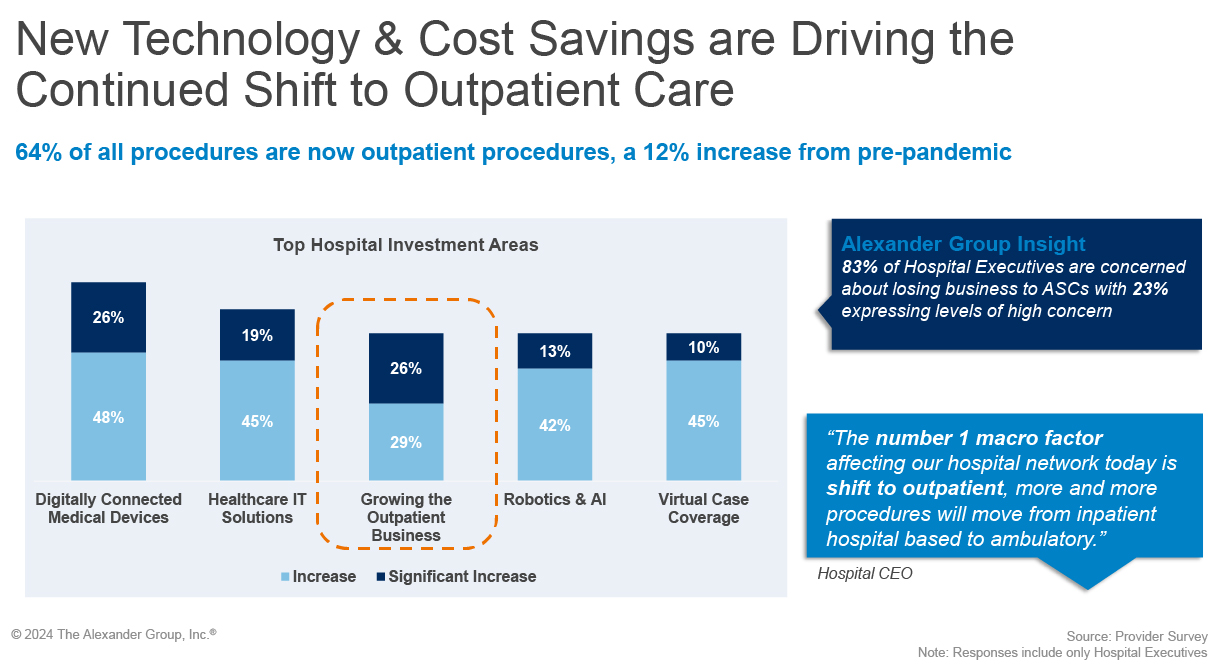

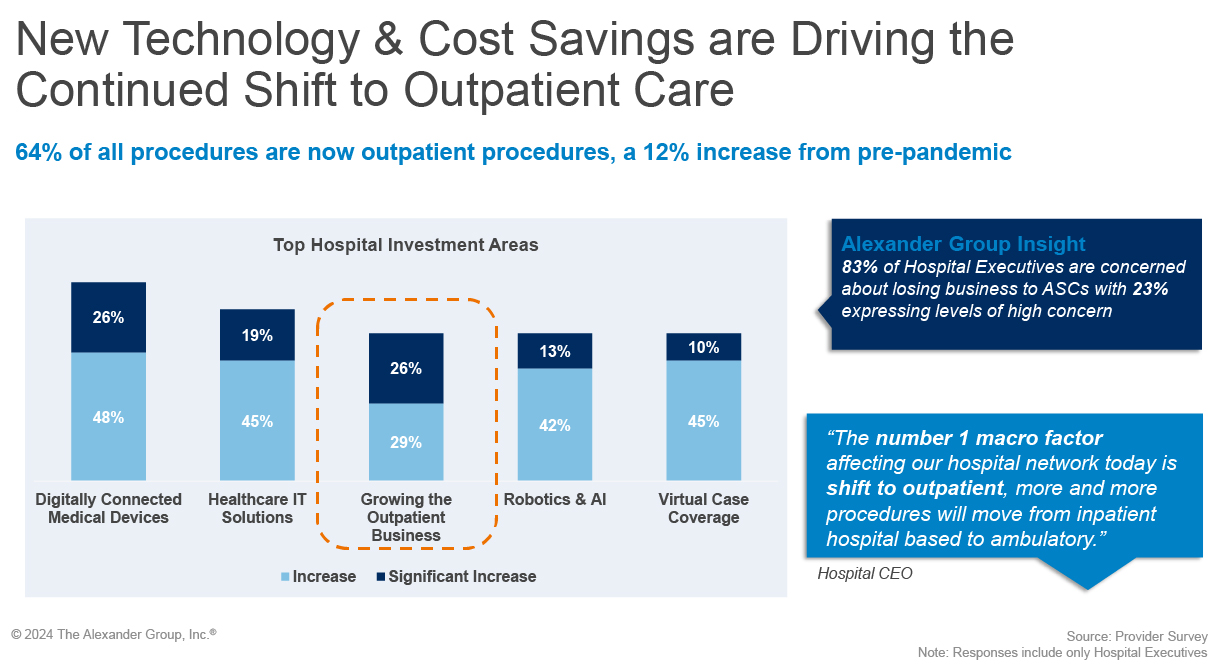

Procedures have continued to shift to outpatient settings and that trend is expected to remain in the coming years. The outpatient shift has implications for both healthcare providers and the MedTech and digital health companies that support them. In this article, we will explore how outpatient procedures will evolve in the next few years, based on insights from a chief medical officer (CMO) at a leading U.S. hospital that is part of a regional and national health care system. We will also discuss the challenges and opportunities for MedTech and digital health companies in this changing landscape.

According to the CMO, his hospital has seen a significant increase in outpatient procedures in the last two years, especially in orthopedics, dentistry, ophthalmology and plastic surgery. These procedures have been moved to the hospital’s ambulatory surgery center (ASC) or off-campus freestanding emergency rooms (FSDs), which offer better facility rates and revenue generation than the hospital-based surgery center. The CMO estimates that outpatient procedures will continue to grow by 10 to 15% in the next two to three years, mainly driven by increased capture of market share in the region. He also expects that some cardiovascular procedures, such as electrophysiology and interventional cardiology, will eventually shift to outpatient settings, but not in the short term as the hospital has a very advanced catheterization laboratory that provides high-quality care for these patients.

Alexander Group Research Findings

The CMO identified several challenges and opportunities for MedTech and digital health companies in the evolving outpatient environment. These include:

The hospital’s GPO has strict guardrails around vendors’ access to providers and contracts for devices and software. The CMO says that vendors have to work through the GPO to get their products approved and contracted, and that the hospital has a new product committee that reviews the products based on their contribution margin and patient outcome. The hospital has to comply with the minimum percentage requirements for certain product categories that are contracted at the regional or national level, which is complicated by the shift of purchasing to outpatient settings.

The hospital’s providers need education and training on the new products, especially if they are complex or innovative. The CMO says that vendors must provide education and training for the providers, as well as data analytics on the providers’ skill sets, time in the OR, length of stay and quality metrics. This presents a challenge as more procedures shift outpatient.

The hospital’s patient population is becoming sicker and more complex, as the healthier patients are shifted to the ASC or FSD. The CMO says that this poses a challenge for the hospital’s quality metrics, as the patients who stay in the hospital have longer lengths of stay, increased risk of readmission, wound infection, re-exploration, etc. The CMO also says that this requires more advanced and specialized products and software that can cater to the needs of these patients.

The hospital’s interest is in digital health solutions that can help them with billing and coding, length of stay and patient engagement. The CMO says that the hospital is looking for digital health solutions that can help them with the appropriate documentation, coding, DRG capture, and revenue generation, as well as predictive modeling for length of stay and patient discharge. The CMO also says that the hospital is looking for digital health solutions that can help them with patient education, communication and satisfaction, especially for the outpatient procedures.

Alexander Group Research Findings

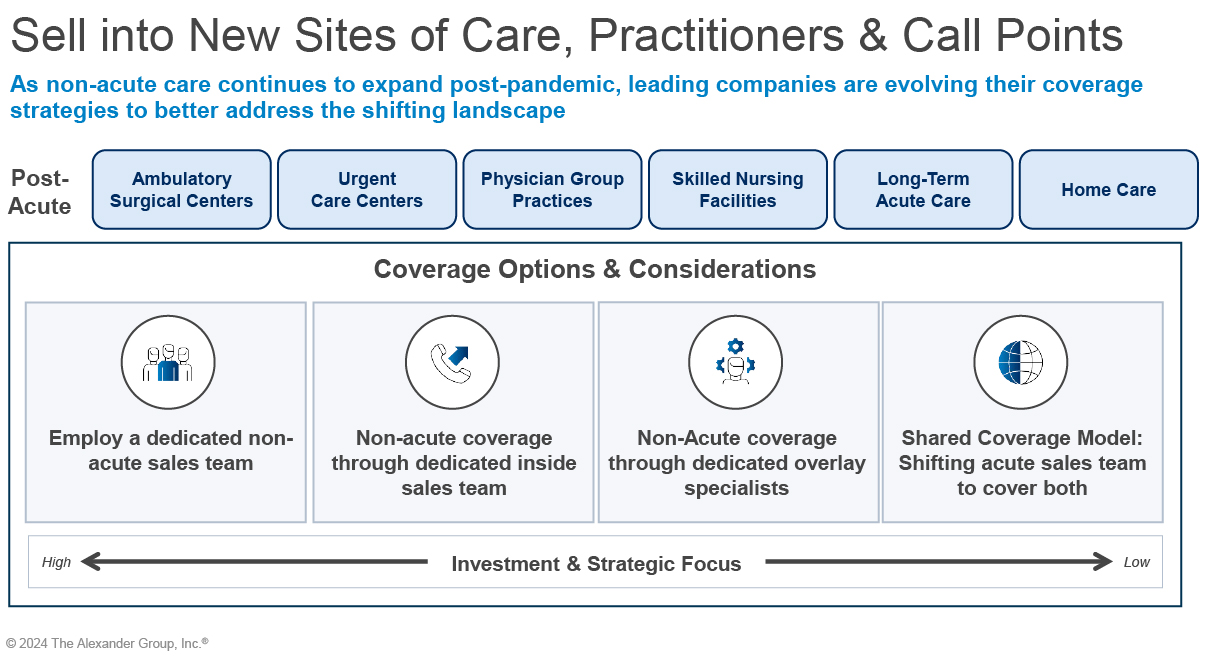

Outpatient procedures are expected to continue to grow in the next few years, as hospital reimbursement and product innovation continue to improve care in outpatient settings. This presents both challenges and opportunities for MedTech and digital health companies that want to support the hospitals in this continued transition. MedTech and digital health companies must continue to evolve their go-to-market models to support providers in what is a very fragmented non-acute market by doing the following:

Providers must operate in a way that accommodates the transition of patient volumes to outpatient. MedTech and Digital Health companies should be aware of the care continuum providers face and avoid disjointed approaches to supporting providers that cross the continuum.

Contact us today to learn more about our healthcare industry research and consulting services.