Healthcare is static, but customer needs are changing rapidly.

Last year’s optimism for a significant rise in procedures didn’t materialize, indicating a slow return of patient volume. When combined with global economic issues, increased insurance co-pays, coverage changes, and supply chain shortages, it is no wonder that healthcare spending remained tenuous.

In 2023, it is no surprise that staffing shortages, alternatives to rising costs and the need to develop a hybrid sales model will dominate the landscape.

When Will Patient Volume Increase?

In 2021, the industry expected a significant rebound, awaiting patients who delayed outpatient services during the pandemic. Instead, the year ended with 5% fewer procedures than initially predicted, resulting in less revenue and tighter margins for healthcare providers. Since these facilities rely on elective procedures as a profitable revenue source, the less-than-expected turnout impacted the bottom line. As a result, hospitals are looking at decreased revenue and increased operating expenses, a reality that providers and vendors must both address.

Patient volume is increasing – slowly. Compared to pre-pandemic levels, projections for Q1 and Q2 of 2023 forecast that patient volume will be at or slightly above (100%-101%), and elective procedures will remain slightly below (95%-97%) historical levels. Fewer than half of leaders believe they have already returned to pre-pandemic volume and elective procedures. At the same time, the remainder is widely split, thinking it may take another four to five quarters to recover.

Roadblocks to increasing volume and procedures include staffing shortages, insurance payment concerns and patient cancellations due to illness. The new reality is that patients must be physically and financially fit before they have a procedure.

The Need for Alternative Vendors

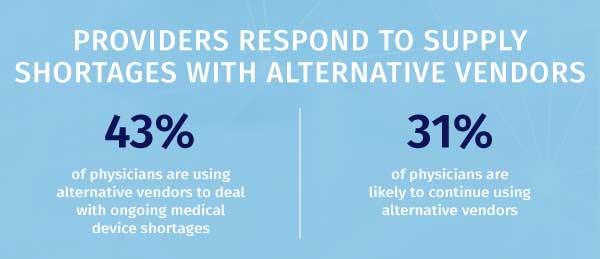

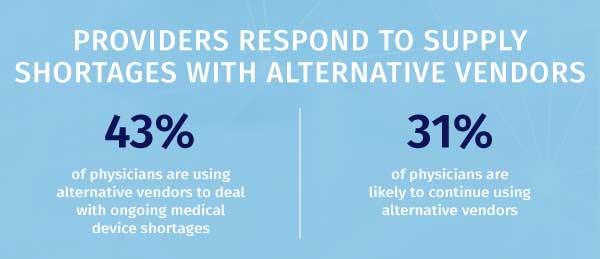

The current economic climate and inflation concern cuts across all industry sectors. In the past, facilities may have refused price hikes, but now reasonable increases are a fact of life. In addition, products and services must be available and delivered timely, or the price is irrelevant. An incredible 37% of providers believe supply shortages significantly impact their ability to provide care. To deal with critical medical device shortages, 43% of providers are now turning to alternative vendors and product options for near-term shortages, and 30% will continue using those vendors for the long term. The takeaway? There is an opportunity for Tier 2 suppliers to unseat established incumbents. On the flip side, established vendors will make concerted efforts to regain or protect their core business in 2023. Some supply chains are doing well, but companies cannot produce enough to pick up more shares.

Using new products and services depends on the openness of the physician to utilize alternative options. An increased number of physicians are now slightly more willing to consider new treatment options, rising from 62% from 59% during the pandemic.

Leaders are keeping a watchful eye on the bottom line. As costs accelerate and outpatient revenue falls short of rapid growth expectations, alternative vendors and cost control are part of a more significant issue of margin compression. That is why most hospitals are purposefully not limiting utilization due to cost, but 15% are prioritizing procedures by profitability, as they balance patient care and ongoing financial pressures.

Optimizing Your Commercial Model

In the last 10 years, seller productivity increased and commercial model expense decreased as Medtech companies moved away from traditional generalist rep models. Additionally, provider operations, patient preferences, and technology advancements are expected to evolve faster than pre-pandemic levels. As a result, the commercial model is ripe for change, transforming to meet new customer expectations and promote next-generation technology solutions.

Sales reps are just one of many factors that influence a purchase decision. Also, virtual interactions with providers are projected to remain at two times pre-pandemic levels. That is why 52% of healthcare companies are increasing their investment in marketing to become more effective at leveraging data to target accounts, align with sales, generate leads, and improve the customer experience. Companies who use this modern approach invest nearly 2% points more revenue into the marketing budget and have a headcount-to-expense ratio of 27%/73% as opposed to the industry average of 32%/68%. Although traditionally reliant on physical channels, 88% of healthcare companies plan to increase their investment in digital technologies, which may not be fast enough to meet the demands of the industry.

The speed of these trends points to the need for a hybrid sales model that leverages multiple skills while controlling costs. For instance, investing in inside sales and service is a high investment priority, as is digital engagement and new technology coverage models that include specialists, solutions architects, and sales engineers. Conversely, core field sales are the lowest investment priority as the organization seeks to provide more solutions and support while differentiating sales by target customers.

However, core reps protect the amount of business within a territory and the opportunity to grow that business. But they must work hand-in-hand with marketing to serve customers effectively. Therefore, mixing virtual, online, and in-person sales remains essential for a successful coverage model.

Customers Are Changing. Is Your Sales Organization Keeping Up?

Healthcare is static, but customer needs are changing rapidly. Targeting the right customer with the correct mix of resources is essential to maintain and increase market share. But is your sales organization keeping up? Alexander Group offers new insights on keeping up with the rapidly changing healthcare landscape and growing revenue while balancing costs.

For more information on how to optimize your commercial team, please contact an Alexander Group healthcare practice lead. For a full briefing on the latest hospital providers’ research, please complete the form and an Alexander Group representative will be in touch.