Hospital segmentation and targeting under Obamacare

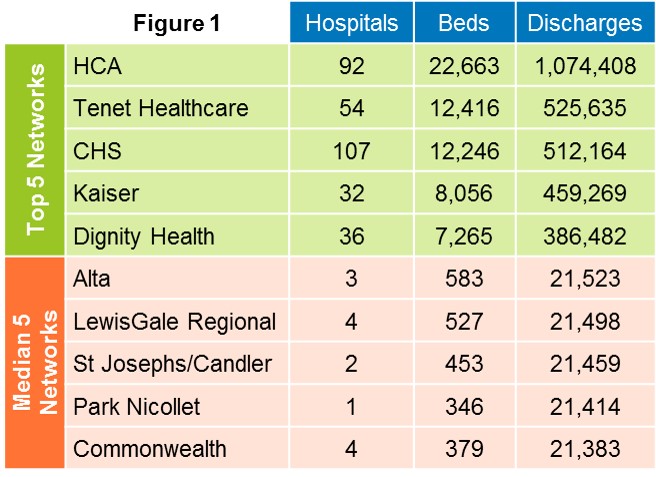

Segmenting hospitals used to be easy. First, segment them by their purpose in the community: general hospitals, specialty hospitals and research hospitals. Second, segment them based on legal entity: non-profit vs. for-profit vs. government-owned. Third, segment them by size, counting the number of sites, beds, and patients discharged. The American Hospital Association and third-party data companies made this even easier by publishing ongoing updates, such as that in Figure 1 below.

Sales Potential Segments. Go one step further and you could calculate sales potential based on the number of procedures a given hospital or network performed involving your product, and multiplying the procedures by a factor of product usage and price. With readily available third-party procedure data you had yourself a pretty good sales potential model at the account level. You could see market share and trends clearly. The savvy marketer placed every hospital in a unique segment, sales management sized the salesforce and territories to optimize coverage of account potential, and sellers targeted each segment with unique messages based on share and potential.

The Ground Shifts. The rapid growth of networks through M&A and affiliations shifted the ground beneath the feet of device marketers. Now hospital networks look more like corporate enterprises than old hospital segments. Segment marketers increasingly must consider how a network is structured and, more importantly, how the network wants to look in the future. For example, some networks remain on an acquisition binge, but most have settled down into a period of consolidating what they’ve already assembled. Becker’s Hospital Review reveals that hospital M&A announcements and deal volume declined substantially in 2013. Is the ground shift beginning to settle? Maybe. But apart from network structure and expansion plans, other business-to-business segmentation factors should be mixed into the equation as well, including the following:

- How healthy is their business, and will they be a long-term partner?

- Is my value proposition relevant to their network strategy and structure?

- How can we as vendors help them consolidate?

- What are the implications for their capital budgets and operating expense?

- What does this mean for our current share, contract position and pricing tiers?

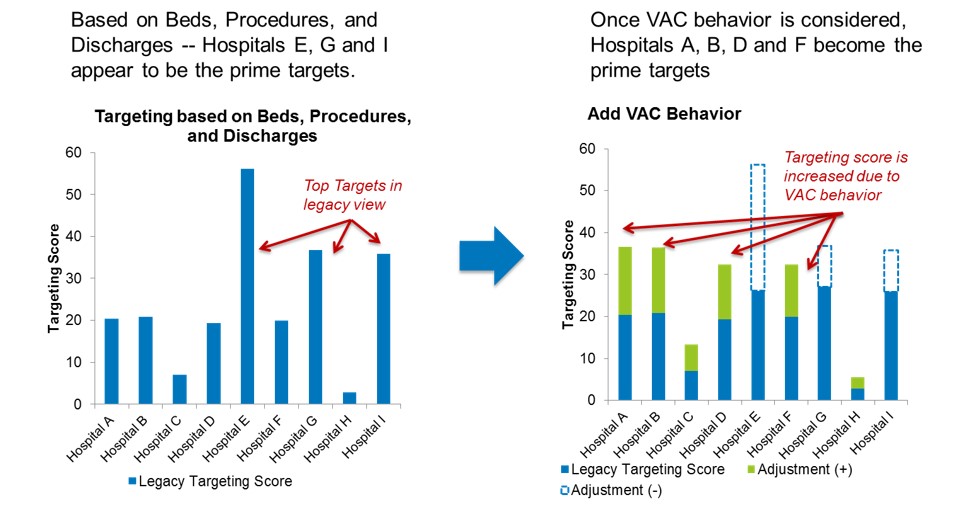

Targeting in the Field. What does this mean to sellers in the field? Most medical device sales reps target doctors not hospitals, let alone networks. For years, sales reps successfully targeted doctors based on their specialty, sub-specialty and openness to new technology. Since most doctors have become hospital employees and are no longer independent decision makers, they’ve become far less important targets. More important are hospital Value Analysis Committees (VACs) — the cross-functional teams made up of hospital administration, purchasing, materials management, finance, and medical staff. VACs dominate device conversion sales decisions. Thus VAC behavior is an important sales factor and should be used to confirm or reprioritize targets.

Obamacare and Targeting. As Obamacare drives hospitals from fee-for-service to pay-for-performance, the VAC helps chart the course. Obamacare creates two paths, with hospitals receiving reimbursement incentives for (a) reducing costs; and/or (b) improving quality and patient experience. Most VACs went down the near-term cost reduction path first. To be sure, every device vendor fits into a hospital’s cost reduction or quality improvement plan, whether they know it or not.

As VACs reveal their course and behavior, device marketing and field sales must adapt. This means understanding a VAC’s behavior when targeting them, and deploying sales and service resources against them with this in mind. See Figure 2 below, which shows a typical territory’s nine hospitals. On the left, we show how they score on the basis of legacy volume factors. On the right, we show them re-scored after factoring in VAC behavior and alignment with the vendor’s value proposition.

Figure 2

Conclusion: Where a VAC takes a sharp turn down the cost reduction path, device vendors must reduce the cost to serve these hospitals. Where cost-cutting isn’t enough, and a VAC shows an interest in quality improvements that align with a device vendor’s value proposition, then that hospital deserves more sales coverage. We recommend you shift now, before the hospital networks force it upon you.

Learn More

If you sell to hospitals, how do you target them? Do you factor in behavior alongside legacy factors? How do you need to change your salesforce deployment in 2014? Learn more about our Medical Device practice or contact us today.