How are progressive pharma companies shifting to a customer-centric model?

As the healthcare landscape continues to evolve, pharmaceutical manufacturers must keep pace with the implications of healthcare reform, ongoing industry consolidation and shifts in decision-making authority. Market conditions require companies to either update their model to meet changing customer needs or face waning relevancy and potential extinction. Progressive Pharma and Biotech companies see this as an opportunity—an opportunity to redefine their commercial organizations from Brand-Centric to Customer-Centric. Sound familiar? It should, as similar transformations have taken place in other industries including Automobile Manufacturing and High Tech. Consider IBM, Cisco and Ford. History is rife with examples where companies took difficult steps to blow up once successful business models to address changing business realities.

From Brand-Centric to Customer-Centric. How are progressive Pharma companies changing to remain relevant in the eyes of their customers? We asked leaders from Pharma and Biotech companies this question in a recent Alexander Group study and found the following four prevalent actions:

1. Organizing Around Influential Customers

The number and type of health providers/systems will continue to evolve and consolidate. Some estimates suggest that as few as 300 major health systems may exist five years from now. Similar scenarios may be seen among physician practices and with payers. Even if consolidation estimates prove to be only directionally correct, true buying decisions for Pharma products will be in the hands of fewer and fewer decision makers. Pharma commercial models must therefore evolve to properly engage with large, complex accounts. Progressive companies are working hard to change from siloed, brand-centric models to collaborative, customer-centric teams. The leaders we spoke with candidly shared how this sort of culture shift does not happen overnight. Those gaining the most traction seem to exhibit an organizational sense of urgency to break down traditional silos in favor of transparency and collaboration. Beginning with top-down leadership, they are changing long standing reporting structures, integrating annual planning efforts and using systems such as CRM to enable communication, collaboration and messaging. Externally, progressive leaders are identifying opportunities to collaborate with customers to understand mutual sources of value and build “reference accounts” where they find success.

2. Building Commercial Model Flexibility

So it’s all about big customers, right? Unfortunately, it’s not that simple. The best commercial models must also recognize and be suited to handle local market needs. Factors such as the favorability of managed care access, degree of system influence and density of physician call points change the local market “ecosystem.” Progressive leaders told us they are testing different deployment models based on the local market characteristics. These models vary by geography in everything from products promoted, number/types of roles deployed and the value propositions being delivered. Leaders are recognizing the need to better leverage local market knowledge through greater call plan flexibility and more precise targeting. We also found organizations struggling to adapt legacy HCP-oriented reports and systems to a model that allowed for local differentiation at an account level.

3. Taking a Page (and Talent) From Other Business-to-Business Models

Not surprisingly, top Pharma and Biotech leaders say the skills and abilities necessary to succeed in the emerging Pharma landscape differ from those of a traditional Pharma rep. The current “share of voice” model needs to adapt to a more traditional Business-to-Business model where business acumen (i.e., the ability to leverage insight from business issues and industry trends) and account planning (i.e., understanding how best to deploy company resources to decision makers) are necessary skills. As a result, we found leaders working hard to coach and train their field leadership to these newly valued core competencies. We also found companies hiring from outside of the Pharma industry in an effort to infuse Business-to-Business skills directly within their sales teams. One leader shared a recent example of hiring 80 percent of a new salesforce from outside of the Pharma industry–a number that would have historically been closer to 20 percent under the old model.

4. Testing (at Times Unsuccessfully) New Ideas in the Marketplace

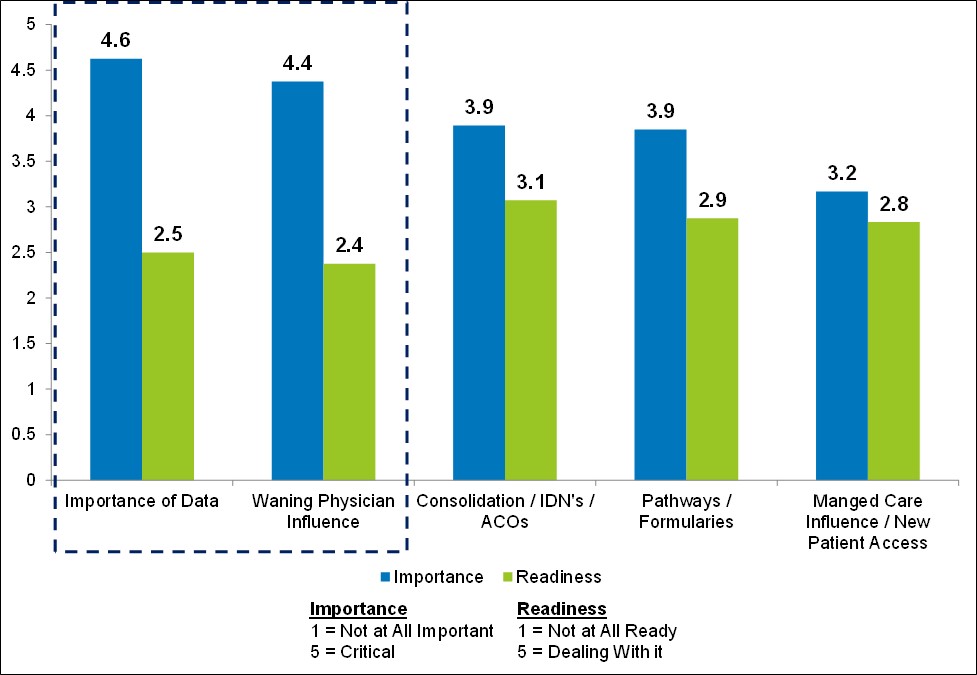

There may be broad consensus on the issues facing Pharma leaders, but aside from the above ideas, we did not find as much consistency in approaches or progress to date. When we asked leaders to rate a set of issues on relative importance and on their readiness to address these same issues, we found most companies in the early to middle stages of addressing major issues:

Leaders describe a “trial and error” approach to finding the exact right commercial model. As scary as this sounds, it’s to be expected given the degree and speed of changes in the marketplace. For an industry where traditional commercial approaches have been so historically successful for so long, changing commercial models from brand-centric to customer-centric will take time, commitment and strong leadership. In this case, it will be the companies that look beyond the traditional Pharma approaches and learn from other industries that are most likely to succeed.

To schedule a briefing of The Alexander Group’s recent commercial model study and learn more about how you can successfully transform your Pharma commercial sales organization, please click here.