How Many Account Managers Does Your Team Need?

Three ways to optimize your Account Management organization

Revenue leaders regularly debate go-forward coverage – should we operate with a hybrid hunter/farmer sales role or split into two distinct Account Executive (AE) vs. Account Manager (AM) functions? While most pure-play companies operate with a hybrid coverage model, organizations are increasingly exploring alternative setups with the introduction of expansion-focused AMs dedicated to pursuing up-sell and cross-sell opportunities.

Determining how many AMs are needed is more nuanced than a simple ratio of AMs to AEs. Variables include market, customer and product maturity. Established markets will have a heavier weighting towards AMs whereas emerging markets usually have a heavier weighting towards AEs. Because business in emerging markets is focused on rapidly acquiring customers, the need for account management is limited. Meanwhile, developed markets often see new logo acquisition slowing so more focus is needed on the expansion of existing accounts and optimization of Net Recurring Revenue (NRR). The establishment of an ideal AE:AM ratio is a helpful starting point, but lacks rigor and, if used exclusively, can lead to massive over- or under-investment.

First, Ask These Questions

Before calculating the number of AMs required, it is essential to understand current customer dynamics and the ideal AM job function vis-a-vis other resources within the company.

Product and Account Dynamics

- What is the account servicing load? Is there high attrition risk?

- How many contracts do we have in each account? Do they co-terminate?

- How “sticky” is the solution? Are there high costs associated with switching? Are there substitute solutions that could replace our solution?

Leveraging Upsell and Cross-sell Opportunities

- How much wallet share do we have in each of the accounts?

- Have our clients purchased our entire portfolio of products? Are there more opportunities for cross-selling?

- Have our clients maximized their usage of the current products they purchase? Are there additional upsell opportunities?

- Do we need to transition customers to new pricing models (e.g., subscription to consumption)?

Post-Land Engagement Model

- To what extent will other roles (e.g., customer success manager) support upsell and cross-sell motions?

- Is the AM function expected to support adoption and/or value realization activities?

After addressing these questions, more reliable assumptions can be utilized for each AM sizing methodology which ultimately leads to more confident headcount outputs. Alexander Group recommends these three sizing methodologies:

- The Dollar Value of Your Current Book of Business

- Total Number of Accounts

- Other Post-Sales Investments

Let’s explore each option in greater detail.

Method #1: Book of Business Dollar Value (aka “Net Ratio”)

The AM has a finite amount of time to sell, and as such, organizations should understand incremental growth potential within existing customer accounts. Developing a “Net Ratio” is a simple way to distill multiple variables into a single metric. It is the upsell/cross-sell net of churn as a percentage of the book of business under management.

Organizations usually follow two paths when utilizing Net Ratio:

- Estimated: Estimate Net Ratio on a forward-looking basis. The estimate can then be compared to expected AM productivity. For example, 20 AMs are needed if the Net Ratio is estimated at $30M and expected ACV productivity per AM is $1.5M.

- Actual: When in pilot mode, the actual Net Ratio can be compared between AM covered and non-covered accounts. A high observed delta suggests AM coverage is accretive to the overall business and revenue leaders should increase AM headcount to cover more segments and/or verticals.

Advantage: The higher the Net Ratio, the more opportunity there is for increased penetration. The business case has been made for AM investment.

Disadvantage: Net Ratio struggles to account for non-sales activities. The AM function may have various service responsibilities attached to it which isn’t picked up in the formula. Additionally, Churn CMRR’s impact may be overstated if other roles own the renewal motion (e.g., renewal rep, customer success manager).

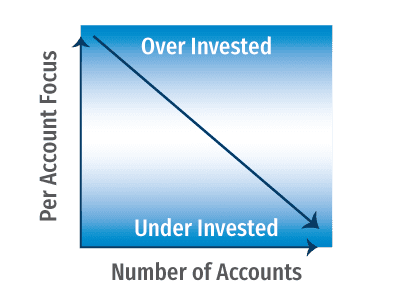

Method #2: Total Number of Accounts

The more accounts that an AM oversees, the less time they have to focus on each account. Overloading an AM, particularly in strategic and enterprise segments, can have the opposite result than desired – lower than expected bookings and possibly even account attrition due to insufficient account servicing. Conversely, it’s cost prohibitive to assign too few accounts to each AM. Avoid these negative outcomes by establishing an account load minimum and maximum range. Then test and revise these figures over time based on evidence and feedback (e.g., NRR growth, AM performance and satisfaction, customer health scores).

- Minimum Load: How much growth within existing accounts is needed to cover an AM’s cost, and how many accounts are needed to achieve that baseline performance level?

- Maximum Load: How many accounts can our best AMs cover without significant impact to customer experience and/or sales capacity per account?

Alexander Group recommends that revenue leaders establish account load ranges for each segment. Don’t be surprised if those results vary by large margins. It’s common for AMs in Strategic segments to have account loads in the single digits while AMs in SMB may have hundreds of accounts.

Advantage: Output is straightforward and easily understood by all parties involved.

Disadvantage: Accounts are treated equally. In reality, service intensity and/or incremental spend potential varies by customer. For example, an AM with a disproportionate number of “high maintenance” accounts will have capacity challenges relative to their peers.

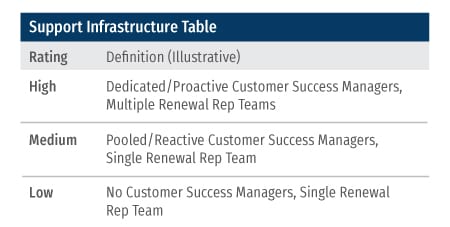

Method #3: Other Post-Sales Investments

Customers demand more than ever from IT vendors. Organizations are responding by investing in roles to meet customer expectations throughout the end-to-end relationship. Roles such as customer success managers, value consultants and renewal reps support adoption, value realization and retention efforts. These support roles help free up AM time to focus on selling activities that result in more cross-sell and upsell business. Less AM headcount is needed when each individual AM’s sales time and productivity increases.

Alexander Group recommends that revenue leaders establish a “Support Infrastructure” rating for each segment. All else equal, a low Support Infrastructure rating suggests more AMs are needed and vice versa.

Advantage: Calibrates for more complex coverage models used by tech companies with increasing frequency.

Disadvantage: Not a reliable standalone approach since sales potential is not considered.

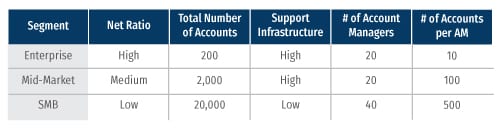

Bring It Together

Best-in-class organizations use multiple methodologies to determine and refine AM headcount requirements. Combining the multiple approaches described in this article allows organizations to create a sizing chart like the one below.

Notice how Account Load per AM (10) is narrowest in Enterprise because the Net Ratio is high. It can also be reasonably assumed that the economics are more favorable in the Enterprise segment relative to other segments allowing organizations to invest with more confidence. Conversely Account Load per AM (100) is broader in Mid-Market relative to Enterprise because Support Infrastructure is rated the same while Net Ratio is not.

Ongoing Evaluation

Revenue leaders must reassess the AM sizing chart during each planning cycle; a change to any of the ratings likely means that changes to AM headcount are needed. Continue to ask these questions as part of the ongoing evaluation process:

- What is the net-growth within existing accounts?

- Can AMs execute their assigned growth objectives?

- Are AMs productive, or do they have too many/too few accounts?

- Are support roles adding value?

Speak With Technology Practice Leader

Not sure how many AMs, AE’s or support staff you need to optimize revenue? Alexander Group has the experience working with leading companies in a rapidly changing business environment, helping them create high-growth, high-performing revenue organizations.