Insight-led Selling in Medical Devices

“Obamacare” ushers in a new world of pay for performance to improve quality and reduce cost of care. CMS is putting the squeeze on hospitals to improve in several areas. As hospitals improve quality and cost, they gain better reimbursement rates and profit making opportunities. In turn, hospitals put the squeeze on their device vendors to deliver additional value beyond product and price, and help more broadly with quality and profit goals. So hospital and vendor destinies are linked; one could even say they’re wedded, with CMS officiating.

Insight-led sales. As hospitals choose different paths to improve quality and profits, device vendors must anticipate which way their hospital customers are going and help them get there. Or better yet, show them a new way and influence the direction. Hospitals need better insights on quality and profit-making—insights that device vendors could be providing, at least far more than they do today. However, this requires device vendors to re-cast their sales motion with hospitals from a traditional product push relationship (adversarial at times) to a more consultative, supportive and enduring relationship … one based on delivering insights that help hospitals improve both patient outcomes and profitability.

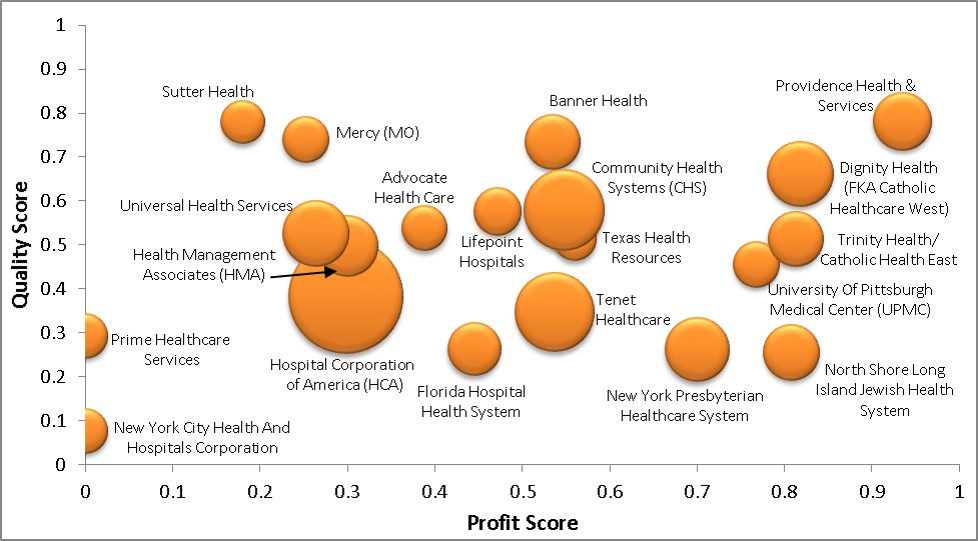

Understanding the position of hospitals. First let’s understand the starting point for most hospitals. We recently evaluated a handful of IDNs and plotted them by size, quality position and profit position (See Figure 1 below).

The size of the bubble estimates volume on the basis of (a) number of procedures and (b) number of discharges. The quality score is an indexed rank of (a) length of stay, and (b) readmission rates, both vs. expected. The profit score is an indexed rank of net income per procedure. Hospitals want to move upward and to the right in the graphic, and, as you see, they are all over the map. To be sure, the burden of helping hospitals move upward and rightward falls on all parts of the vendor organization. However, the sales force can and should play a more important role.

How sales can help hospital quality. To help hospitals improve quality, device vendors will typically focus first on R&D, manufacturing and quality control units to bring the best products into the hospital. Next, compliance and medical affairs ensure that regulatory safeguards, product quality and expected patient outcomes are achieved. But the forward-thinking sales force can help by delivering clinical data and insight in language that addresses a hospital’s patient outcome and quality goals. While the vendor sales force doesn’t develop the outcomes data, the sales team can become astute at delivering it and articulating the key points with support from colleagues who have medical or nursing degrees. This is true insight-led selling. Vendor sales reps must fully understand the hospital’s position on patient care outcomes; their quality improvement plans; and their performance on metrics such as readmission rate, length of stay, patient safety and other inpatient quality indicators. In addition, vendor sales reps are in a unique position to convert clinical observations from one hospital into insights for another hospital customer. The focus on delivering patient quality improvements forces a device seller to move beyond product pushing, extend relationships beyond legacy contacts to the most important clinical influencers across the IDN, partner with marketing and medical affairs, and deliver unique patient outcomes insight to hospitals. This is a high calling!

How sales can help hospital profitability. The hospital profitability conversation typically begins with pricing and contracting. Over the years, IDNs have beefed up their supply chain and materials management functions. They’ve hammered away at unit price and payment terms and strengthened their hospital operations to run factories that produce procedures more efficiently. Too often the device vendor pricing and contracting teams are caught on their heels. Our interviews with hospital executives confirm that hospitals and IDNs are very interested in strategic sourcing for lower unit prices. And these interviews revealed a keen interest in exploring new ways of financing capital equipment, specifically through risk-sharing contracts. We’ve seen cases where the vendor has written a large check to the IDN to purchase all of their capital equipment in a given department. In return, the vendor receives a long-term service contract from the IDN which pays monthly. Device vendor sales teams, with the right support from finance and management, can create and guide opportunities for these types of deeper, longer term relationships with IDNs. To add to the list, IDNs are also interested in less “sexy” things that drive profit such as free service; free nurse training; greater ease of doing business; and, most important, general operations insight for transforming financially strapped hospital networks into thriving business enterprises. These are all ways that the device vendor sales rep can steer the relationship toward the win-win combination of higher device sales and higher hospital profitability.

Conclusion: Sales can play a strategic role. Hospitals and IDNs need to improve both patient care quality and profits. They each start from different places, and their improvement paths and timing will vary. To win share in the largest IDNs, device vendors must discard the legacy adversarial transactional relationship and develop a new relationship based on insight. This insight is largely untapped today, in both the quality and profit dimensions. Those who can effectively develop and package outcomes and profit-making insight and deliver it through their sales forces will win the race. We’ve seen it in B2B and CPG, and we’re starting to see it in medical devices, too.

Are your device sales reps practicing insight-led selling? The Alexander Group’s medical sales consulting practice helps device clients strengthen their position in hospitals in an increasingly competitive and complex selling environment. Our clients achieve success by delivering insight to hospital customers and adapting winning practices from outside legacy hospital sales models.

Learn more about our Healthcare practice.