Can Sellers Compete with the Online/Mobile Growth Game?

Insurance industry trends show a decline in employ-led sales and a rise in online/mobile channels.

Property and casualty, life insurance and specialty line carriers utilize various sales routes to customers, historically with a marked preference for external sales channels (agents and brokers). With the advance of technology and changing buyer habits, employ-led and online/mobile sales have taken a consistent share of new policy and premium sales. Alexander Group’s latest research reveals a potential pivot in this strategy. Despite seeing tremendous growth in online/mobile sales, insurance carriers are more cautious about adding more inside sales, employ agents and account managers.

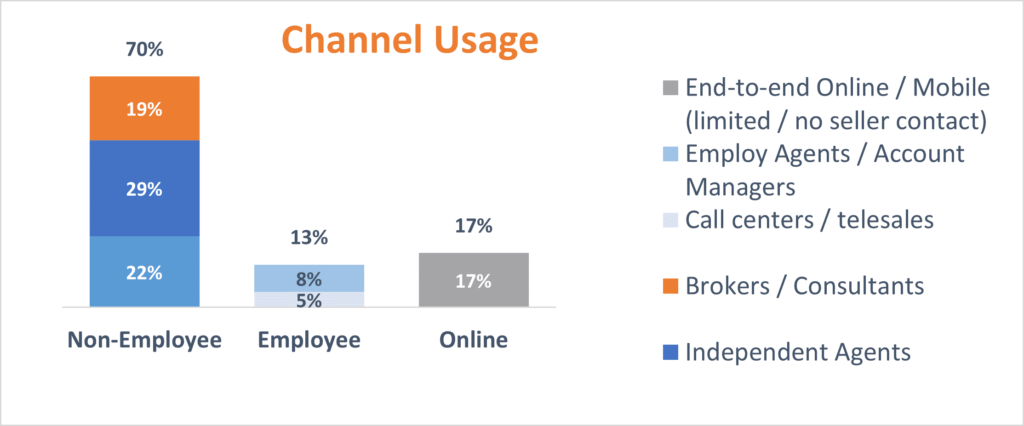

Alexander Group surveyed 80 leaders from over 60 carriers representing property and casualty, life, commercial and personal lines. These leaders provided feedback on market trends, sales roles, sales channels and compensation programs. Based on overall premium managed, the research shows the following breakdown of sales channels:

Around a third of carriers use employ-led sales channels, where at least 30% of premium is driven and supported by employ sellers. However, when asked about future growth in roles and sales channels, they did not differ substantially from carriers who primarily utilize external sales channels.

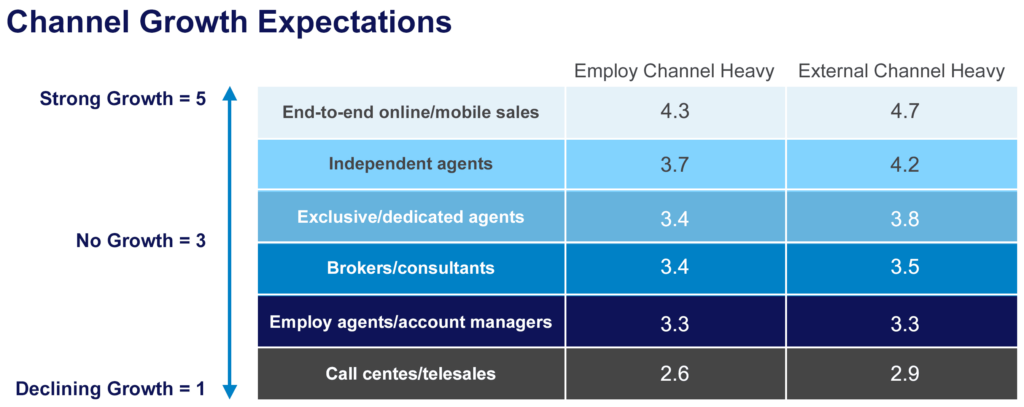

From a scale of 1 to 5 (decline to growth) where do you see the most growth in selling channels/roles?

Both carrier types see the best growth in selling opportunities through online/mobile channels, especially those relying primarily on external sales channels. Both carrier types also see growth in independent agent channels. Interestingly, though, carriers that have historically been most reliant on telesales see a decline in growth for that path to market. Overall, when other employ selling roles (employ agents, account manager) are included, carriers see low to modest growth for these resources. In further assessing these findings and integrating Alexander Group client experience, we see several key trends that are fundamentally altering insurance sales models:

- Online/mobile offers tremendous growth opportunities when it is balanced and integrated with external sales channels.

- Most carriers choose independent agents as the preferred route to market, albeit requiring more effort and higher commissions to support long-term growth.

- Employ sales channels may be stagnating/declining due to cost concerns and talent management, but they can be a significant advantage with the right sales strategy and compensation approach.

In the following interview, we discuss our research findings in more detail with Ernie Wolansky, who most recently led the sales compensation strategy and design team for one of the largest property and casualty insurers in the United States, serving independent agency, exclusive agency, national relationships and direct channel distribution operations. Wolansky shared best practices in both integrating online/mobile channels and doing it with the optimal incentive structure.

Integrating and Growing Online/Mobile Sales

There is obvious growth and high expectations for online/mobile, but insurance carriers vary in their approaches to capitalize on this route to market. For some it helps drive policy growth, but it also creates an additive expense if agent commissions are not reduced in tandem. Other carriers do not share commissions with other sellers and channels but opt for either more operational online/mobile resources or more sales-oriented resources who are incented to maximize close rates and bundling.

Alexander Group: What do you see as best practices in both integrating online/mobile channels and doing it with the optimal incentive structure?

Wolansky: Almost all large personal lines carriers have a dedicated online channel for customers who prefer to do business without a traditional agent. Most of these companies have robust online portals and make significant investments in advertising to drive customers online in lieu of compensating traditional agents. For online/chat support positions, small per policy closing incentives are often effective and expense-efficient for carriers to complement online sales.

This online infrastructure should be integrated with the agent channel to meet the ever-increasing customer demand for self-service (including adding/making coverage changes and buying additional policies). Carriers need to build service capabilities for their customers and agents as a cost of doing business, while designing sales compensation plans and commission rates accordingly. Best practice is to “price-in” online support into the commission structure for all policies. Separate or reduced compensation structures that penalize an agent when an existing customer chooses to do business online opens the door for channel conflict/complexity and is not recommended.

Preference for Independent Agents

In the competition for a preferred channel to market, outside of online/mobile, independent agents come out on top. This is not necessarily driven by cost, as commission rates are generally higher for independent agents. But rather it’s based on flexibility. The best independent agencies are sophisticated and flexible businesses that can easily adapt to changing consumer/business needs and carrier strategies.

But there are downsides. Carriers generally have very little leverage with independent agencies and must work to earn and maintain their trust. Carriers also need to be careful how they support and grow other channels that compete with independent agents.

Alexander Group: What have you seen work best in building thriving relationships with independent agents? Is it mainly about the best commission tables, or are they looking for more?

Wolansky: Independent agents (IA) tell carriers they need it all: high commissions, competitive and steady pricing, innovative products, premier claims processes, and quality agency support/services. While very important, IA compensation (e.g., commission rates, bonuses and incentives) is only one lever that carriers use to drive more profitable business. Carriers can be successful using the other levers but having scale is important to do it efficiently. Small carriers (without scale) are more likely to overutilize high commission rates. To profitably grow the IA channel, carriers must assess their optimal level of compensation to complement their go-to-market strategy. Additionally, some large carriers have separate IA insurance brands which gives an appearance of ‘IA dedication’, even though channel is managed by shared executive leaders across channels. Carriers with one brand enjoy the scaled marketing benefits but suffer from channel conflicts.

Stagnation of Employee Channels

Employ sales channels do seem to be falling from favor. As mentioned, one key driver of this is the rise in online/mobile sales, but another driver is cost – primarily fixed costs. Base salaries account for 65-90% of total compensation for employ sellers, and with benefits in the mix, fixed expenses take up an even larger portions of sales costs. There are carriers, though, who do efficiently and effectively utilize employ sellers. These carriers focus on metrics and productivity, in particular new policy and new premium per seller. They also put more emphasis on incentive compensation and performance overall, and continuously evaluate the selling roles and competencies they need. Managed effectively employ sellers can still be an advantage as they allow carriers to pivot more quickly on growth strategy compared to external sellers.

Alexander Group: What are your thoughts on employ-led selling models?

Wolansky: While life insurance employee channels may have continued viability, I believe the death knell rang decades ago for P&C insurance field office employee channels. With the commoditization of personal lines products driven by internet sales, price becomes paramount to growing the channel. The carrier employee model is inefficient due to relatively high salaries, expensive benefit packages and required real estate investment. And with only one product to sell, attaining a break-even sales volume becomes a challenging hurdle.

We have seen carrier exclusive channels (employee and independent contractor) add brokered options to sustain seller commission earnings when the carriers’ own products are uncompetitive; however, this ‘hybrid-exclusivity’ approach is complex and may further erode long-term profitably. The remaining employee and exclusive channels will be closely watched by competitors to see if management teams can be agile enough to successfully maneuver and profitably grow, despite a high fixed cost structure with limited product options.

How Do Insurance Carriers Respond?

Insurance selling models are rapidly changing, and carriers must stay ahead of these fundamental shifts. Based on the insights from survey respondents, our client work and the in-depth industry expertise garnered from Wolanksy, here are five key actions to consider:

- Develop a robust online/mobile strategy that is integrated across sales channels

- Assess the productivity and effectiveness of traditional channels to market, whether external or employ-based

- Invest in sales and marketing operations to better enable and support all sales channels

- Put analysis and rigor behind adding selling capacity

- Ensure that traditional incentive plans are driving the right behaviors in priority lines and market segments

To help navigate these growth challenges, Alexander Group is providing complimentary briefings on the Insurance Market Trends survey. Please contact an Insurance practice lead.