Investment analysis: The importance of sales organization due diligence

Private Equity companies seek good deals, and to find them they perform due diligence. Often times their due diligence focuses on financials, product and operations, and overlooks the sales organization. This is essentially like crossing your fingers in hopes that the company’s sales force is capable of generating the desired top-line revenue growth.

With the amount of capital available in the market today and the proliferation of private equity funds, the search for good deals has become more difficult. Some acquisitions or buyouts will be decided based primarily on technology or product, and less so on people and operations. For investments focusing on top-line revenue growth (which in today’s market seems to be increasingly the case), effective due diligence of the sales organization is critical. And we’re not just talking about sales talent. A poorly constructed or dysfunctional go-to-market strategy and model can lead to poor revenue and profits, high cost of sales, low employee morale, an elongated holding period and, ultimately, a lower than desired ROI or IRR. It is important to investigate and evaluate the strategy, structure and management of the sales organization during the due diligence process. Sales organization due diligence should:

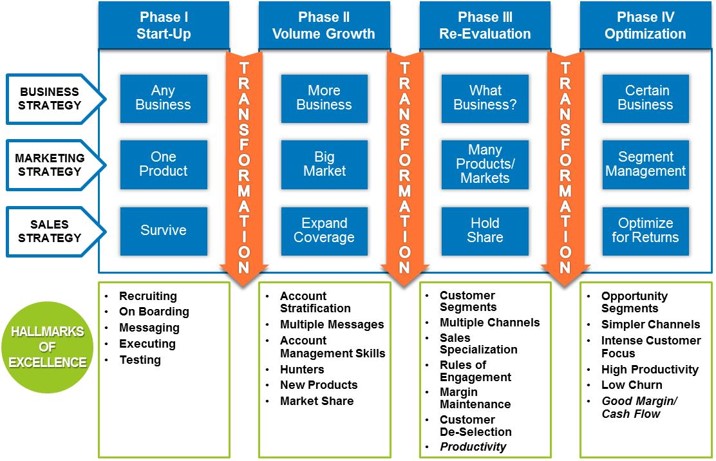

1. Evaluate the Target’s Go-to-Market (GTM) Design’s Alignment to Growth Phase. First and foremost, it is imperative to understand whether a company’s go-to-market strategy and model is properly aligned to its growth phase. The alignment of the sales model (or lack thereof) to the current and future phases of growth can be easily ascertained during the due diligence process. Below is a schematic of the Alexander Group’s four phase model. During the start-up phase (Phase I), companies tend to have a singular product or service offering and all business is good business. Upon exiting the start-up phase, companies enter a volume growth phase (Phase II) whereby the focus is on scaling via customer acquisition and retention and the introduction of new offerings. The most perilous phase, re-evaluation (Phase III), requires companies to rethink their product portfolio, pricing and cost structure. Successful companies reinvent themselves and enter an enlightened state of optimization (Phase IV). As companies meander through this evolution, sales organizations morph from simplistic to complex, from single channel to multi-channel, from one sales job to job specialization. Understanding whether the target company’s sales model lines up with the business’ phase helps determine if the sales organization is in position to support desired revenue growth, or the degree of change that is required to get there.

2. Assess Target’s Organizational Culture. To generate shareholder value for your investors, targets will need to achieve a level of sales excellence both strategically and operationally. Often times achieving sales excellence is easier if the organization is already sales-centric versus product- or finance-centric. Product-driven companies tend to focus on innovation, features and benefits and discount the value provided by sales, while finance-centric companies hyper-focus on near-term results and lose sight of the investments required to achieve scale and long-term success. The most successful sales organizations share a common set of attributes in that they are: customer-centric, passionate about customer needs, highly productive, centered around profitable growth and excellent at execution. Does your target’s culture support a growth through sales philosophy, or does it have a product-/finance-centric culture that might impede the organization’s ability to achieve sales excellence?

3. Profile Sales Leadership’s Potential. Whatever your long-term investment objectives are (initial public offering, resale, spin out, etc.), no constituency is more important to top-line revenue growth than the leadership team of sales. During due diligence, examine the investment level in sales management, the dedication and devotion to sales development and, finally, the experience set of sales leadership. Given the size and growth phase of the company, does the Head of Sales have the pedigree and experience to navigate the organization into the next phase? If the potential is low, fixing could create organizational disruption and, once again, elongate time to shareholder value. What is the relationship like between sales leadership and the rest of the executive team? Good sales leaders manage relationships across the executive team as well as overseeing the sales force. Finally, do sales managers adhere to formalized methods and structured times for region management, pipeline management, and rep coaching and mentoring?

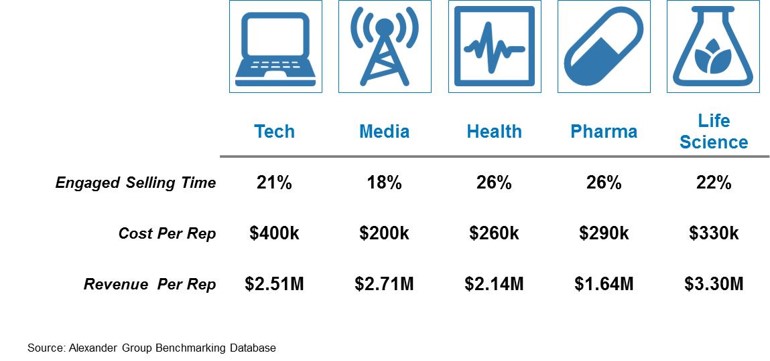

4. Benchmark Sales Effectiveness against Market Peers. The previous analyses have a qualitative bent; it’s equally important to quantify the company’s sales effectiveness against several core metrics. Productivity metrics lend insight into yield, competitive positioning and, potentially, sales force talent levels. Investment levels in headcount, support and enablement allow you to look at total costs per rep relative to peer companies (see table below). Are there appropriate manager to sales rep ratios across the organization? (AGI Benchmark Database – Cross Industry Average: one sales manager for every eight field sales representatives and one sales manager for every 12 insides sales representatives). Combining productivity and investment metrics allows you to determine if your target is getting an attractive return on its investment in sales. These benchmarking efforts can help you to formulate your 30-60-90-180 day plans for optimizing the organization post-close.

As with any investment, Private Equity managers and investment teams are pressured to produce strong ROIs for shareholders. Concentrating on the sales organization during due diligence will increase your odds of success.

Originally published by: Jeff Hersh

Learn More

How well are you examining sales as part of your due diligence today? To learn more about sales organization due diligence and sales transformation, please visit our Private Equity practice or contact us today.