Profitability Metrics in Sales Compensation Plans

Since mid-2023, the media sector – much like most other sectors – pivoted to emphasizing profitable growth over at-all-cost, topline growth. Driving profitable growth quickly became a cross-functional ‘problem’, with cross-functional solutions. To entrench the shift in strategy, companies deployed a mix of sales compensation and commercial model change to balance new and current customers for efficient growth.

Key Points:

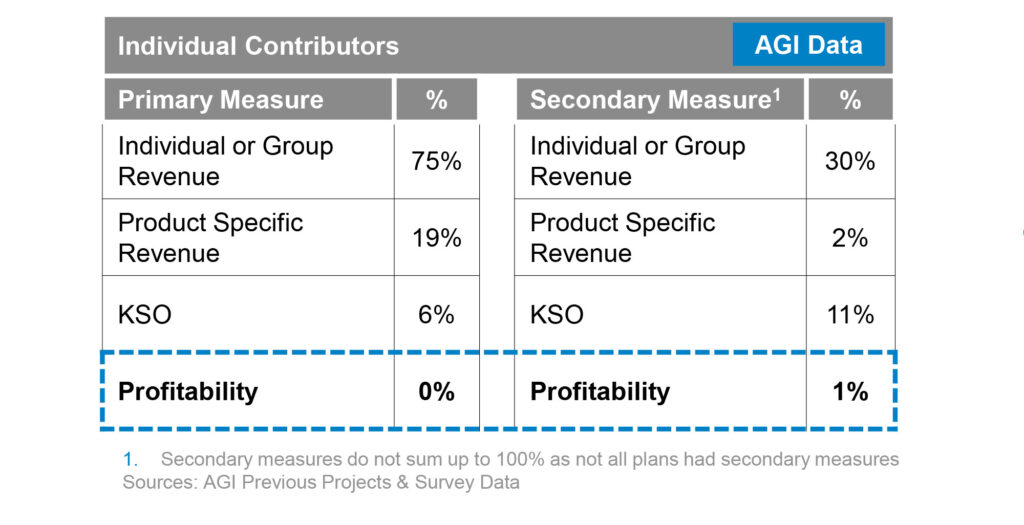

- Direct profitability metrics (e.g., revenue ex-TAC, margin, EBITDA) are rarely used in sales compensation plans for individual contributors

- They are quite common for executive leadership and country management plans

- Most often, companies drive profitability indirectly via the use of strategic measures and commercial model changes

Despite the instinct to ‘incentivize desired outcomes’, or ‘behaviors’, profitability metrics are rarely used in compensation plans for individual contributors (ICs). If profitability is paramount (and these days, it is), why don’t companies ‘put it’ in the sale comp plans for ICs directly, or explicitly? It comes down to influence.

Can the reps directly ‘control’ the profitability of a deal that has many different channels – programmatic, performance, etc.? If not, it would violate a core principle of sale compensation, which is to reward persuasion and influence against strategic goals, or plan measure. Unlike at the leadership level where profitability metrics are common, an individual contributor’s lack of direct control over ultimate deal profitability makes it a poor plan measure.

Alexander Group’s Media Sales Industry Trends study across 40+ participants in programmatic (DSP, SSP), gaming and premium digital highlights the way media companies do compensate IC and, in that case, what other tools do companies have at their disposal to emphasize profitability? As the data suggests, most of the plan measures for ICs are revenue-driven (80%+). The product-specific measures are typically more profitable creating a nuanced way to drive profitability via sales compensation.

Mechanisms to Drive Profitability

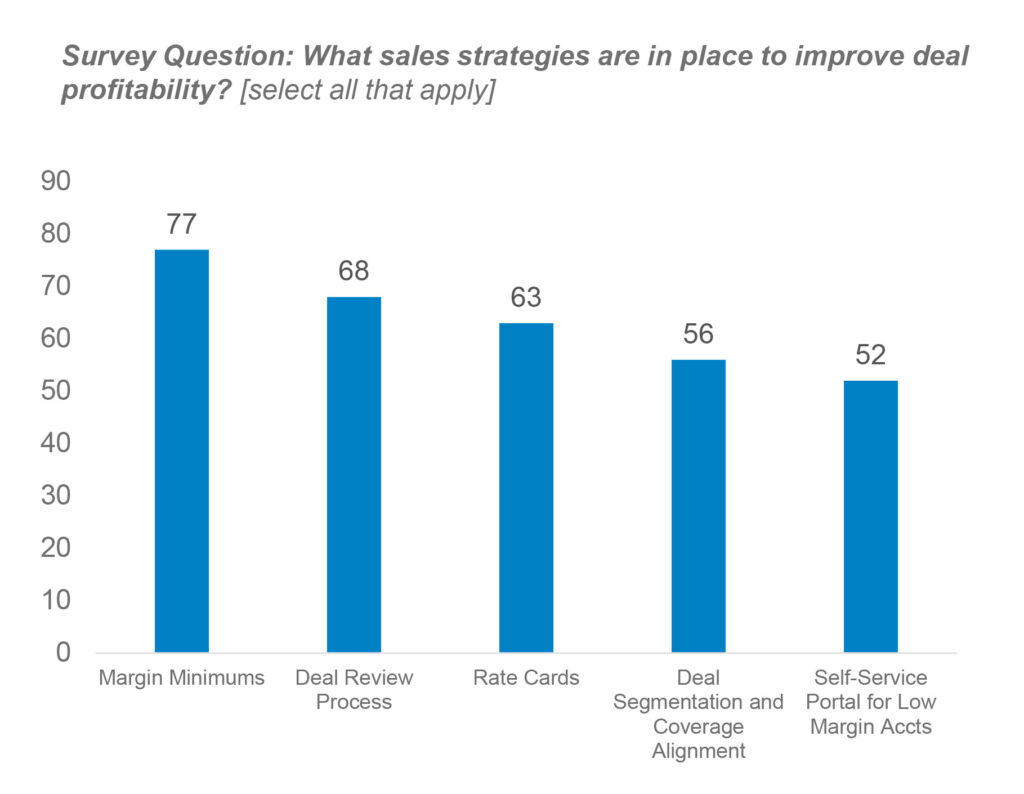

More so than any one specific non-compensation mechanism for driving profitability, our data suggests that an effective strategy is deploying a mix of mechanisms. Almost universally, no mechanism received a ‘top 1-3’ rating less than 25% of the time. This indicates that each is a useful and viable strategy in driving profitability. There are interesting nuances, or applicability prevalences, across sectors, but the broad theme applies.

From a sales process perspective, the ‘multiple mechanisms’ strategy comes through most effectively (see below). Each of these mechanisms directly drives profitability without an explicit profitability plan measure.

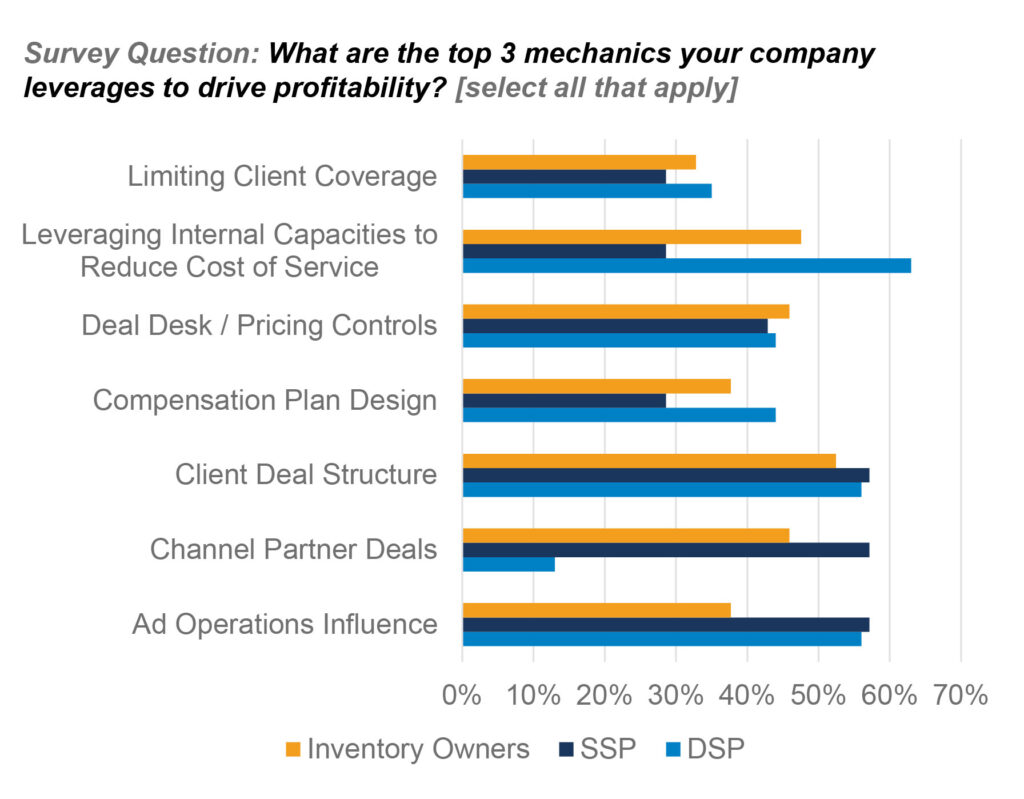

Efficient leveraging of resources (e.g., increased organizational efficiency via differentiated coverage) is the top focus area by companies Alexander Group surveyed to drive profitable growth. Specifically, demand-side platforms (DSPs) primarily focus on efficient organization sizing and expanding into new markets while leveraging lower-cost resources. Supply-side platforms (SSPs) strive to increase operational efficiency through scale.

Implementing tight pricing controls, or deal desk, is the second most common approach to managing profitability on deal-by-deal basis. Others embarked on a path of vertical integration of capabilities (e.g., taking on certain creative capabilities internally and circumventing agencies).

From a marketing perspective, companies are reassessing the integrity and actionability of their first party data, improving data sharing with partners and creating clear buyer personas for specific messaging. Additionally, they are looking to gain a better understanding of what their clients truly value in the solutions they provide and invest in more advanced, relevant offerings.

Most companies maintain account management and customer success headcount as these roles had a direct impact on keeping net advertising revenue retention high. They shifted the time profile of these roles more towards sales execution as opposed to campaign management and optimization.

Final Thoughts on Profitability Metrics

To stay competitive in a rapidly evolving industry driven by digital transformation and changing consumer behaviors, companies must embrace innovative revenue growth strategies, leverage data-driven decision-making and invest in digital capabilities. By optimizing sales productivity and enhancing employee motivation, organizations can navigate market disruptions and achieve profitable growth. As the industry continues to evolve, staying ahead of trends and adapting to new market demands will be critical to long-term success.

Need Help With Your Organization?

For additional information and insight on driving profitable growth, contact our Media practice team.