Why Companies Are Focusing On Profitability

Key Areas to Drive Growth

Preparing for 2023, the corporate world anticipated an economic recession which would impact topline growth. Unsurprisingly, many media and consumer technology companies proactively responded with a bevy of strategies to reduce operating costs. Other companies took a wait-and-see approach to determine their path forward, predicated on observing general macro-economic performance and what competitors were doing.

While pre-emptively acting or taking a wait-and-see approach are both viable strategies with different benefits and costs, companies should have a set go-to-market strategy to enact when operating within a slow topline growth environment. Driving efficiency when the market is not growing will allow for more competitive positioning; capturing revenue will be done more by displacing competitors rather than landing first-time buyers, and profitability will grow via more efficient operations and expanding relationships with existing customers. Exiting market downturns with an efficient organization will provide a springboard to drive investments and expansion in product, sales force and market positioning.

An efficient sales organization with appropriate go-to-market structures will create a competitive advantage compared to companies with sprawling and disorganized structures. Most leaders of companies with profitable growth in media and consumer technology drive profitable relationships from existing clients. However, profitable structures may not be the same as growth structures, and companies should review their current and future sales goals annually to shape their organization towards the appropriate focus.

Challenges & Approaches for Achieving Profitability

In a shift from pure top-line growth to profit-focused growth, it’s crucial for sales organizations to evolve their go-to-market strategies, whether those entail transforming from a successful growth company or refining inefficient practices. While the approach and adjustments will differ company to company, there are consistent focus areas which all companies can benefit from refining.

Broadly, it’s key for a go-to-market strategy to align the best revenue opportunities for a company with efficient account coverage. This requires several efforts, including (but not limited to):

- Revenue segments which are appropriately defined

- Understanding each segments’ revenue, growth and profit potential

- Target typical opportunities to land and expand clients within each segment

Establishing clear and identifiable checkpoints for clients and differentiating strategies by segments will lead to distinct benefits in maintaining a profitable relationship over time. Identifying common expansion points for clients to grow, such as new/strategic products, expanded use cases of existing products or new buyers within an existing relationship, becomes simpler with a strong account plan with appropriate account coverage. Maximizing that expansion is dependent on appropriate product development, segment identification and deployment of resources to effectively cover accounts.

At times, companies may have stagnant account coverage strategies which are not refined for the current market. Stagnant account coverage strategies can leave high growth potential accounts unnurtured, align reps with customers they do not have the skillset to serve or have high-cost sales reps aligned to low-value accounts.

Separately, inefficient account coverage is just as deleterious to success. A few common areas where inefficient account coverage can exist includes:

- Reps covering accounts across too many segments

- Deploying specialists or generalists ineffectively (using the wrong coverage or over/under deploying reps)

- Leveraging high-cost support for low potential accounts

- Not deploying automated/limited support coverage appropriately

While this list is not exhaustive, these all significantly impact the capacity to expand revenue generation profitably from existing relationships, which is the primary differentiator between companies demonstrating high profitable growth and others that are lagging behind.

Mechanisms to Drive Profitability in Media

Across media and consumer technology companies, 60% of North American executives expect profitability to increase over 2023. Leading high growth, high profitability companies focus on three key areas to drive profitable growth:

- Horizontal integration of capacities

- Right sizing the organization

- Increased organizational efficiency via differentiated coverage

Horizontal integration of capacities (reducing redundant oversight, AdOps, RevOps, administrative support and even sales reps) follows many of the same tactics as right sizing the organization to maximize revenue per rep via appropriate levels of enablement. Without sufficient support, reps cannot manage large books of business, while too much support leeches the business of profit margin. The appropriate balance of resources is predicated on type of company, type of accounts served, level of client support & expertise and anticipated level of integration across similar subsidiaries or business units.

Differentiated coverage is another primary focus area for high-growth, high-profitability accounts and includes driving automation/limited touch for the numerous low revenue accounts, while leveraging experienced resources for a more consultative selling relationship for larger, more sophisticated clients. The needs of these clients are different, and the benefit of a relationship is fundamentally different for accounts spending $50,000 and $15,000,000 annually. The appropriate points for automation/limited touch, moderate interaction and high touch consultative selling will be different for every business.

Different Strategies for Different Company Types

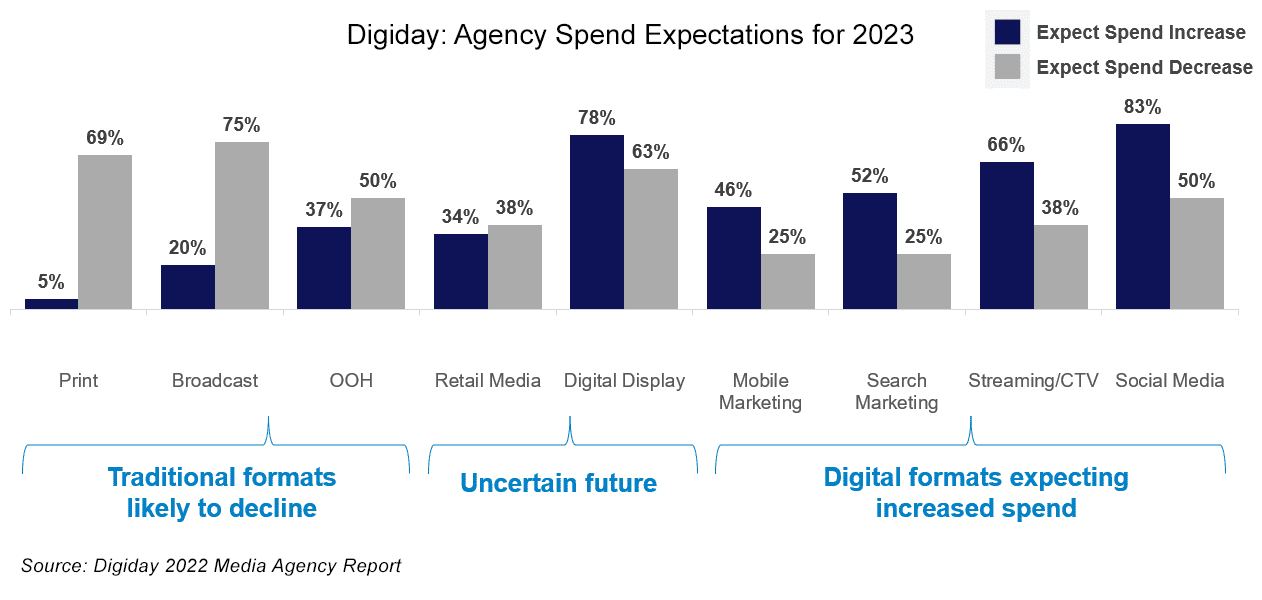

Digiday polled agencies to determine their spend expectations for 2023, delineating across three categories as shown below.

Print, broadcast and OOH face challenges with users substituting consumption due to CTV, digital media and ordering on demand. These challenges require traditional formats to leverage some form of vertical integration – approaching bundled sales for multi-pronged consumer targeting and offering preferred rates to those buying a mix of products. In doing so, go-to-market strategy and account coverage must evolve as well – requiring overlay and/or specialist support to navigate new channels of ad sales and to provide attractive bundles for advertisers.

Digital Display and Retail Media are listed as having uncertain future with mixed sentiment on spend increase or decrease from agencies. Digital Display is dependent on traditional push advertising (ads that may be of interest but are not directly what a user is searching for), while pull advertising drives relevant content above search results. Push advertising provides volume but may not drive specific behavior when deciding between options. Retail Media can fall into the trap of leveraging existing users ineffectively and not deploying an effective push and pull advertising strategy. Consultative selling for retail media relationships will drive strong relationships, providing a mix of push- and pull-advertising to provide a strong ROI for buyers.

Finally, digital formats which continue to grow are social media, streaming/CTV and search & mobile marketing. These are high-growth, high-demand areas where demonstrating value within existing relationships is key to continued profitable growth. Playbooks, vertical-specific knowledge and sales strategies are key to drive increasing spend and profitable growth.

To summarize, traditional formats need to embrace bundled sales philosophies, retail media and digital display need to leverage multi-pronged sales approaches to fully capture strong ROI, and mobile/search marketing, streaming/CTV and social media will need to contend with maturing markets necessitating a stronger consultative selling approach to effectively drive expanding revenue relationships.

Elevating Your Sales Investment and ROI

Effectively refining a company’s go-to-market sales strategy requires significant industry knowledge and the ability to redefine focus areas without harming existing relationships. Striking a balance between effective change and minimal disruption can be difficult, and evolving go-to-market strategies will require a deft touch to take correct action. Legacy constraints can result in delayed or unsuccessful integrations that can negatively impact your sales investment.

Alexander Group has the media industry expertise to evaluate your sales integration efforts to ensure alignment between your various concurring workstreams. Contact us today to get more information on how we can help ensure expected results become reality.