Research highlight: the impact of the recession on SEs and inside sales

When times got tough, the tougher, scrappier, and often under-appreciated Sales Engineers and Inside Sales people started to kick it in to high gear. Both SEs and Inside Sales have experienced dramatic increases in Engaged Selling Time from pre-recession to recession to recovery. Most of these gains were at the expense of sales completion activities such as Order Entry, Customer Service, and Implementation Problems. Coaching time and travel remained flat for both roles. SEs spent less time closing. Meanwhile, Inside Sales spent more time prospecting (up 61%, from 14% to 22% of their time).

Could it be that Sales Forces among our client companies are learning how to more effectively leverage these valuable roles?

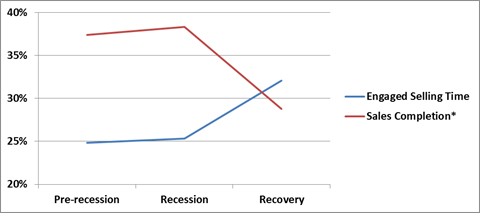

- Sales Engineer EST way up – Post Sale Time Way Down. Engaged Selling Time went up slightly during the Recession and then jumped significantly during the Recovery period, rising from ~25% to 32%, an increase of about 3 hours a week – which translates into 3 to 4 weeks of more selling time per year. That is a significant surge! And, this is entirely at the expense of Sales Completion activities, which fell from 37% to 29%. The question to ask is has this time shift increased productivity? The analysis we did in June indicates that productivity has improved in the Recovery Period, but not beyond pre-recession levels. This would imply that SEs are working harder and reps are leveraging SEs more effectively in pre-sales in order to improve sales productivity back to pre-recession levels.

*Sales Completion includes Back Office, Order Entry, Implementation Problems, Customer Service. Time periods for all charts are as follows:

Pre-Recession – December 2008 and Prior

Recession – January 2008 through June 2010

Recovery – July 2010 present

Sales Time data is for Sales Engineer only, all Industries

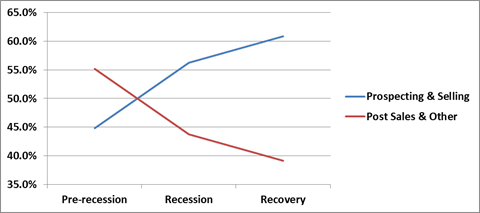

- Inside Sales Selling Time Way Up – Post Sales Time Way Down. The story with Inside Sales is equally remarkable. Selling Time (including time categories 1-4a) went up from 45% to over 60%… an increase of 36%, or nearly 6.5 hours a week, or 40 days per year of more selling time. That is a remarkable shift. This is likely part of a larger story of sales forces improving the use and management of inside sales. The recession period drove a strong focus on cost savings, leading to higher usage of inside sales as a channel, and specifically inside sales roles to drive more selling as opposed to sales support activity, which inside sales often gets dragged in to in decentralized and poorly managed models.

*Sales Time data is for Inside Sales (Generalist) only, all Industries.

*Sales Time data is for Inside Sales (Generalist) only, all Industries.

Parting Shot

The Recession has forced sales organizations to improve. The time profiles for SEs and Inside Sales indicate vast improvement in the utilization of these resources. The bar has been raised. To compete and win, sales organizations must deploy sales resources with more precision (SEs, Inside Sales, other Overlay, as opposed to just highly paid Field Reps). This puts increased pressure on sales leaders that oversee SEs and Inside Sales teams to maintain these high levels of selling time, and even more pressure on sales leaders that don’t yet, as the need to gain sales leverage from these lower cost roles increases.

With the recent volatility in the market and the potential of a ‘double-dip’ recession looming, the need to focus on productivity has never been greater. The trends of increased selling time among Reps, Managers, SEs and Inside Sales could indicate that the low hanging fruit has been picked. Sales leaders are in need of even better ideas and innovation to drive more with less or the same. This is likely going to come from changes ‘upstream,’ meaning improved market-sizing, segmentation and targeting, and improved leverage of indirect channels.

Read more about Alexander Group.