Rule of 40–Capacity & Deployment Considerations

Fiscal year planning requires revenue leaders to work with the management team on strategy, GTM design, budgeting and execution plans. Sales headcount (including all revenue generating roles) will probably be the largest investment, and therefore a critical factor that will drive both growth and profitability in the next fiscal year. The natural inclination is to add more headcount to increase the probability of hitting lofty ARR goals set by the board and executive team. However, as a company with XaaS recurring revenue streams, your capacity and deployment decisions are more nuanced given the highly differentiated motions of Land, Adopt, Expand and Renew.

How does Rule of 40 impact headcount capacity and deployment planning? As referenced in “Why XaaS Revenue Leaders Should Care About Rule of 40,” there are four key situations that XaaS companies will fall into. These situations are: a) Subscription Revenue Acceleration b) Profitability Engineering c) Targeted Commercial Investment and d) Sustainable Profitable Growth. It is critical that revenue leaders understand which of these situations best describes their company; headcount strategy will vary substantially in terms of resource types, hiring plans and territory/account assignments.

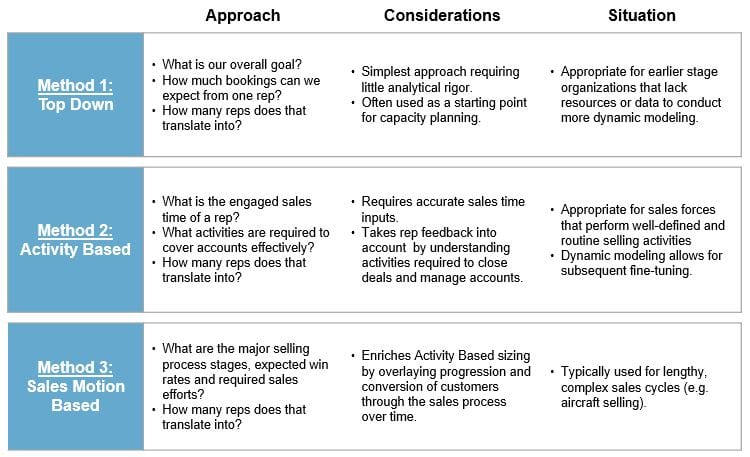

Scenario 1 – Subscription Revenue Acceleration: Growing ARR at all costs requires an extensive investment in organic quota carrying resources (e.g., traditional field reps). The goal at this stage is to capture market share quickly given today’s technology environment where the eventual market leader captures a disproportionate share of the sector’s overall valuation. Hire high-quality sales reps, give them a “patch” and let them run. Use this tranche of sellers to test value proposition efficacy, profile sales motions (that work and don’t work) and source product improvement opportunities from early buyers and users. Move quickly and fail fast; learnings from this stage will serve as inputs that help companies move into the next scenario with confidence. Headcount sizing in this situation is relatively simple as ARR growth trumps profitability concerns. Using a top-down approach (see Method 1 shown in the table below) is most appropriate.

Scenario 2 – Profitability Engineering: Companies in this scenario have typically established a strong productivity baseline. AGI research suggests most companies operate with a $1.0 million to $1.8 million ACV expectation for field resources (excluding renewals) at B2B software companies. However, each incremental addition to organic quota carrying headcount will eventually lead to a decrease in marginal return. AGI refers to this phenomenon as “algorithmic” failure which has a material impact on Rule on 40. What’s the right number of heads? Use at least two of the methodologies below to right size the sales force, and ensure that affordability (Method 5) is in the mix—otherwise, risk unintended EBITDA hits.

Exhibit A: Headcount Sizing Methods

Scenario 2 fundamentally presents revenue leaders with two options: continue to hire expensive field sellers with the hope of maintaining high growth rates or pivot investment to lower cost resources (e.g., Inside Sales) and/or enablement (e.g., training) to improve FTE productivity and overall profitability of the sales organization.

Companies in Situation 2 often experiment with strategic account models or hunter/farmer setups in their largest accounts. This is often manifested through the introduction of account managers whose charter is to expand ARR within the highest spend potential accounts. Under Scenario 2, revenue leaders are advised to provision a handful of incumbents towards strategic accounts from which they can source profitable growth. Keep account loads to a minimum (10:1 or less) so account managers have ample capacity to engage new locations and buyers, and explore incremental use cases within this attractive set of customers.

Additionally, companies in this scenario will introduce “overlay” roles, including product specialists, lead generation resources, for example. with the intent of increasing core seller productivity through improved account expansion but doing so at lower cost. After all, expansion sales motions (upsell and cross-sell) cost less than land motions.

Scenario 3 – Targeted Commercial Investment: Utilization of expansion resources continues as monetization of the base moves to the forefront. CROs likely have an emerging Customer Success organization at this stage. But Customer Success will put a strain on Rule of 40 unless it has material impact on retention rates (through strong adoption and identification of at-risk accounts). Customer Success also serves as a mechanism to source upsell and cross-sell opportunities that other members of the sales organization can exploit.

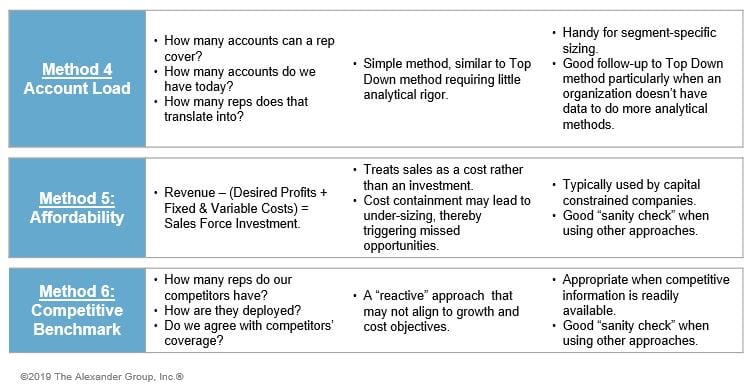

Customer Success, like other overlay resources, are an important investment. Unfortunately, companies regularly over- or under-hire as they either have deficient capacity planning techniques (see Exhibit A), fail to account for critical factors (e.g., ramp and attrition), or lack market insights to make informed decisions. Output from Alexander Group’s XaaS Market Study can help revenue leaders right size their overlay resources.

Exhibit B: Headcount Ratio Benchmarks

The example Customer Success benchmark (see Exhibit B) is useful in that it helps organizations rationalize headcount investment. It’s ok to be above or below market so long as there is strong business case justification.

Scenario 4 – Sustainable Profitable Growth: It’s time to examine all sales resources across different segments and geographies vis-à-vis territories/assigned accounts. Profitable growth is contingent on territories yielding ample return without excessive investment. Often this will necessitate usage of Method 2 and Method 3 (see Exhibit A) to precisely measure resource capacity. Additionally, revenue leaders must conduct detailed territory sizing and equitability analysis to solve for two fundamental headcount challenges:

- Identify and correct for coverage whitespace. Selling resources spread too thinly across large territories translates to lost productivity and lower revenue growth. Coverage whitespace can also lead to missed opportunities that otherwise could have been covered by another resource with more bandwidth.

- Locate and solve for insufficient workloads. Every seller (and overlay) needs enough opportunities to keep them busy. Narrow territories lead to suboptimal productivity and a high expense to bookings ratio thus placing downward pressure on margin and EBITDA.

Is your company in need of sales growth advice? Is growth and/or profitability disallowing you from achieving Rule of 40? Learn more about how Alexander Group’s Technology practice can help design the strategy, structure and management of your commercial organization to maximize company performance and valuation.

______________________

RELATED

Why XaaS Revenue Leaders Should Care About Rule of 40

Rule of 40–Implications for Fiscal Year Go-to-Market Planning

Rule of 40-Quota Targets and Incentive Compensation

Rule of 40–Coverage Models and Roles for 2020

Rule of 40 – Account Prioritization and Segmentation