‘Careful About That Threshold’

In the world of sales compensation, a threshold is a minimum level of sales performance that a seller must achieve before becoming eligible for incentive earnings. Common practice might express the threshold as “the seller must achieve 70% of the quota before the incentive formula begins to pay.” As this example suggests, it might be expressed as a percent to quota, or alternatively as a dollar amount or number of units sold. Regardless, a threshold rule is clear: No incentive is paid below the stated threshold level of performance.

Let’s look at several topics related to thresholds: types, principles and practices, challenges and suggestions.

Types

You might think a “threshold is a threshold.” Simple. Yet, there are several versions of incentive thresholds:

- Hard Threshold. This threshold means what it says: no payment or cumulative credit for sales below the hard threshold. In other words, the seller must reach this level of performance. All sales going forward receive credit at the defined rate. Usually, this is a single incentive rate that pays for performance between threshold and target (quota) performance.

- Bump Threshold. A “bump” threshold means the seller receives a lump sum payment (a “bump” award) when the seller achieves threshold. It can be a fixed dollar amount or a “retro” credit, providing payment equal to the incentive rate for sales below the threshold. Or, it can be a percent of the target incentive, such as 50%. When credit is given back to dollar-one, these payments are sometimes called “retro-payments” as in “retro back to first dollar for sales credit.”

- Two-Step Threshold. A two-step threshold (either a hard or a bump threshold) provides two payout rates once the seller reaches the threshold. The first payout rate begins at a lower rate, then at a pre-determined percent to quota (80%, for example), the second, higher payout rate begins extending to the target performance. This design is sometimes called a “soft threshold.”

- Mid-Performance Period Threshold. A common incentive design is to provide an annual sales objective, but divide that objective into quarterly or monthly goals. In such cases, sales leadership will assign proportional thresholds consistent with the performance period either monthly or quarterly. For example, the salesperson must reach the quarterly threshold before the seller can earn incentives.

Principles and Practices

So, what is the purpose of a threshold and what is the best way to set the threshold?

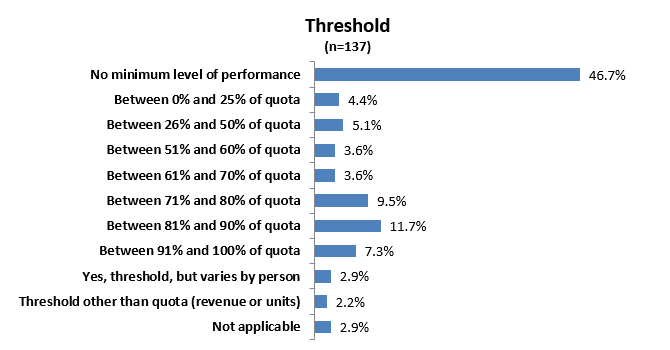

As the Alexander Group’s benchmark data suggests, companies are split between those using and not using thresholds. For those using a threshold, no uniform threshold level prevails.

Here are some common practices for setting thresholds. Note: These practices are not necessarily consistent with one another.

- Pay for Persuasion Once. One principle for using a threshold is to only pay for new persuasion. If assured revenue is occurring from the previous year(s), the seller is responsible for acquiring new revenue. The seller does not need to be paid on existing revenue, which the incentive plan rewarded in the previous year when the revenue was originally sold.

- Lowest Expected Performance. Another means to set threshold is to determine the minimal level of acceptable performance. This might be the 10th percentile of performance. Using historical performance data, sales management can estimate minimal acceptable performance for each sales job and set the threshold at this level of performance.

- Base Salary Offset. Finally, some companies use the threshold as a base salary offset. For example, if the target total compensation for a job is $100,000 and the pay mix is 70%/30% (base pay/target incentive), then the threshold is set at 70% of the quota. In this manner, the threshold is acting as a base salary offset suggesting the seller needs to “earn their base pay” prior to earning incentive payments.

No Threshold

Almost half of the survey companies (46.7%) do not have a sales performance threshold that must be met prior to paying incentives. Payment from the first dollar of sale (no threshold) provides non-controversial simplicity to the pay plan; from dollar one, the seller is earning incentives. This is a sound design choice when all sales are “new” and not renewals or replacement sales.

Challenges

Because the target incentive amount is fixed (the amount of pay at-risk earned when the seller reaches quota), many sales compensation designers “shrug” when selecting a threshold. This would be a mistake. The false reasoning follows: No additional target incentive monies are available so setting the threshold for pay below quota can be left to judgment. Here are several reasons why you should be more mindful when setting the threshold:

- Sales Compensation Plan Costs. Once you set up a cost model in Excel where you can test different threshold levels, a designer will see the full cost impact of a threshold. Even minor variations in threshold levels will reward or not reward a significant number of sellers. Costs could be too shallow or too high. When considering “bump” and “two-step” thresholds, the cost variance is even greater.

- Hard Versus Easy.As can be expected, thresholds that are too “hard” will demotivate the work force. Meanwhile thresholds that are too easy do not have performance meaning. A threshold should ensure that 90% of the sellers reach and exceed the threshold. Meanwhile, the lower 10% who don’t reach the threshold should rethink their sales approach and, perhaps, their career. Certainly, these individuals may find themselves on a performance improvement program with the risk of termination if sales results do not improve.

- “Bump” Threshold Issues. One appealing but risk-prone design is to provide a “bump”–either a lump sum or a retro credit when reaching threshold. Take these considerations under advisement when using a bump threshold: 1) It provides an enormous return for one dollar of performance. Once that one dollar crosses the threshold, a comparatively large payment is made. And, 2) such designs might breed unethical behavior (such as “ghost orders”) to achieve the threshold performance level. In one case, a salesperson purchased product so the total sales reached the threshold and the bump payment was made.

- Incentive Rate Quirkiness. Incentive rates are “slope calculations” that pay from threshold to target and then a second rate pays for over-target performance. The threshold will determine the payout rate between the threshold and the target. Now, when plotted, a sales compensation plan should have a higher incentive rate above quota as compared to incentive rate below quota. Not setting the threshold correctly can cause quirky outcomes: If the threshold is too low, it could cause the jump from the first rate to the second rate to be illogically substantial. If the threshold is too high, it might cause the payout rate above quota to be less than the payout rate below quota—a non-motivational regressive formula.

- Threshold on an Annual Plan. To avoid having multiple mid-period thresholds, such as every quarter, how about having an annual threshold? Such an approach withholds incentive payments until the seller reaches the threshold on the annual quota. Of course, the challenge with this approach is cash flow. If the pay plan has significant pay at risk, then waiting until the second half of the year when the threshold is most likely achieved may be too long to wait from a cash flow perspective.

Suggestions

Here are some common sense suggestions to follow:

- Pay for persuasion once. Set the threshold above previously sold recurring revenue.

- Set so 90% of sellers reach and exceed. Set the threshold so that it’s not too easy and not too hard.

- Assess bump payments. Be aware of the risks of using bump payments before adopting the practice.

- Assess cash flow. Make sure the plan provides reasonable cash flow to the sellers.

- Calibrate payout rates. Design the payout rates to feature a higher payout rate above quota performance as compared to the payout rate from threshold to quota.

- Model costs. Test various performance scenarios to assess the cost implications of different threshold levels.

- Don’t use a threshold for new product sales. There is no need to use a threshold if sales are new and the revenue is not recurring.

Finally…

Be careful, and don’t trip on that threshold!

Speak With Our Experts

Our sales compensation leaders compare existing plans to market research and our robust industry benchmarks. We can help with all elements of your sales compensation program.