The Perplexing Topic Explained

Sales compensation reveals itself to be much more than a simple pay-for-performance transaction system.

“Perplexing.” That’s how most market leaders describe sales compensation. Whether you are a sales executive responsible for hundreds of sales professionals, or you are the CEO of your company managing a sales force of three to six sales professionals, the challenge to find the right incentive plan never seems to end. Frankly, there are so many configurations and applications that even after quizzing your most trusted industry advisors and peers, there is seldom a standard answer to the question: “What is the best way to keep my sales professionals motivated and consistent with the company’s objectives?”

Perhaps you are among the rare few who have found the right incentive solution that is both meeting the needs of the company and the needs of your sales professionals. The pay plan seldom changes and the complaints from the sales staff and the chief financial officer are minimal. If you are in this rare group: Congratulations! You don’t need to read any further. However, if you are among the majority of market leaders sorting through the many sales compensation issues, a path for solving this perplexing management tool awaits you.

What is Sales Compensation?

The short answer: Sales compensation is an additional variable pay for sales performance. On the surface, it suggests that sales personnel should receive incentive pay for producing sales results. Why make it any more complex than that?

When examined more closely, sales compensation reveals itself to be much more than a simple pay-for-performance transaction system. Consider the following list of objectives:

- The pay plan must attract and retain the right sales talent.

- The incentive needs to motivate incremental sales efforts.

- The pay program must reward the company’s business objectives.

- Incentive pay attributes should be consistent with the company’s management philosophy.

Now, what about constraints?

- The pay plan must be fiscally responsible.

- The plan must be easy to understand.

- The compensation plan needs to be internally equitable.

- Quota setting, account assignment and sales crediting must align with the reward system.

- The cost of administration should be minimal.

Still perplexing? Maybe even more so as numerous objectives collide with numerous constraints.

How Sales Compensation Works

In this in-depth video, you will learn:

- How strategy drives segmentation and job design.

- Why sales jobs are the gateway to sales compensation design.

- How to apply sales compensation principles.

- What are sales compensation philosophies, principles and terminology.

- How to construct payout formulas.

- Where to find pay data and automation services

A Brief Tutorial of Incentive Plans

If you gather as many sample sales compensation plans as you can find, what do you notice? A seemingly varied catalog of pay programs: some are partially brilliant, some are partially incoherent, most are kind-of working, many have flaws, and, forgivingly, most have good intentions.

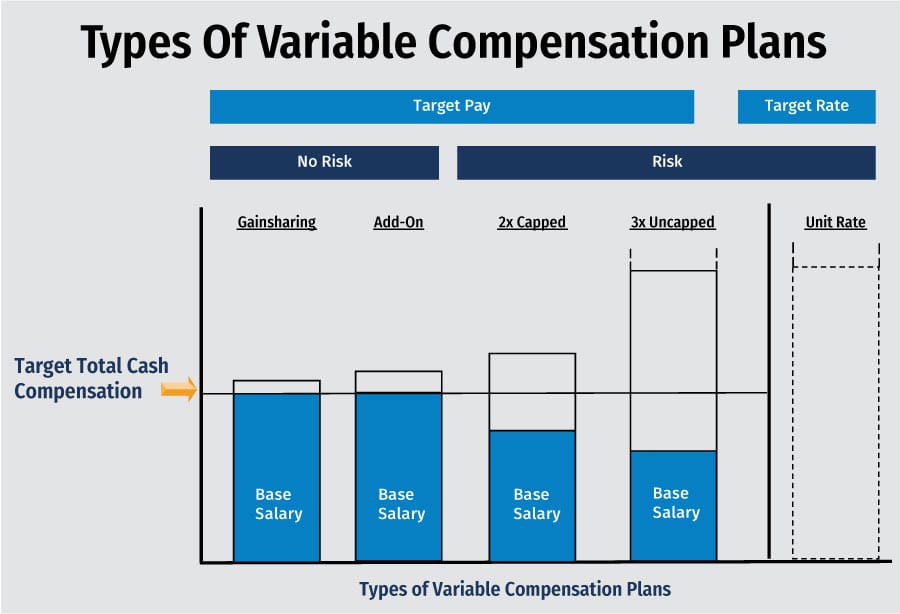

Sales compensation sits within the family of five different types of classic incentive compensation programs: Gainsharing, add- on, 2x capped, 3x uncapped and unit rate. These five categories act primarily as labels for grouping different types of incentive plans. Sales compensation uses, most frequently, two of these approaches: The 3x uncapped and the unit rate plan. Sales incentive compensation target refers to the specific goal or objective set for sales personnel to achieve.

Target pay plans begin with a market rate for the job, called target total cash compensation. The no-risk plans include gainsharing plans and add-on plans. No risk means management has not reduced the base salary below the target total cash compensation for the job. Any incentive earned is on top of this amount. Gainsharing plans usually provide a target payout of three to five percent of base pay for performance on (usually) total company performance. Gainsharing plans were last in vogue in the mid 90s. Add-on plans are popular when wage inflation is low. Add-on plans are worth five to eight percent of the base pay and provide rewards to individuals or small teams for exceptional contributions.

At-risk plans pay a reduced base salary when compared to target total cash compensation and no base salary in the case of unit rate plans. The 2x capped plan provides a target bonus, e.g., 20 percent of base salary, with a maximum earning of 2x that amount, or 40 percent of base salary. The payouts are capped. Companies most often use this design to reward management level personnel (directors and above), and this approach is occasionally used for select sales jobs, such as consumer-packaged goods and pre-sales technical support jobs.

The most common pay program for sales representatives (not income producers) is the 3x-uncapped design. In these programs, target total cash compensation is divided into two components, base pay and target incentive. The target incentive is available for those achieving their sales objectives with incentive earnings rising as sales personnel progress against their expected performance goals. Sales personnel, who exceed expected goals, continue to earn additional monies so that the best performers (the 90th percentile) should achieve a total of three times the target incentive. These plans are not capped and few sales personnel (less than 10 percent) will exceed this 3x leverage, but not by excessive amounts.

Sales representatives are sales personnel who represent the company’s value proposition and service offerings. Management assigns accounts to sales personnel for sales development purposes based on the preferred product configuration, pricing and service levels desired by the company.

The last design is the unit rate plan, reserved for income producers. A unit rate plan does not have a market target total cash compensation amount. Instead, there is a well-known, industry-wide commission rate paid on all sales revenue. In other words, whatever the sales person sells, he/she receives that commission rate on all sales volume, from the first dollar of sale, including all recurring sales, often indefinitely.

Examples of income producer jobs include life insurance, stockbrokers, currency and bond traders, mortgage origination and real estate agents. More important is the nature of the sales job. In essence, the company’s product is a commodity and the value is created by the income producer’s relationships with customers, often called their book of business. A confirming test of an income producer’s status is his or her ability to take customers when they leave.

The Best Approach: Begin with the Right Job Design

When management knows something is not right with the sales compensation plan, leaders will often struggle to untangle the existing plans while trying at the same time to craft features to serve new and emerging go-to-market strategies. Try this next time: Pretend that nothing existed; no sales jobs, no sales personnel and no current or lingering past practices. Now, answer this question: What do you really want your sales jobs to do and what do you want the incumbents to accomplish?

Freed from past practices, you might find that you need to make substantial changes in your sales coverage model. For example, you might want to specialize your sellers by type of customer — products purchased, revenue size, level of support or profit profile. You might want to have different sellers covering tax-supported entities versus commercial, industrial and retail outlets. Or, you might want to divide your customer contact personnel into three functions: Hunters, farmers and customer service resources. Alternatively, you might want to deploy income producers who own a list of accounts or a geographic area. Regardless of the approach, successful sales organizations carefully structure and define sales jobs. Each unique job gets its own sales compensation plan.

Sales Representative vs. Income Producer

No sales management decision is more important than determining how to manage your sales jobs, either as sales representatives or as income producers. The entire sales eco-system and sales management infrastructure of these types of jobs differ dramatically, including the incentive compensation plan.

Use the income producer model if you see the sales personnel as partners owning their accounts and the company providing the back office service/production/support to their business efforts. Pay them a flat commission on all sales, no base pay.

However, if you deploy your sales jobs to accomplish specific objectives against select customer segments, use the sales representative model. More than nine out of 10 sellers are managed as sales representatives. Accordingly, the income producer model is a relatively rare way to manage (and pay) sales personnel.

The Headwaters of Sales Compensation Design

The starting point of sales compensation design begins with the job — not what others are doing, not what you have done in the past, not what the sales people want and not what finance requires. Yes, each of those voices will play a role in shaping the final solutions, but the starting point — the headwaters — for sales compensation design is the job.

Your first task as a sales leader is to ensure that you have constructed specific, definable, accountable jobs. The more focused the job, the better. The sales job should be so clear that three or fewer result measures describe the expected outcome of the job. Not coincidentally, you will use these three or fewer result measures in the sales compensation plan. Conversely, you will fail your sales force and your company if you have blended sales jobs (too many dissimilar tasks) or corrupted sales jobs (loaded with competing goals).

Follow These Steps & Apply These Principles

Here is the logical method for designing sales compensation plans. Follow these steps and apply the principles for each job to develop the right plans for your company.

Step 1: Define the Job. Ensure you have devised focused and well-defined sales jobs. Avoid blended and corrupted sales roles. Decide if the job is a sales representative or an income producer. If the job is an income producer, ignore all of the following steps; use the industry-standard commission rate. Pay no base salary. Use a flat commission rate from first dollar. Do not vary the commission schedule among the different types of sales outcomes: new revenue, renewal revenue, profitability and product mix. But if you have sales representatives, then continue with the following steps.

Step 2: Set Target Total Cash Compensation. Collect market data. Determine the price point of the job. This is the total dollar amount you expect to pay for expected performance. And, yes, you can modify this number to reflect your circumstances.

Step 3: Determine Pay Mix. Split the target cash compensation amount into two components: base pay and target incentive (base/target incentive). No need to go deeper than a 50/50 plan. Most direct business-to- business sales jobs have a 60/40 to 70/30 pay mix. Follow this principle: The more influence that the sales person has in the customer decision process, the deeper the pay mix. The less influence, the more shallow the pay mix will be with a higher base pay component.

Step 4: Select the Leverage. The leverage is the upside earning opportunity expressed as a multiple of target incentive. The most common leverage is 3x. This means the best performers (90th percentile) should be able to earn a total of 3x their target incentive. The plan would be uncapped. Use a 2x capped plan for field helpers and pre- or post- sales support personnel. Inbound customer service can use a 90/10, 2x capped plan. Outbound telephone sellers should be on a 65/35, 3x-uncapped plan.

Step 5: Pick and Weight the Performance Measures. Select business result measures. Use no more than three. Do not select compliance or corporate entity measures or any other measure the sales personnel cannot influence. Do not reward activity measures. Avoid Management by Objectives (MBO) measures whenever possible. Weight the performance measures according to importance. Sales production should always be weighted more than 50 percent when compared to the other measures.

Step 6: Determine Performance Expectations. For each weighted measure, determine the minimum (10th percentile), expected (50th percentile) and outstanding (90th percentile) performance expectations.

Step 7: Select the Right Formula Type. Use a commission calculation when territories are equal. Calculate the commission rate by dividing the incentive earnings by performance expectations. If territories are dissimilar in size, use a bonus formula tied to a quota. Payout the incentive element as quota is achieved. Calculate the incentive formula by dividing the incentive dollars by the percent to quota expected. Use hurdles when two or more measures are important and one measure (the “hurdle”) must be accomplished before favorable payouts can be earned on the second measure. Use an incentive modifier when two measures are important, but one measure significantly dominates the important, but less significant second measure. Calculate the payout for the first measure and modify the payout (positive or negative) by the performance on the second measure. Finally, use a matrix (bonus grid) when two measures compete with each other (such as revenue growth and profitability), which allows the sales person to balance these two objectives.

Step 8: Set Up the Qualifiers. Define when revenue or other performance is recognized for incentive purposes. Establish quota and account assignment adjustment rules. Define sales crediting rules. Establish a mega order cap, if necessary. Establish thresholds if you do not plan to pay for recurring business.

Follow these steps for each job, and you will develop a contemporary and powerful incentive plan.

What about the Current Pay Program?

Now, what about your current pay practices? They might be vastly different than the new, proposed plan. It might be hard to make the changes. At this point, a conflict between courage and practicality arises. A general rule of thumb in business is: Never delay the inevitable. But changing your current pay practices might upset the sales personnel.

This is not always true. Sometimes your current pay plans are not working for them either. Be practical. Commit to the target earnings opportunities. Provide a bridge guarantee if their current pay is displaced.

Need Help?

Alexander Group has helped thousands of clients, including worldwide sales organizations, realize the full benefits of effective sales compensation programs to attract, retain and reward best-in-class sales talent to grow their businesses profitably. Learn more about our Sales Compensation practice.