Sales Investment Planning: The Risk of E/R

“How much should I invest in my sales organization?” is one of the more frequent questions we hear from senior leaders. In their search for answers, CEOs, CFOs and heads of sales will often ask us about the ratio of sales costs to revenue (E/R). It makes sense. E/R is straightforward: For every dollar of revenue, we spend X percent on sales. E/R is consistent: It can be applied across industries and geographies. And E/R is revenue-neutral: Companies both large and small can be compared using a common metric. For directional guidance and benchmarking, a standard E/R provides useful insights, but it is a less-than-perfect measure for building next year’s investment plan.

What Is Cost of Sales Ratio?

The cost of sales ratio is a financial metric that compares sales costs with sales revenue. While E/R is a common metric applicable to all industries, the target ratio for each varies accordingly. For instance, manufacturing can incur a higher ratio due to material and labor costs. Meanwhile, business services tend to have a lower cost of sales ratio because they don’t rely on physical products.

The biggest issue with using E/R as a planning tool is that while it compares sales investment relative to a revenue figure, it is not a predictor of sales performance. Companies with a higher E/R (i.e., higher level of investment) don’t necessarily grow faster than companies with a lower ratio.

Like any ratio, sales cost E/R is calculated using a numerator and a denominator. As a result, high sales cost E/R can come from either high sales cost dollars or low revenue. These are two distinct scenarios, potentially requiring very different courses of action.

A high cost of sales ratio can result in reduced profit margins. Cash flow issues are another potential risk. Meanwhile, low sales cost E/R can lead to underinvestment in product quality or service. Since there’s no ideal E/R that applies to all companies, the main objective is to strike a balance between the money spent on sales and the revenue received.

Cost Of Sales Ratio Example

As an example, let’s take a mid-size enterprise software company, which we’ll call GrowMore Software, getting ready to build its 2015 plan. GrowMore averages $1.5MM in revenue per salesperson. Based on Alexander Group’s sales benchmarking database, the median all-in sales cost E/R for enterprise software companies is 25%. Using that data, GrowMore’s executive team allocates 25% of revenue ($375k per rep) to sales for the upcoming year. Is that the right level of investment to ensure GrowMore maximizes the odds of meeting its plan?

Intuitively it makes sense that (up to a point) the more a company invests, the more it should grow. But what we observe in practice is quite different.

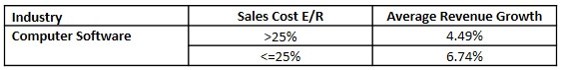

The table below shows the average growth rates for software organizations above and below the 25% E/R benchmark.

What we observe in the data is that companies with sales cost E/R higher than the median (i.e., greater than 25%) have widely divergent growth rates. In fact, there is almost no correlation between E/R and revenue growth. There are many companies that have high E/R and low or negative growth rates, dragging down the E/R average.

But what happens if we change the methodology and look at those same software companies on a dollar-per-rep basis? We find that those companies with E/R >25% and low growth rates share two important characteristics:

- Lower revenue per rep than the median

- Lower investment per rep than the median

These companies are struggling with slow growth or declining revenues. They may not be in a position to aggressively invest in sales, but their lower overall revenue drives a higher overall E/R.

Looking at the results through the lens of $/rep provides a much clearer picture of what’s happening. It eliminates the distortion caused by low revenue results. Companies with a high E/R on a $/rep basis are consciously investing in the sales function, more often resulting in high revenue and high growth.

Further, Alexander Group’s data show that, everything else being equal, companies that invest in higher-than-median sales cost $/rep are almost twice as likely to have higher-than-median revenue $/rep than companies that do not. Even if those higher revenues do not materialize immediately, a higher-than-median investment in sales produces a higher average growth rate over time: 16% vs. 6% for those below the median sales cost $/rep.

An important conclusion from this analysis is that when it comes to revenue and investment planning, a more appropriate measure is sales cost and revenue on a dollar-per-rep basis ($/rep).

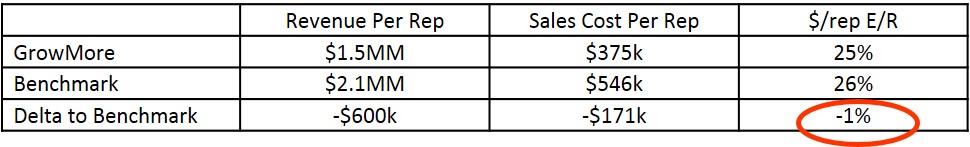

And how about GrowMore Software? GrowMore has average revenue per rep of $1.5MM and established an initial investment plan of $375k per salesperson. The software industry benchmarks for revenue and sales costs per rep are $2.1MM and $546k, respectively. If we compare GrowMore with the benchmarks, we find some compelling gaps:

While the revenue per rep and sales cost per rep numbers are initially more eye-catching, it’s the 1% gap that should worry GrowMore’s leadership. Based on the benchmarks, GrowMore would arguably underfund its sales organization by $15,000 per rep (26% * $1.5MM). With GrowMore having 500 salespeople, that’s a $7.5MM gap! Armed with this important new data, GrowMore has decided to go back through the planning process to evaluate the important trade-offs associated with an increased investment in sales.

Monitoring Sales Cost E/R for Improved Results

Tailoring cost of sales ratio to its specific industry context allows leaders to take a more informed position. When determining how to fund an organization’s sales, it pays to continuously monitor E/R for:

- Performance benchmarking: Consistent monitoring of E/R enables companies to compare performance with competitors and industry standards. When companies commit to establishing optimal ratios, it’s easy to identify trends and act on them. This policy enables executives to adopt best practices to drive revenue.

- Informed decision-making: Calculating ratios allows a solid understanding of the deviations from the company’s projection. This information is crucial in decision-making and strategic planning for increased profit.

- Long-term sustainability: Maintaining an optimal cost of sales ratio influences the company’s long-term sustainability and growth. It’s an indication of efficiently managing sales costs relative to sales revenue. Sticking to that ratio helps keep costs in check and retain more profit from each sale.

- Better resource allocation: An optimal E/R ratio opens up more effective strategies for resource allocation. Instead of overspending on inefficient plans, leaders can focus on better cost management. Use the ratio to identify the areas that yield the highest returns. Proper resource allocation supports industry competitiveness and innovation.

- Competitive advantage: More than resource allocation and performance benchmarking, efficient sales cost management enables competitive product pricing. An optimal ratio of sales costs and revenue breeds healthy margins. By maintaining the ideal ratio for the company, you can attract and retain customers.

Mitigating Potential Risks in E/R for Competitive Positioning

Both sales cost and sales revenue influence the cost of sales ratio. Since it’s not a definite indicator of profitability, there are risks associated with focusing too much on one side of the ratio. Maintain healthy positioning in the competitive market and ensure long-term growth by pursuing optimal E/R.

The following are a few ways companies can work to keep E/R balanced and stay competitive in their sector:

- Technology and automation: Streamline processes to reduce cost of sales with automated technologies. Leveraging data-driven insights allows companies to monitor relevant ratios in real time. Collecting and continually reviewing data also equips decision-makers to identify and act on gaps and trends.

- Product innovation and differentiation: Redesigning products or services is another way to minimize costs without sacrificing quality. Maximize innovation or improve diversification to reduce risks and increase overall revenue potential.

- Waste elimination and continuous improvement: Identifying and eliminating waste within the process results in lower costs. A culture of continuous improvement nurtures actionable recommendations that enhance efficiency and limit potential risks.

- Training and development: Invest in employee training to equip staff with best practices for cost management. Bringing teams together for innovative problem-solving can contribute to developing cost-reduction strategies. Well-trained staff and cross-functional teams are pivotal in mitigating risks in E/R.

Set Realistic and Effective Benchmarks Today

Want to compare your company’s $/rep, or is it time to start thinking about next year? Learn more about Alexander Group’s Sales Analytics. We will help you establish the optimal cost of sales ratio to promote greater profitability and sustained success. Contact us today to learn more about E/R and its impact on revenue growth.