Service opportunities big and small in medical equipment

Overheard in the C-level corridor of a top 50 IDN…the EVP of Supply Chain talking with two other IDN executives: “We’re gonna make sure that [vendor] Corporate Account Rep won’t make quota this year. By the end of the year, he’ll be sweating or crying.”

Supply Chain focus on unit price cuts has caused pain for medical equipment sales organizations. Our 2015 AGI Medical Industry Sales Benchmarks show that medical equipment gross margins have declined from 66 percent to 62 percent over the past five years. Nearly a full point a year, most all in the product margin. With relentless product price pressure, medical equipment vendors are turning to service for growth. Historically neglected, services were often provided free by medical equipment vendors, or buried in the product price. Capital equipment vendors resigned themselves to running a low-to-negative margin service operation as a cost of doing business. In too many examples, we’ve seen the service business neglected with little mind share from company leaders.

But now we see a change afoot, with service becoming prominent both with traditional equipment service contracts, and in the emerging large IDN solutions segment of the market.

Traditional Equipment Service Improvements

Great improvements can be made in the traditional equipment service business. First, it helps if the equipment vendor can offer some type of innovation alongside break/fix service. Some vendors can take hospital equipment performance data from all their hospital customers under contract and deliver valuable benchmarks and operational assessments of a relevant hospital department, function or floor.

Second, it helps if the company is committed to actively marketing and selling service contracts. Frequently we see service passed around like a hot potato – the sales force reluctant to take a service quota, and the service team not cut out to sell in the first place. We find the best medical equipment service organizations have a small separate sales team for new services contracts and renewals. Some deploy a separate renewal sales rep. The key to renewal success is not the sales job design, but paying attention. If the vendor can pay attention to a hospital’s real-time equipment usage metrics, then the vendor should know if the customer has a service problem, needs more service or has the right amount in the current contract in a timely fashion. Paying attention to the usage data lets the vendor make a compelling case for the right type of renewal.

Third, proper sizing and deployment of the field service team is critical. The key is deploying service people where the installed base is growing. Also, if field service and sales teams can be aligned – so they mirror each other as much as possible – then we see better communication between the two groups. Better communication between service and sales leads to better service for hospital customers and better cross-sell/upsell results for the vendor.

Big Service: From Capital Equipment to Managed Services

At the high end, we see Big Service for Big Solutions. Big Service is another chapter out of the book of enterprise technology, the chapter called managed services. In these deals, medical product vendors bundle capital equipment; hospital operations support; and other services such as installation, training, maintenance and consulting, both clinical and business consulting.

Long-term contracts provide volume discounts on capital equipment with automatic technology upgrades to the IDN’s capital fleet, all under a fixed monthly fee. Managed services help sprawling IDNs establish consistent technology and clinical pathways across multiple hospitals and non-acute sites.

These deals take a long time to close as the IDN and vendor go back and forth on risk-sharing terms. Front-loaded deals help vendors offer widespread equipment upgrades at the outset, which can help IDNs quickly add capabilities and/or change their cost structure.

The big equipment players–Siemens, Philips, GE and others–have taken the plunge into this world of Big Service. With each big IDN-managed services win, the vendors will learn from the last one to fine tune their solution offerings and fee structures.

Conclusion: Little Service and Big Service

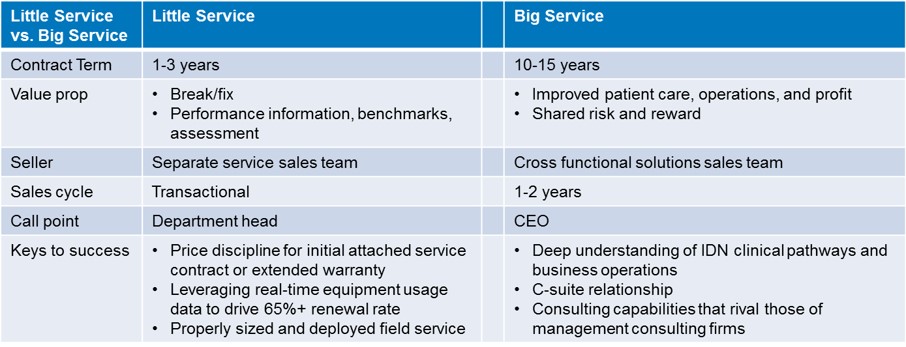

Whether you’re an equipment vendor with a limited product line or a broad line, you can boost revenue and margin substantially in the services that wrap around your equipment. See Table 1 below. The service business is becoming one of the best ways to overcome supply chain product price pressure. More important, innovations in service will become the single most important differentiator among medical equipment vendors.

Learn more about our Medical Device practice.