Technology: Demystify Sales Leadership and Management Compensation Plans

Four Key Questions You Need to Be Asking

Sales Management plans are typically given minimal attention during the annual planning process. Plan design time, focus and energy is prioritized for primary selling roles. But why should Management plans get the short end of the stick when they are often cited as the most important role in the sales force?

At Alexander Group’s recent Sales Compensation Symposium, a facilitated discussion was held with three technology executives to understand current practices around the top four compensation questions that companies should address when designing management-level sales compensation plans. For those four key questions, Alexander Group shares its point of view and the practices adopted across the three panelists.

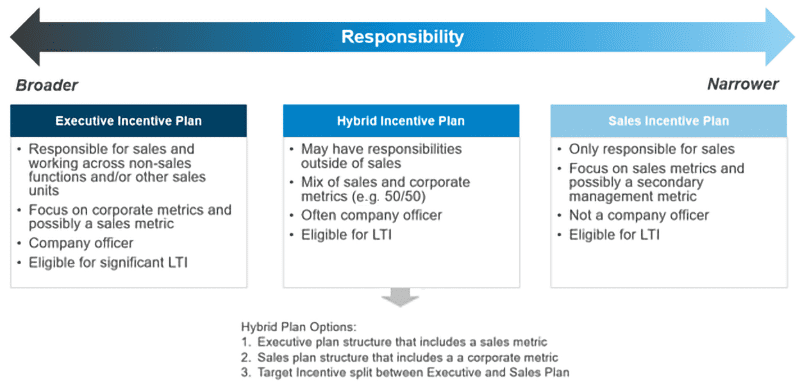

Question 1: Should Sales Leadership Be On A Sales Incentive Plan (SIP)? Or On An Executive Incentive Plan (EIP)? Or Both?

Alexander Group’s POV: Sales leadership’s compensation program generally depends on company growth phase, leader’s scope of responsibility and company philosophy. The below graphic highlights this more in detail.

Example panelist practices:

Company A: A mature company where only top leaders are on a Hybrid SIP and EIP. At this top level they want sales leaders to be accountable for both sales and company performance. The EIP is based on the “Rule of 40.”

Company B: All leaders are strictly on a SIP. They want them 100% focused on sales and expect them to balance company performance.

Company C: Mature company where only Head of Sales is on an EIP. Everyone else below this top level is solely focused on sales execution and on a SIP.

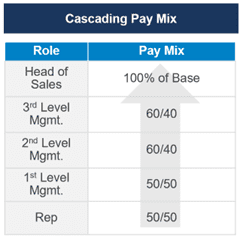

Question 2: How Is Pay mix Differentiated Up the Management Chain?

Alexander Group’s POV: Pay mix is less aggressive at higher management levels as they are further removed from the persuasion event and have less influence on specific deals:

Example panelist practices:

Company A: This company aligns management and rep pay mix 100% of the time. They experimented with less aggressive management pay mixes in the past, but that resulted in decreased earning opportunities that was not offset by target total comp.

Company B: This company provides a less aggressive manager pay mix to differentiate managers being more removed from sales process. However, they create motivational earnings potential through steeper accelerators and target total comp increases.

Company C: Management’s pay mix changes year-over-year due to aligning to both sales strategy and market data. This means that some years management’s pay mix is aligned with reps and other years it is less aggressive. When assessing sales strategy, they evaluate 1) the primary go-to-market motion (secure net new logos or expand) and 2) the role of the manager (how much are they expected to be a player/coach). This company noted that frequent pay mix changes results in monetary cost as well as a change management costs. Alexander Group notes that this is a very atypical and unideal practice.

Question 3: Should Management’s Plan Measures Be The Same Or Different From Reps?

Alexander Group’s POV: The level of measure alignment between sellers and their management levels depends on manager’s role, company philosophy and company priorities. Regardless, there should be some measurement similarities to ensure behaviors are aligned and that interests are not conflicting.

Example panelist practices:

Company A: This company utilizes the same new bookings measures across sellers and most levels of sales management. At the VP level, they introduce a renewals measure to incentivize and encourage the new and renewal teams to partner together. This is a new practice for this company, and it is cited as too early to tell if this design structure is driving the right behaviors.

Company B: This company aligns measures across sellers and all sales management levels to ensure everyone is working towards the same common sales goals.

Company C: Reps and first-line sales managers are measured on revenue. At the second-line management level they introduce a profitability measure at 30% weight. This company has been utilizing this structure for many years and has helped them achieve their business objectives.

Question 4: How Should Companies Incorporate Equity Or Long-Term Incentives Into Management Compensation Plans?

Alexander Group’s POV: Varied long term incentive practices based on pay philosophy and degree of promoting and rewarding “company ownership” mentality. Equity and long-term incentives are typically reserved for higher levels of management, needing to reward for long-term benefits, and to hire and retain the right talent.

Example panelist practices:

Company A: Private equity owned company. At VP and above level, RSUs are offered to ensure that management has a balanced view of not just sales but also overall company objectives.

Company B: Public company. RSAs are utilized as the main vehicle for providing long term incentives. However, this company cited that their long-term incentives are not a significant differentiator and are not as aggressive compared to what smaller pure play competitors offer.

Company C: Public company. The external talent they are hiring are expecting healthy equity, so equity is perceived as table stakes. In addition, this company offers “event-based” equity, which is reserved for special occasions – retention, transfers and promotions.

In Summary, A Few Key Takeaways:

- A sales leader’s compensation program – ranging from a sales incentive plan to executive incentive plan to both – generally depends on company growth phase, leader’s scope of responsibility and company philosophy

- Management’s pay mix is typically less aggressive to accommodate the less influence and persuasion they contribute to the sales process

- Management’s plan measures should generally align with direct reports to ensure interests and behaviors are aligned, but may deviate to accommodate differences in manager’s role and overall company priorities

- The use of equity and long-term incentives is typically reserved for the highest levels of sales leadership to reward for long-term outcomes, drive a “company ownership” mentality and hire and retain the right talent

Contact Us

This is a subset of this session’s great discussion, which was part of Alexander Group’s featured Sales Compensation Symposium event. To learn more about these practices or to explore how they may or may not apply to your company, please contact Alexander Group’s Technology practice lead.