Explore Our Insights

-

Life Sciences: Driving Efficiency & Cost Savings

-

Pharma: Best-In-Class Customer Segmentation

-

Manufacturing & Distribution: Sales Compensation – Turning Challenges into Strategic Advantages

-

Manufacturing: Driving Growth – A Commercial Transformation Story

-

Technology: Improving GRR – Mastering Renewal Measurement Complexities

-

Cross-sell vs. Upsell: What’s the Difference?

-

Media & Consumer Technology: How Media Companies Can Win in the Mid-Market

-

Financial Services: Using Coverage and Compensation to Tackle Challenges

-

Why Pricing is the Next Frontier for AI

-

Healthcare: Driving Cultural Change – Sales Comp Change Management Best Practices

-

Navigating Customer Journeys and Growth Strategies

-

Business Services: Transforming AI Insights into Business Impact with RevOps

-

Technology: How CROs Can Win the New Logo Game in 2025

-

Private Equity: Sales Compensation: A Strategic Lever for PE Firms

-

Manufacturing & Distribution: Leveraging Machine Learning to Uncover End-User Opportunities

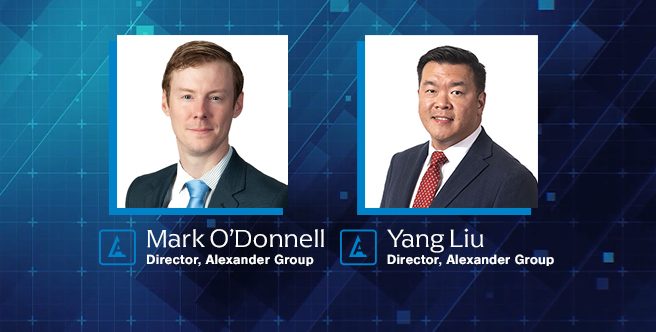

Alexander Group has helped thousands of clients.

Our expert leaders assess, align, design and implement powerful sale compensation programs. Alexander Group has helped organizations realize the full benefits of effective sales compensation programs to attract, retain and reward best-in-class sales talent to profitably grow the business. We can help with all elements of your sales compensation program. Contact us today.