How to Deploy Your Sellers in a Consumption Pricing World

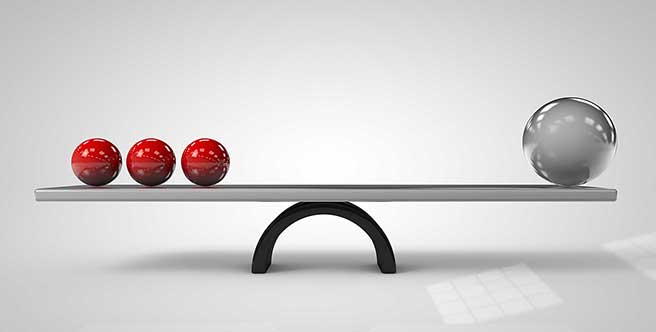

In the technology industry, more companies are experimenting, adding and/or making the complete transition from annual subscription-based to consumption-based pricing models for certain segments of their product offerings. From our recent Sales Compensation Trends Survey, 40% of technology companies are using consumption-based pricing right now. While the products may not change, this new pricing strategy changes customer behavior. Customers don’t have to lock into a contract for an entire year–instead, they are free to hop in and out of an application as needed or walk away entirely after a one-month trial. Thus, companies must consider how this new pricing model fits within their go-to-market strategies and affects their coverage models. Since customers can walk away at almost any point, successful coverage models should enable sellers to continually engage and persuade customers to ensure they’re extracting enough value to drive usage, rather than just checking in as a renewal date is approaching. What are the key coverage decisions that companies need to weigh when introducing consumption-based pricing models?

Customer Types

When companies sell to enterprise customers using the traditional XaaS subscription model, often the buyer might not be the person who is using the product. While the end-user has some say in enterprise subscription purchasing decisions, the end-user is even more influential in the purchasing decision when consumption-based pricing models are deployed. With consumption-based pricing, the buyer can immediately determine whether or not the product is being used. Instead of assessing the value generated at the end of the year on an annual subscription, customers can assess their repurchase decisions after a few months or less.

This plays into coverage decisions because companies will need to have roles that are closely connected with both the buyer and the end user. In some cases, the user and the buyer might be the same person, so it makes it critical that the seller is following up, not only from a selling standpoint but also making sure that the customer is adopting and using the product well. While a variety of different role types can work—account executive, customer success manager, inside sales or partner role, companies must ensure the chosen role aligns with their overall go-to-market strategy.

Contract Type

For technology companies implementing consumption-based pricing, the choice between committed and uncommitted contracts will have different coverage implications. With committed contracts, customers commit upfront to a specific amount of product usage such as a dollar amount or a number of credits. Committed contracts may appear more similar to traditional subscription models because there is an upfront booking event. In contrast, uncommitted contracts are paid on an ongoing basis depending on usage either upfront as credits or at the end of the month based on usage.

The right coverage model for committed and uncommitted contracts, depends primary on the need to drive usage and monitor value realization. Thus, there needs to be a role responsible for closely monitoring usage to determine when to re-engage clients to re-up their credits or persuade them to continue using the product. The main difference is in how a sale’s “land” stage is defined. Committed consumption is similar to traditional subscription pricing in that there is a booking event upfront, defining the sale as closed. With uncommitted contracts, there isn’t a clearly defined booking event, since the customer could cancel at any time, driving a greater need for ongoing persuasion from the seller.

In some instances, uncommitted contracts are advantageous as they offer a lower cost to entry for the customer, but disadvantageous to the seller as they’re likely paid out on the usage over a long period of time instead of being paid upfront for a committed contract. With committed contracts, the customer typically benefits from a lower price per unit.

Rules of Engagement

In a traditional subscription model, the primary seller typically takes ownership of landing the sale, before passing off adoption and implementation activities to post-land teams. The primary seller may or may not come back in for expansion and renewal opportunities. But as companies transition to consumption-based pricing models, the lines between pre-land, sales and post-land roles blur. Thus, when planning the right coverage model for consumption pricing, it is critical to consider what roles are present and who owns each activity within the customer engagement process.

In consumption models, the seller still owns the land stage, but after the initial sale, the customer needs greater coverage to ensure ongoing usage. Understanding how sales and supporting roles work together ensures that not only is the sale landed, but that the customer adopts and uses the product.

Depending on the organization, product and overall go-to-market strategy, the coverage can take on many forms, such as:

- The seller owns the entire customer journey, from landing the initial purchase, monitoring ongoing usage and re-engaging as needed.

- A hunter gets the customer to try the product, and then ongoing account management is passed off to a farmer to encourage product usage and repurchase.

- A hybrid approach where the seller lands the sale but is supported by other roles to stay engaged with customers, like customer success managers, and then the seller is brought back into the conversation when sales opportunities arise.

The complexity of the product often helps to inform these coverage decisions. The higher the degree of complexity of the product sale, the more supporting roles are likely required to nurture the customer’s usage. In contrast, sellers for lower-complexity products can have sufficient product knowledge to ensure smooth customer onboarding.

Conclusion

To successfully adopt consumption-based pricing, companies must carefully consider their go-to-market and coverage strategies. Companies should consider who their customer is, how they are contracting their offerings and what rules of engagement they need to support ongoing customer usage and relationship management. As coverage strategies are reevaluated to support consumption-based pricing, other considerations around customer segmentation, seller compensation based on usage and other go-to-market factors may arise. For assistance with planning coverage models and go-to-market strategies for consumption-based pricing, contact the experts at the Alexander Group to learn more.