2. Key Questions for CPG Companies

For CPG companies, especially those with limited direct sales teams, several critical questions arise:

- Which Accounts Require Broker Engagement? Not every account necessitates broker involvement. Identifying the right accounts for broker collaboration is crucial to economically expanding your coverage.

- How Should the Broker Relationship Evolve Over Time? Brokers’ roles can shift as products mature or new opportunities arise. Adapting the relationship is essential as your supplier power increases.

- How Can Companies Hold Brokers Accountable? Ensuring broker accountability is key for success. Metrics, performance evaluations and clear expectations play a vital role and need a standard cadence for review.

- Which Brokers Deserve More Attention? Some brokers excel, while others may underperform. Companies must consider their investment decisions and allocate resources wisely.

- Is Your Broker Spending Effective? The money spent on brokers should be yielding the desired results to be worth the investment. Regular evaluation is essential.

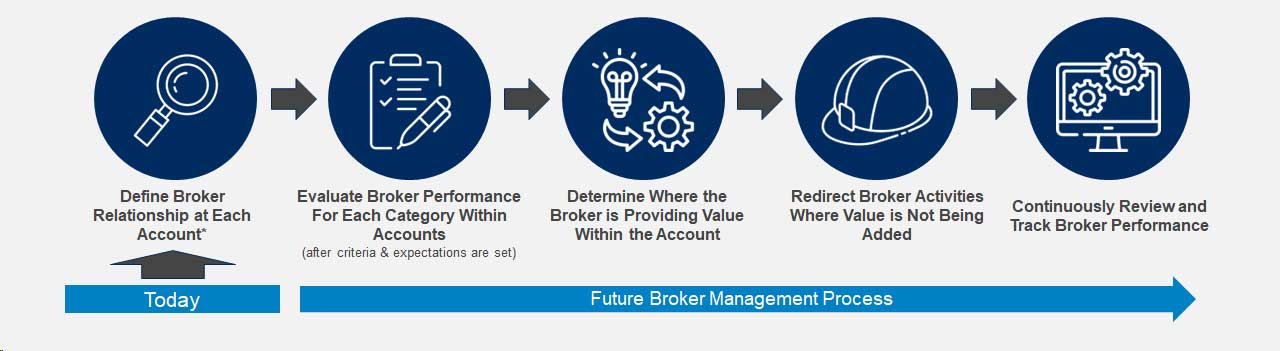

3. The Broker Performance Model

To address these questions, consulting firms collaborate with leading organizations to tailor a broker performance model. Here are the key components:

- Define Broker Relationship Tenets for Each Account. Clearly outline expectations, roles and responsibilities for brokers working with specific accounts.

- Evaluate Broker Performance by Category Within Accounts. Assess how brokers perform in different product categories. Identify strengths and areas for improvement.

- Identify Value-Adding Opportunities. Determine where brokers can provide the most value within each account. Redirect efforts as needed.

- Continuous Review and Evolution. Regularly review broker performance, track progress and adapt strategies. Reward outstanding performance.