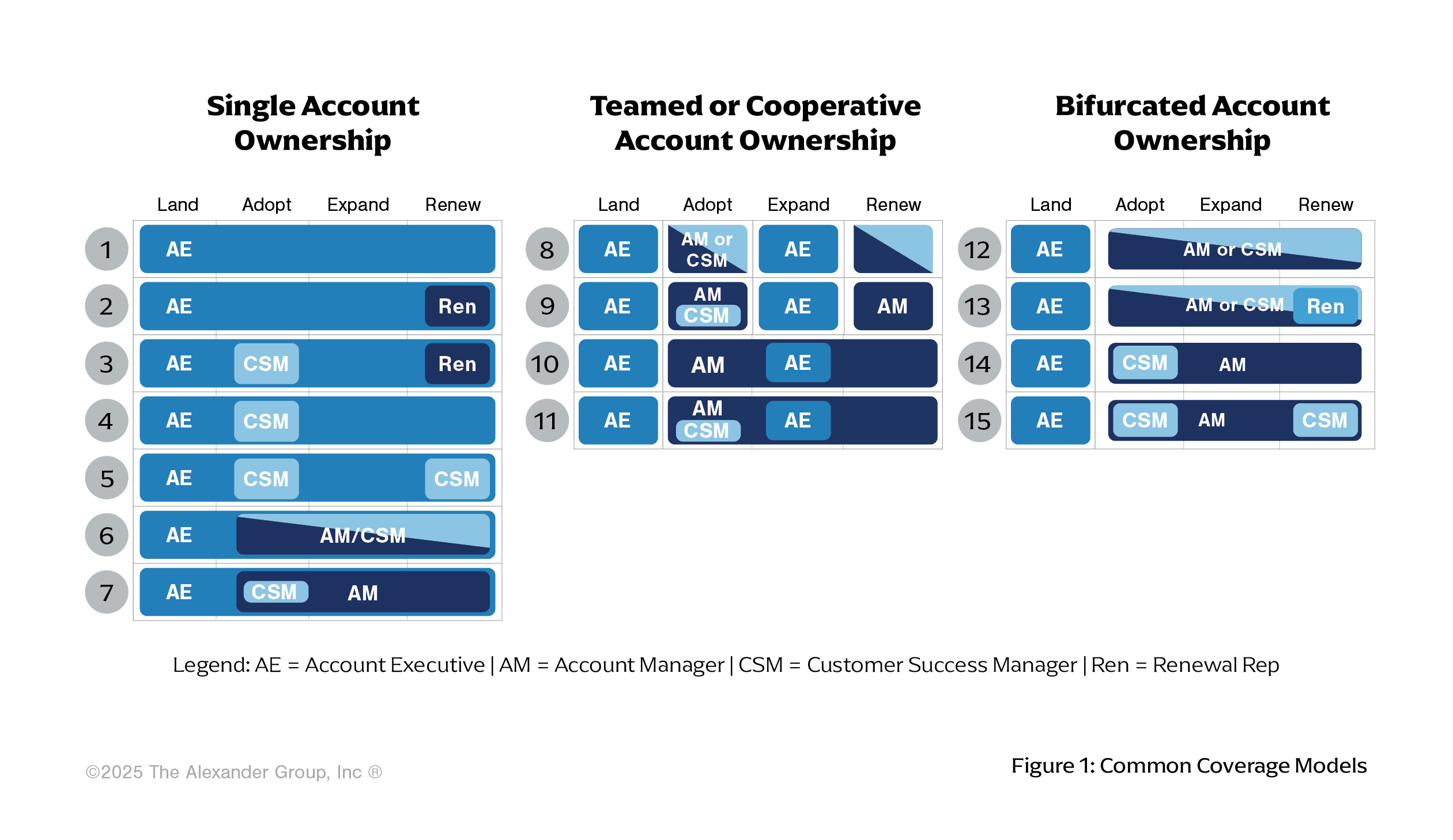

When a Fintech provider first enters the market, limited sales resources may lead the company to use a single seller to do all of the selling motions (see Figure 1, options 1 and 2). Given the initially limited install base, business development activities are naturally the sales team’s primary focus. These motions are essential for establishing the company’s first customers. However, if the sales organization remains only in hunting mode, they become problematic as the business evolves. Continuing to primarily focus on initial land motions results in a failure to realize, retain and expand revenues, in turn, limiting organic growth. Net recurring revenue (NRR) that doesn’t meet company goals is a clear signal that the GTM model should evolve to include stronger post land coverage.

Most mature FinTech firms utilize a bifurcated coverage model to drive increased emphasis through role specialization: roles dedicated to new acquisitions and roles dedicated to the post land motion (See Figure 1, options 12-15). However, with changes to coverage, downstream impacts must be considered. Sales incentives need to change to support the new coverage model and drive the right sales behaviors for new job roles. Leadership must clarify rules of engagement (RoE’s) to ensure successful execution of the new model, appropriate handoffs of customers and expectation setting for the customer experience. Based on how your company has evolved and how customers are changing, you may be at the point of transforming your coverage model and GTM processes to realize the revenue potential of new deals.

Challenge #2: Poor Discipline Around Implementation & Onboarding

Poor discipline during the implementation and onboarding process can significantly impact revenue, causing it to fall short of expectations even after new sales deals are signed. Several common scenarios in implementation and onboarding can lead to these issues.

First, the handoffs between account executives (AEs) and account management (AM) teams are often inconsistent. Individual sellers may choose their own methods for handing off deals, without adhering to a standardized process. This inconsistency can lead to confusion and a disjointed client experience. To address this, it is essential to have clearly defined job roles and rules of engagement across the organization to drive consistency and ensure seamless client experience.

Second, there is often a lack of alignment or understanding between sales, implementation and AM teams regarding the potential of new accounts. It is crucial to have a well-defined process for setting expectations, collecting and validating data-driven inputs, and aligning these expectations with the client throughout the process. Without this alignment, there can be misunderstandings and miscommunications that lead to unmet expectations and dissatisfaction.

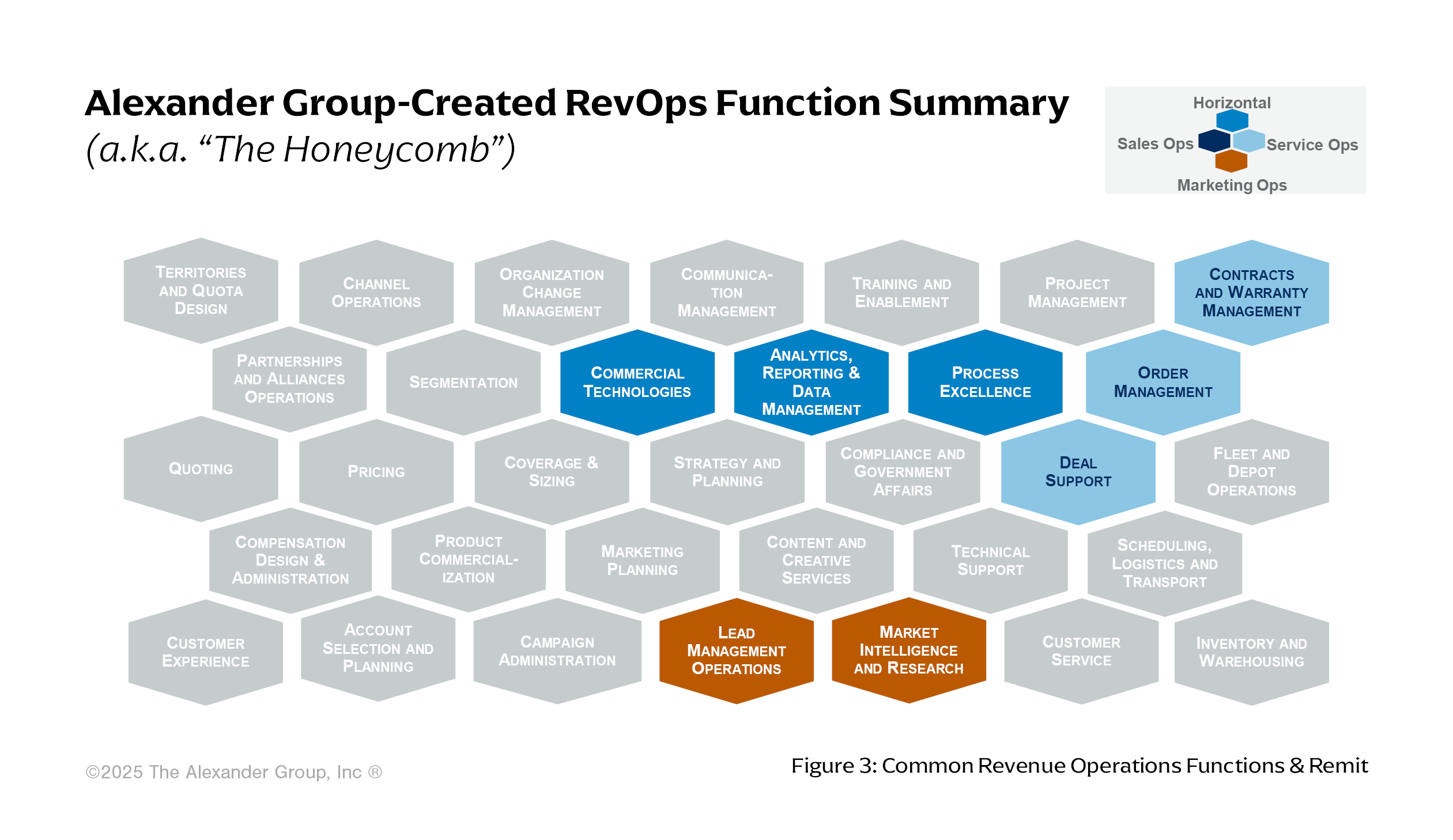

Last, revenue operations resources must play a vital role in setting processes and standards to measure expectations and key performance indicators (KPIs) during the transition to account management. It is important to have monitoring systems in place, such as dashboards or early warning alert systems to track whether accounts are meeting expectations. These systems can help identify potential issues early on and prevent accounts from being lost due to missed expectations.

Challenge #3: Sales Incentives Lack Balance between Land/Expand

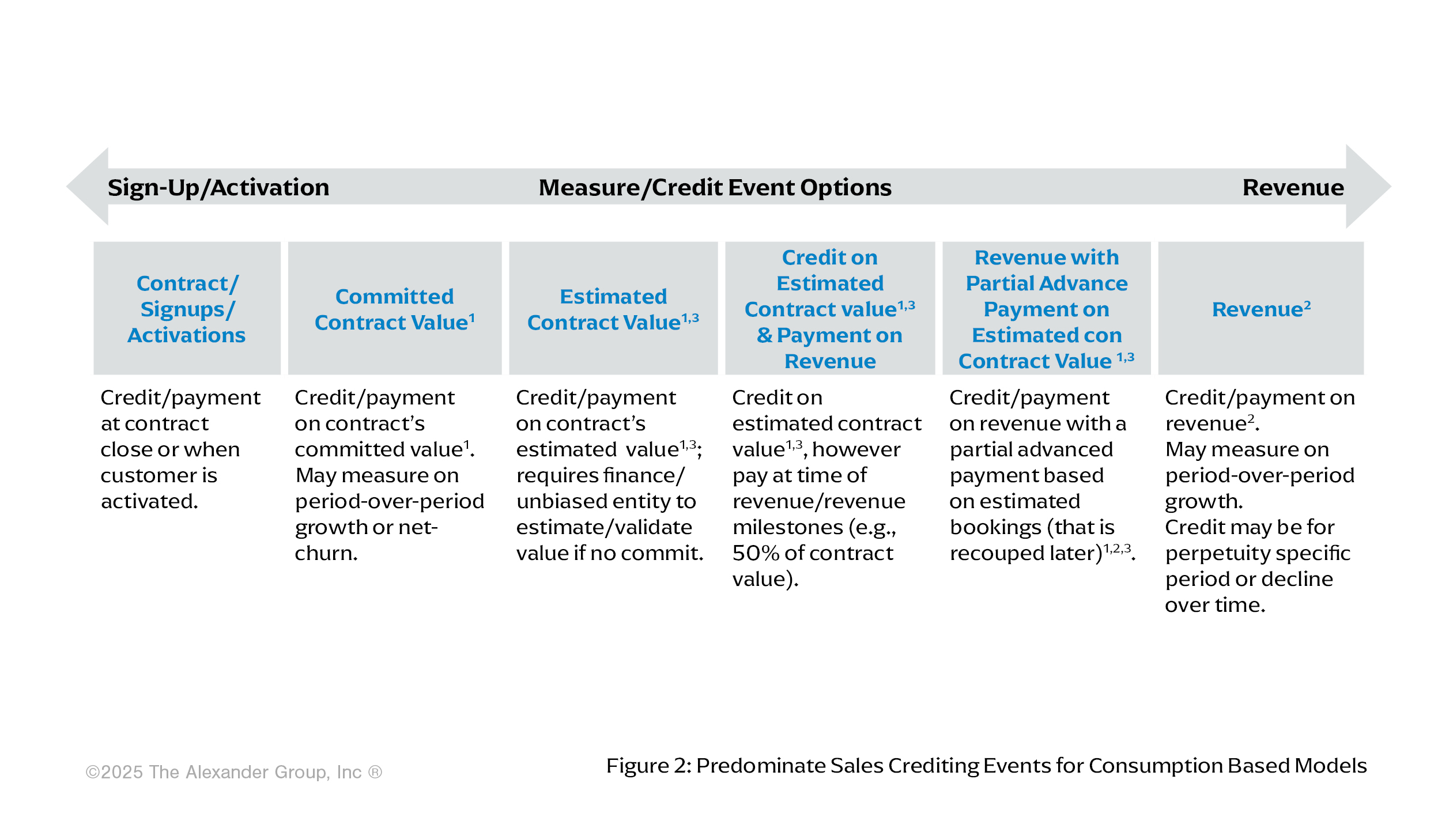

Having the right coverage in place will only be effective if sellers are also incentivized to run the right sales motions. With consumption-based models, compensation plans must incentivize sellers to drive adoption and revenue pull through. FinTech companies with a consumption revenue model may consider six predominate methods for crediting sellers (see Figure 2).