Value segmentation leads to better resource allocation

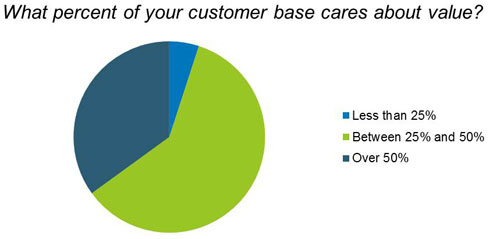

At the Spring Forums conducted in May and June, Alexander Group polled over 70 sales executives to learn more about their mandate to inject value into the sales process. We asked, “What percent of your customer base actually cares about value as opposed to cost?” The results of this poll are noted below; nearly two-thirds of executives indicated that less than half their customer base cared about value. If this is true, then why all the fuss about value selling?

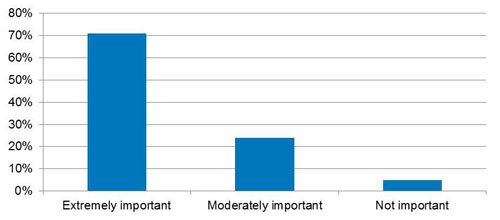

The same audience indicated that the value oriented segment is extremely important to achieving their growth objective in 2013. How important? See the chart below:

Over 70% of participants indicate that the value oriented segment is extremely important to making their growth objective. As one executive put it, “These customers are growing the fastest. They demand more of our products and are willing to pay a premium.”

What kind of value do such customers expect? Three words were used again and again…we call them “the Three Ds”.

- Depth. You need to understand the customer’s business at a level that permits discussion about “how to do things better.” Some value is placed on helping customers run their businesses more efficiently and save on cost. But over 70% of the executives surveyed at the Spring Forums said the most value was ascribed to insight that would “help customers generate more revenue.”

- Delivery. Customer-facing resources, both sales and service, must be dedicated to helping clients implement the solutions that they were sold. Vendors are expected to deliver the promised results.

- Devotion. No more sell and run. If vendors want to be treated like partners, they need to show a devotion to the client that runs the gamut from involving them in discussions on new product development to accepting risk (upside and downside) on the ROI of the investments made as a result of the sales process.

Where do you find such customers? This is important since by the estimates of the executives at our Spring Forums over half their customer base cares mostly about price. Only 30% to 40% appear to want real value. How do you locate these customers? Executives at these events cited three important factors to qualify whether a customer (or target) was truly value oriented:

- Loyalty. Does the customer (or target) tend to stay with one company or do they often switch to whichever vendor offers the best price? Do they buy a basket of products and services or do they “cherry-pick” based on price? Loyal customers tend to remain so for a reason…they get value from their vendors beyond the simple price of the products they buy.

- Strategy. How does this customer compete in their own market? Are they avowed value sellers themselves or do they compete based primarily on price? Companies that compete based on value tend to buy based on value.

- Vertical. Do you have insight and solutions that are deep in one or more verticals? If so, the odds are that you will have greater success and more references within these verticals, so target there.

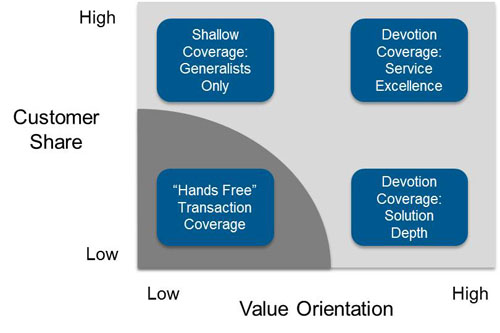

Taking all of these factors into account enables sales executives to make smarter coverage decisions. See the chart below.

Where customer share is high but the value orientation is low (upper left), executives protect customers that are prone to switching with shallow, generalist resources. While they want to maintain the business base, they also know that investment in expensive solutions resources is a waste when the customer is loyal to the lowest price. They save such investment for customers in the upper right where share and value orientation are both high. The base can be protected by ensuring that the customer maximizes their return on their investment in the vendor.

Where customer share is high but the value orientation is low (upper left), executives protect customers that are prone to switching with shallow, generalist resources. While they want to maintain the business base, they also know that investment in expensive solutions resources is a waste when the customer is loyal to the lowest price. They save such investment for customers in the upper right where share and value orientation are both high. The base can be protected by ensuring that the customer maximizes their return on their investment in the vendor.

Similarly investment may also be warranted where share is low but value orientation is high. Put another way, these customers are loyal…but to another vendor. If you want to lure them away, price alone won’t do it. You are going to have to show them superior return. Build the case with all the right pre-sale resources. Be prepared to build it slowly and thoroughly; such customers are hard to win but are worth it in the end.

Below a certain level of value orientation and share (lower left) it is not worth investing much to win or keep the business. Here, using the internet, partners or (at most) lower cost inside resources is the best way to do business. Efficiency, not effectiveness, is the key to making money here.

Yes, the size of the account matters too and should also be factored into the equation. But by paying attention to which accounts place value on your expertise you can avoid wasting time and resource pursuing procurement-centric RFPs and target accounts (large and small) where your expertise can really make a difference.