Vital signs of a sales force

Sales consultants like to think of themselves as doctors of sales. Yet, a doctor’s appointment starts with something easy – taking basic vital signs like temperature, blood pressure and pulse rate; a consulting project, on the other hand, often kicks off with a long list of data requests – long enough to keep clients wondering if the consultants are trying to boil the ocean.

Let’s face it: the upfront data requests are inevitable, since the alternative, piecemeal data collection throughout a project, is even more burdensome and undesirable. However, the Alexander Group does leverage two key measures of sales forces to help eliminate unnecessary data requests: the distributions of rep tenure and quota attainment.

We believe that these are the truest vital signs for a sales force.

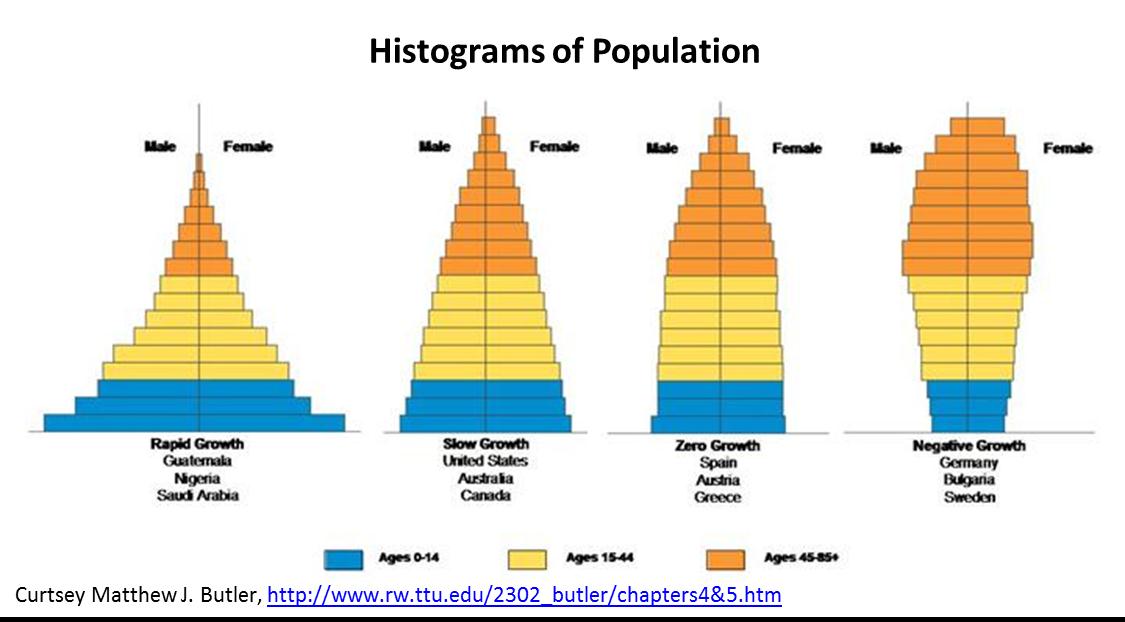

Let’s talk about tenure first. Everybody knows that average tenure is an indicator of a sales force’s experience, but seldom do people think that the histogram of a tenure distribution also reveals turn-over information. In fact, this is a trick that anthropologists have been using for decades. To gauge the population growth of a country, they often take a count of the population by age group, producing something like a histogram rotated counter-clock wise by 90 degrees (see below). Because of different birth and death rates, those countries with large youth populations are experiencing a baby boom, and those countries with large elderly populations at the top are suffering population decline.

By the same token, histograms of sales reps by tenure that show a gradual decline of rep headcount as tenure increases are indicative of a stable sales force. When a company exhibits an exponential curve with very large numbers of rookies, chances are the sale force is in a rapid expansion. These observations then could tee off an in-depth discussion with the sales leaders on sales growth and sales force development…

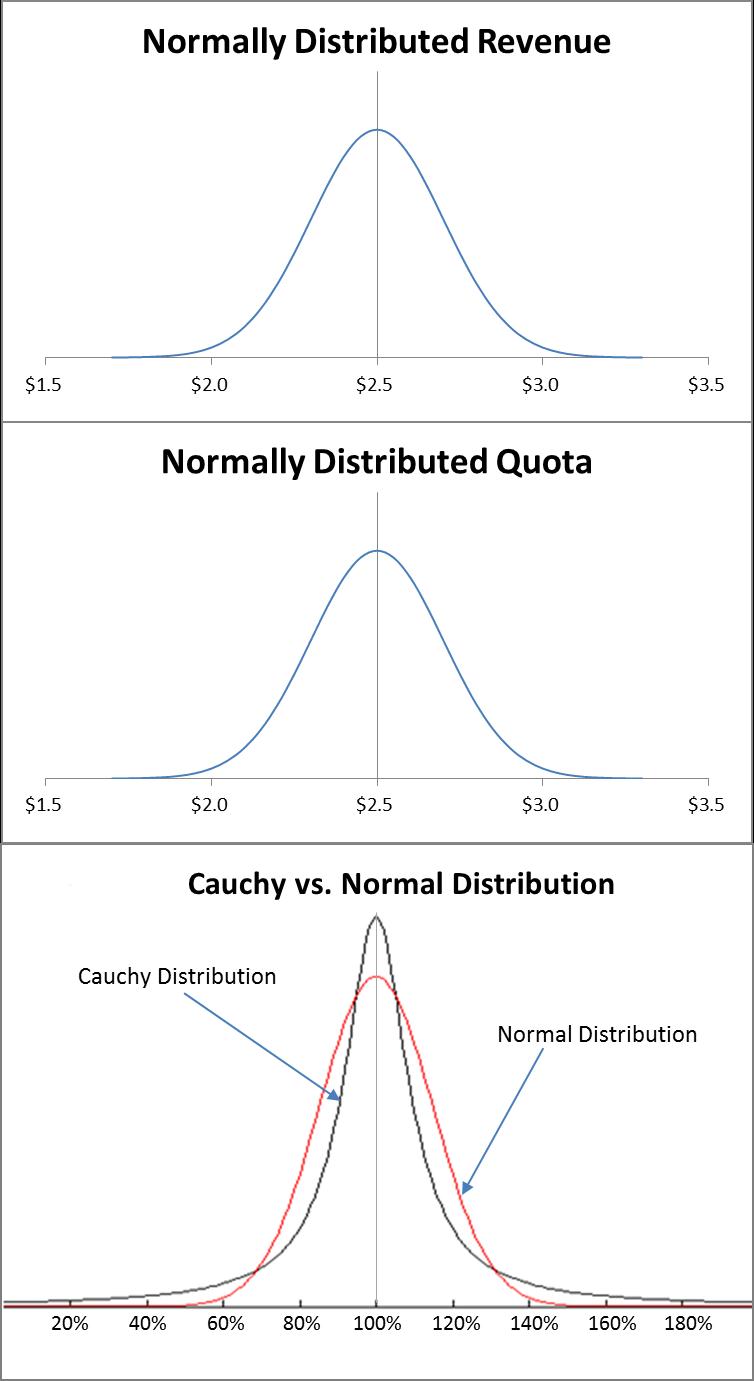

Compared to tenure distribution, the distribution of quota attainments is more complicated. Since quota attainment is calculated by dividing revenue by quota, the distributions of the numerator and denominator both affect the distribution of the quotient. In a most simple case, a sales force should have normally distributed quotas, with, for instance, quotas in North Dakota and New York City on opposite tails of the bell curve. If everybody has a fair chance of making quota, the revenue should be normally distributed as well. When a normally-distributed revenue curve is divided by a normally-distributed quota curve, the result is a so-called “Cauchy Distribution”, with a taller, thinner peak and thicker tails than a standard normal distribution. This is in line with real-world experience. A good quota setting practice should see most reps making (but not exceeding) quotas, resulting in a clustering of reps around 100%; hence, the tall peak. But there will always be some reps making 200% or even 400% of their quotas; hence, the thick tail.

Compared to tenure distribution, the distribution of quota attainments is more complicated. Since quota attainment is calculated by dividing revenue by quota, the distributions of the numerator and denominator both affect the distribution of the quotient. In a most simple case, a sales force should have normally distributed quotas, with, for instance, quotas in North Dakota and New York City on opposite tails of the bell curve. If everybody has a fair chance of making quota, the revenue should be normally distributed as well. When a normally-distributed revenue curve is divided by a normally-distributed quota curve, the result is a so-called “Cauchy Distribution”, with a taller, thinner peak and thicker tails than a standard normal distribution. This is in line with real-world experience. A good quota setting practice should see most reps making (but not exceeding) quotas, resulting in a clustering of reps around 100%; hence, the tall peak. But there will always be some reps making 200% or even 400% of their quotas; hence, the thick tail.

In the real world, however, most quota distributions are not normal and the likelihood of achieving quota is not evenly distributed on either side of 100%. As a result, quota attainment distributions will be either right- or left-skewed. By taking a look at the shape of the quota distribution, we can form basic hypotheses as to whether the quotas are set too low or too high, or if there may be issues with territory design.

As you can see, tenure and quota attainment alone can tell us very important information regarding sales growth, quota setting practice and performance. These are indeed vital signs for sales forces, and like the vital signs that a nurse may take in a doctor’s office, they’re easy to collect. Just as a good doctor has the medical knowledge to interpret your results, so too should a good consultant have the basic statistical knowledge to infer from your sales statistics vital hypotheses for your sales organization.

That’s how we deliver superior values to our clients.

Learn more about Alexander Group’s benchmarking practice.