What Is Behind Every Successful Private Equity Investment?

Private equity firms are chartered with the daunting task of evaluating and investing in companies that will generate significant returns for their investors. Each firm has its own investment “thesis” based on their experience and what they believe works. Much attention is given to the product, the operations and the financials. Here’s a little secret–behind many successful private equity investments is a successful sales organization. Whether it’s a prospective investment or an existing portfolio company, PE firms should consider the hallmarks of both sales excellence and sales obsolescence. Successful sales organizations are customer-oriented, highly productive, revenue- and profit-centric and excellent at both execution and implementation.

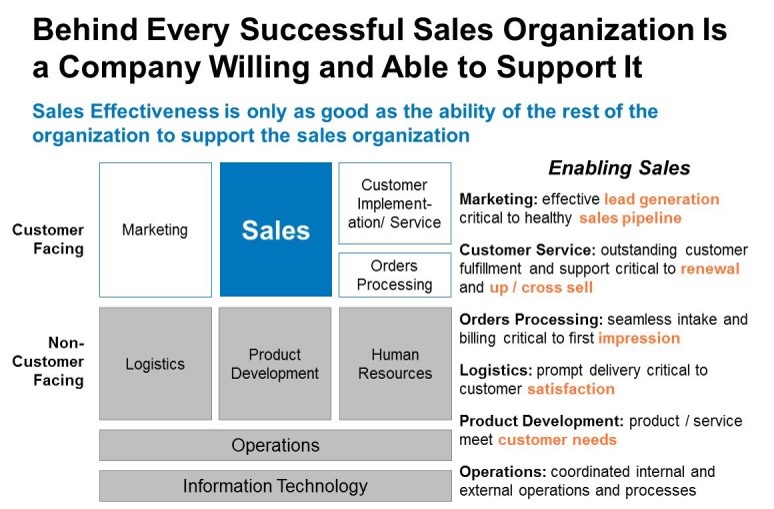

They achieve sales excellence by creating and sharing a strategic vision; deploying the right customer-facing resources against the right sales opportunities; and managing sales headcount, programs and tools in an effective and cost efficient manner. Those bound for obsolescence struggle to change, fail to learn from their successes and failures, and tend to underinvest in sales in order to maximize margin and EBITDA. When companies experiencing sales obsolescence sign up for growth objectives based on historic performance (as they tend to do…versus market opportunity and pipeline…), it leads to low morale, high turnover and poor results.

To illustrate these points, let’s look at three recent Alexander Group engagements. These engagements, and their corresponding sales organizations, range from pre-investment targets to mature, portfolio companies with five- to seven-year holding periods. Additionally, each represents, and conducts business, in unique vertical industries. One of the organizations clearly demonstrated hallmarks of sales excellence, while the other two showed signs of sales obsolescence.

Recent Alexander Group Case Studies

Case Study #1: Recently, the Alexander Group had the opportunity to assist a Private Equity firm to conduct due diligence on a prospective investment. The charter involved reviewing the target company’s sales strategy and identifying any major risks that would inhibit it from scaling in size and meeting its future financial objectives. The target company was a leader in the education and training market sector. Driven by a highly differentiated product offering with a very unique value proposition, the company opted to deploy a very simple go-to-market strategy based on two broad customer segments and a singular, hybrid hunter/farmer sales professional. Simply put, the company took advantage of its product differentiation with a simple and subtle coverage model that yielded revenue per head significantly above benchmark averages. In the end, it was the due diligence on the company’s sales force that gave the PE firm the necessary confidence to make the investment.

Case Study #2: A second PE firm approached the Alexander Group for help with one of its portfolio companies, in this case a leader in the internet marketing and demand/referral generation segment. The company was at a crossroads with high rep turnover and shrinking margins. Initially, the PE firm thought the challenge within the organization had to do with the sales incentive compensation program. After further investigation, it became evident that the main issue was not with incentive compensation, but rather with job design. The primary sales job had become both “blended” and “corrupted.” The blending was a result of taking on multiple different sales responsibilities, including hunting, farming, partner recruitment and partner management. The “corrupting” took the form of several non-selling tasks including services responsibilities and credit and collections responsibilities. We helped the client to redefine their jobs according to three platform job types: lead generation, sales/account executive and partner account manager. The shift toward specialized roles enabled the company to dramatically reduce their sales rep attrition and increase revenues 40+ percent year-over-year for the past two years.

Case Study #3: The third example entails a PE firm looking to re-evaluate its sales strategy for a software applications company struggling to grow. With current sales limited to the U.S. market, weakened by end-customer consolidation, this portfolio company was increasingly challenged to find growth opportunities. What growth the company did experience was the result of acquisitions. Leadership struggled to identify the cause and effect of their challenges. After conducting a comprehensive assessment of the company’s strategic vision, organization and processes, it became evident that the central issue was their post-acquisition strategy of non-integration. The resulting organization had varied levels of sales competency to address customer needs and relied primarily on product-centric sales forces. “Everybody” and yet, “nobody” owned the customer and customer relationships, making it nearly impossible for sellers to effectively represent the full portfolio of solutions. The Alexander Group provided a solution based on establishing a segment-aligned go-to-market model. This model began with a new, robust customer segmentation strategy, sales coverage model, job designs, territories, quotas and compensation program. In the years since the transformation, the company has experienced 11 percent CAGR.

As with any investment, Private Equity managers and investment teams’ ultimate goal is to produce strong ROIs for shareholders. To succeed, continuous concentration, focus and investment in the sales organization will increase your odds of success.

How well are you examining your portfolio companies’ sales organizations? To learn more about sales effectiveness and transformation, please visit AGI’s Private Equity practice.

Originally published by: Jeff Hersh