What are Customer Success Managers? CSM Job Definition, Deployment & Compensation

The customer success team is critical to helping customers realize value from their solutions.

Happy customers who realize business value will continue to renew (not churn or downgrade) and buy more.

What is a Customer Success Manager?

Conceived over 20 years ago, the customer success manager (CSM) job is now a mainstream XaaS job that supports their recurring revenue business. Recognizing its importance, companies have boosted their investments in this team over the past five years. However, there are many questions about this job: How is it defined? How is it deployed and assigned to customers? How is it compensated? We will cover these three questions in this article.

Customer Success Manager Job Definition

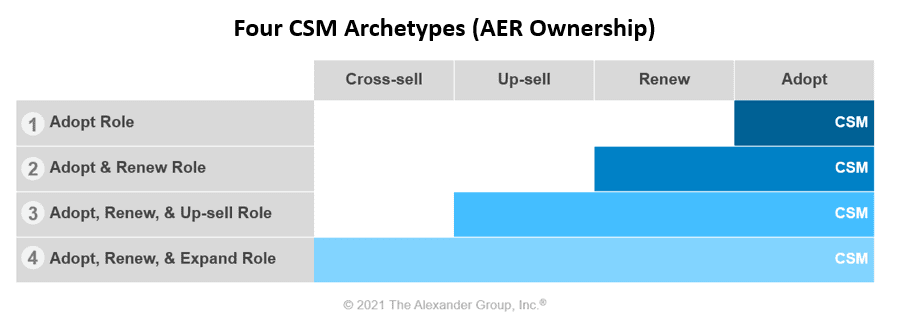

There are actually multiple types of CSM roles. In fact, Alexander Group participants at a recent event indicated that they had 1-5 types of CSMs, with half having 2-3 versions. The graphic below outlines four CSM archetypes and their ownership of Adopt, Expand (Cross-sell and Upsell) and Renewal responsibilities.

Adopt CSM: This is the most common CSM type. As the name suggests, the Adopt CSM focuses on driving solution adoption/usage and monitoring customer health to ensure the customer is realizing value from the solution. Responsibilities can also include building and managing a customer success plan as well as overseeing solution activation, implementation and/or deployment. The strategy for this role is “take care of the customer and allow other sales resources to own the commercial activities.”

Adopt & Renew CSM: This CSM performs similar tasks as the Adopt CSM with the added responsibility of overseeing the renewal contract. This role is commonly used when renewals are auto-renews and/or more administrative reorders as opposed to resells. In theory, the role’s good work focused on adoption will results in successful renewals. Be careful what you ask for. One Alexander Group client shared, “We gave the CSMs renewal responsibility and it was detrimental…many CSMs left and others focused on the renewal over their customer success activities.”

Adopt, Renew & Upsell CSM: This CSM role is a slight derivation of the Adopt & Renewal role. When overseeing the renewal event includes adding more users or capacity resulting from normal customer growth and/or high adoption and usage driven by the CSM, then it makes sense for the CSM to own the upsell along with the renewal.

Adopt, Renew, & Expand CSM: This completely different CSM role owns both the adoption and customer health as well as ongoing account sales. Sales responsibility includes renewals, upsells and cross-selling new solutions to current and potentially new buyers. This role is basically a traditional account manager.

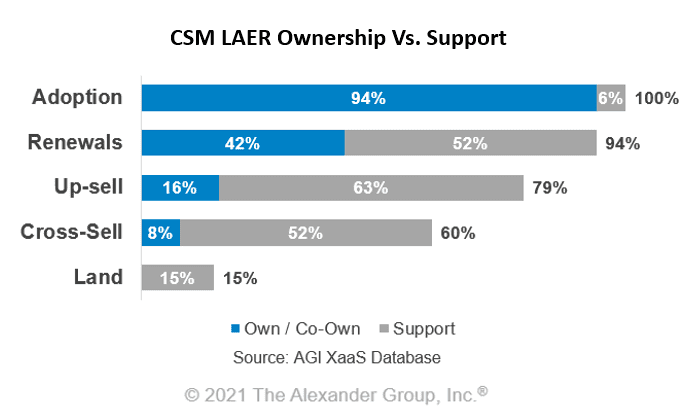

LAER Ownership vs. Support

It is critical to note that while most CSMs don’t own upsell, cross-sell, or even renewal, they often support those motions. In addition, many CSMs will co-own a motion with another sales job. For example, a CSM may co-own the renewal alongside their assigned seller. The chart below highlights typical ownership vs. support across the LAER motions.

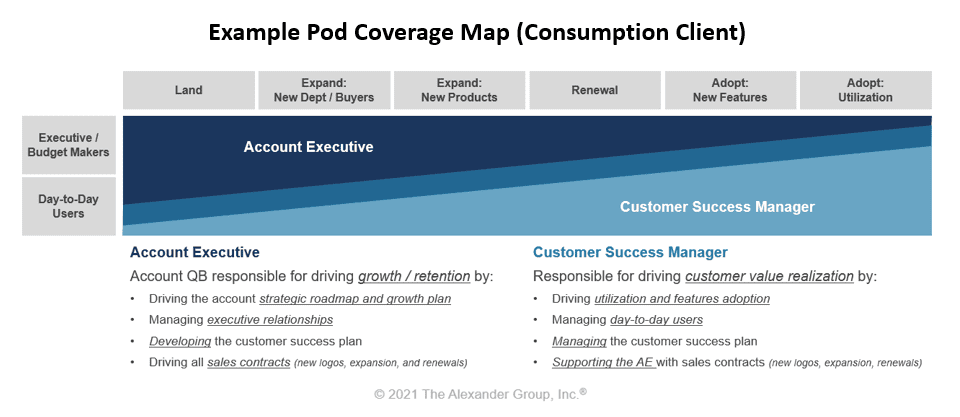

Defining Rules of Engagement

Since most CSMs interface with other sales jobs including account executives, account managers and/or renewal reps, it is critical to lay out each job’s role and responsibility across the customer engagement model and by key stakeholders. Multiple jobs typically have roles in each stage, however their responsibility and who they interface with will be different. One recent consumption client used a pod model (paired AE and CSM). The graphic below highlights the level of responsibility each job played across the LAER motions and their stakeholder alignment.

Customer Success Manager Skills Needed

Talent for CSMs vary. They can include technical skills for sophisticated IT solutions (similar to a sales engineer), business experience for lines of business solutions (considering hiring your customer), and/or sales skills to close contracts. However, they all require strong relationship management, communication, problem solving and data management skills.

How best to deploy CSMs – that is, how to ‘assign’ them – by segment, account, seller, team or pooled.

We’ve discussed the different types of customer success manager (CSM) jobs. It highlighted ways in which the customer success team is critical to helping customers realize value from their solutions, and reinforced the notion that happy customers that realize business value will continue to renew (not churn or downgrade) and buy more. CSMs are thus critical in creating customer ‘stickiness’ and increasing customer lifetime value (CLV).

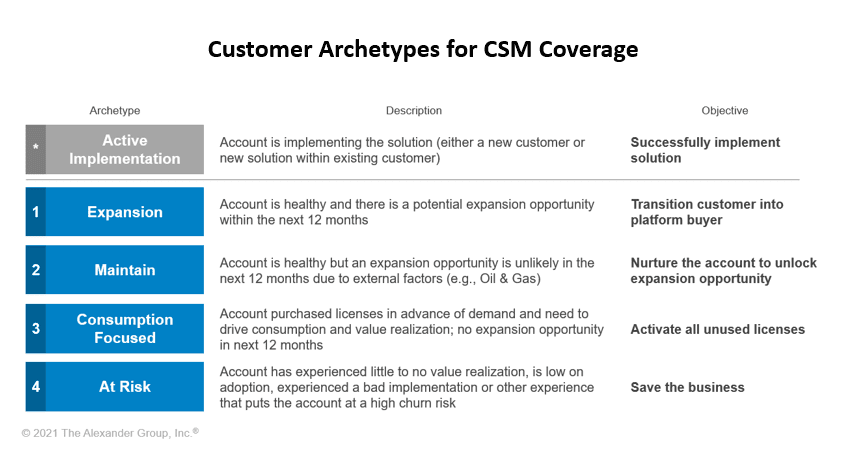

Now we will discuss how best to deploy CSMs – that is, how to ‘assign’ them – by segment, account, seller, team or pooled (i.e., CSMs deployed based on availability and assigned to opportunities as they arise). Much like the wide range of ways in which organizations use CSMs across the sales process outlined, the deployment models vary. Increasingly, companies are deploying CSMs based on several customer archetypes and defining the desired outcome based on the account need and stage of development. These customer archetypes are closely aligned to the four CSM archetypes discussed previously.

CSM Deployment

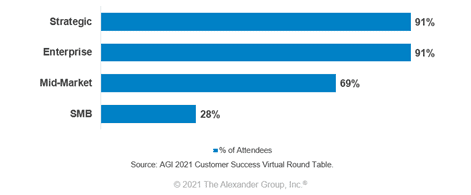

During a recent Alexander Group Customer Success virtual roundtable, attendees were asked to identify the segment(s) against which they deploy CSMs. Not surprisingly, virtually all participants deploy a CSM at the strategic and enterprise segments. While definitions of strategic and enterprise will vary across companies, cutoffs based on annual recurring revenue (ARR) spend and/or number of user or deployed licenses are most common.

At the strategic or enterprise segment, CSMs are typically assigned or paired with sales reps in a one-to-one (largest, most strategic accounts) or one-to-many fashion. Ratios of sales rep to CSM vary in part due to account size and complexity, but these two segments typically range from 1:1 up to 5:1. This level of relatively dedicated coverage ensures that the CSM can maximize time they spend in supporting the upsell, cross-sell and renewal motions.

At the mid-market or SMB segments, most companies will increase their reliance on tools and technology to provide a scaled, proactive touch. Given that the CSMs working accounts in these segments will support a larger number of sales reps, and thus accounts, depth and frequency of involvement is limited. Not surprisingly, the number of organizations that currently provide CSM support at these segments is lower. However, over the years, companies are increasingly providing some level of CSM support at the lower segments. Nearly 70% of the participants at the roundtable provided some level of CSM deployment for mid-market customers. Just five years ago, few companies, if any, were providing CSM support below the enterprise segment.

More recently, several companies are shifting from purely static segmentation based on ARR spend, as outlined above, to a more dynamic one that includes spend potential and relevant use cases, lifecycle and position on the maturity curve. With these parameters in mind, it’s possible to classify customers into four archetypes for CSM coverage. The aim of the model is to provide the correct coverage, at the correct time, while minimizing resource requirements when they aren’t necessary.

This level of sub-segmenting accounts leads to ‘smart’ use, or deployment, of CSMs. It highlights that a homogenous approach is inefficient. The rationale behind identifying archetypes is that companies can use account health scores to fine-tune the success objective at that point in time for that customer. As a customer transitions in and out of these archetypes, the deployment decision follows. This type of flexible, typically pooled coverage and deployment model best allocates the scarce resources to where and when they are needed.

Traditional ways of segmenting customers (primarily by ARR spend) to determine the level and type of CSM support remains common practice. However, companies are increasingly evaluating ways to classify customer needs across the lifecycle and respond in kind with just the right CSM sales motion.

Compensating Customer Success Managers

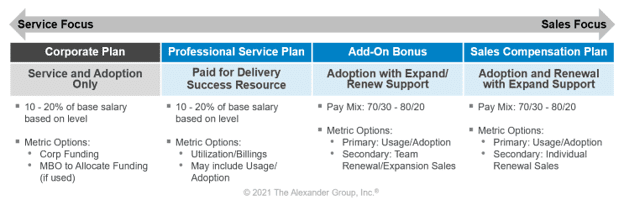

Although there are multiple elements that need to be determined, we will focus on two critical factors regarding how companies compensate their customer success managers: plan structure and measures. As shown in the table below, there are four incentive plan structure options: corporate plan, professional service plan, add-on bonus plan, and an at-risk sales compensation plan.

CSM Incentive Plan Structure Options

Service and Adoption CSMs: When the job is focused on service and/or adoption activity that is difficult to measure, many companies will put their CSM job on their corporate plan. These jobs tend to not have any sales or service expectations.

Professional Service CSMs: Some CSMs are part of a professional services (PS) organization and paid for directly by the client. If this is the case, then the CSM plans tend to mirror how the general PS jobs are compensated—a corporate plan or a separate PS plan.

Adoption and Sales CSMs: When the job has adoption with some sales expectations (even if it is only to support sales), companies will place their CSMs on either an add-on bonus plan or an at-risk sales compensation plan. Add-on bonuses are incentive programs that provide additional payout above and beyond their base salary and the incentive is expressed as a percent of base salary. At-risk sales compensation plans provide a target total compensation (TTC) level and then apply a pay mix to derive the base salary and target incentive. For example, a CSM job with $100k TTC and 80/20 pay mix will have $80k base salary and $20k target incentive.

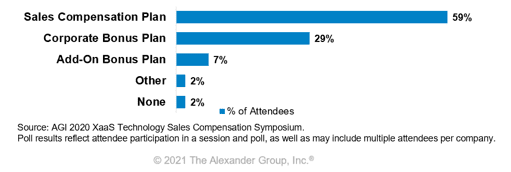

Most companies put their CSMs on a sales compensation plan or a corporate plan. The graph below provides some benchmark practices from our last XaaS Technology Sales Compensation Symposium.

CSM Incentive Practices

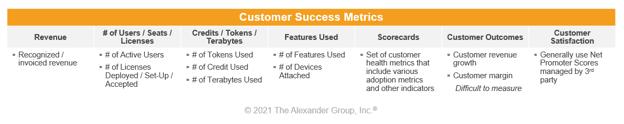

There are a variety of measures companies use to reward their CSMs. The table below outlines each of them.

CSM Customer Success Metric Options

- Revenue – Companies with consumption pricing models and/or recognize their revenue as their offering is consumed generally use recognized revenue.

- Adoption – There are three primary adoption-type metrics that align to a company’s pricing model that are commonly used:

- Users/Seats/Licenses

- Credits/Tokens/Terabytes

- Features/Devices Used

- Scorecards – Some companies with many products will use a more complex scorecard containing multiple metrics including adoption, health scores and/or other indicators.

- Customer Outcomes – Measuring your customers’ outcomes based on the use of your offering is the ultimate method to measure how your customers are gaining value from your offering, however companies rarely used due to challenges setting, tracking and goaling on these metrics.

- Customer Satisfaction – Some companies that leverage a third-party company to measure net promoter scores and other customer satisfaction scores may incorporate a customer satisfaction metric into their CSM plan.

Recurring revenue models require the revenue leaders to place significant emphasis on keeping and growing customers once they have been acquired. The finance community likes the predictability and profitability of a recurring revenue stream. The reality for revenue leaders in recurring revenue models is they must continually “win” the customer’s business or risk churn. The CSM is a key role leveraged to protect the base, drive expansion and ultimately maximize customer lifetime value.

Questions & Next Steps

Alexander Group provides consulting services to companies building out their customer success organizations. For more information, visit Alexander Group’s Technology practice, or contact a Technology practice leader to schedule an executive readout of our latest XaaS research.